Barrick Plans 30% Growth and Considers Rebrand to Reflect Broader Mining Focus

Barrick Gold (NYSE: GOLD, TSX: ABX) announced on Friday that it is advancing a series of growth projects aimed at boosting gold-equivalent production by 30% by the end of the decade.

Chairman John Thornton noted that despite a challenging global operating environment, Barrick met its 2024 gold and copper production targets, sustained its record of reserve replacement, and significantly expanded its resource base.

“We improved our financial performance despite higher costs,” Thornton said in a statement. “Net earnings rose 69% — the highest in a decade — while operating cash flow increased by 20% and free cash flow doubled compared to 2023.”

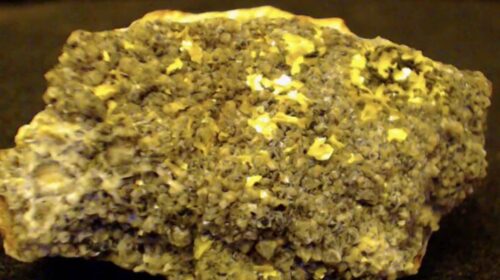

The company is accelerating several key projects, including the ramp-up of the Pueblo Viejo mine in the Dominican Republic, prefeasibility work at the Fourmile project in Nevada, and the restart of the Porgera mine in Papua New Guinea.

Barrick has also completed feasibility studies for two major developments: the Reko Diq copper-gold project in Pakistan and the Lumwana expansion in Zambia.

“These projects are central to our strategy of organic growth, especially in copper. In light of our evolving production profile, we are proposing to rename the company from Barrick Gold Corporation to Barrick Mining Corporation,” Thornton said.

Despite rising metal prices, mining equities have continued to underperform — and Barrick has been no exception. Thornton added that the company considers its stock undervalued and repurchased $498 million worth of shares in 2024.

He emphasized that Barrick will continue to buy back shares whenever they trade below their intrinsic value.

![]()