Key South African mineral exports to the US excluded from damaging tariffs

The Minerals Council South Africa is concerned about the potential damage to global economic growth and the resultant lower demand for South Africa’s minerals as a result of sweeping tariffs imposed by the US government on imports from foreign countries.

While the majority of South Africa’s minerals and metals sold to US consumers are excluded from the tariffs, there are some like iron ore and diamonds that will be subject to the 30% reciprocal tariff on imports from South Africa that President Donald Trump announced on Tuesday as part of his administration’s imposition of ‘reciprocal’ tariffs on its trading partners around the world.

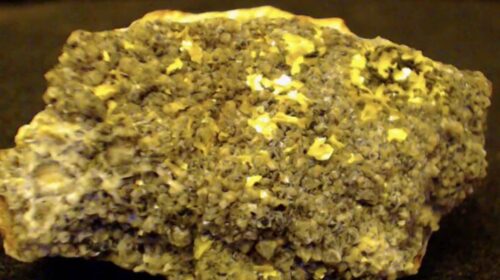

The Minerals Council notes that platinum group metals (PGMs), coal, gold, manganese and chrome are specifically excluded from the tariffs.

“Despite the exclusions, we remain concerned about the adverse impact on business and consumer sentiment and the resultant feedthrough to business investment, consumer spending and ultimately global real GDP growth caused by this unprecedented upheaval in world trade.

Global growth coming under threat is bad news for the entire South African mining industry,” says Hugo Pienaar, chief economist at the Minerals Council.

“Even though PGMs are excluded from the latest round of tariff increases, vehicle prices in the US will increase because of the 25% tariff the Trump administration has imposed on all vehicle imports.

Not only will this slow demand for automobiles in the US, but car makers in other countries are likely to moderate production as a result,” he says.

Platinum, palladium and rhodium are used to make autocatalysts for vehicle exhausts to scrub out pollutants. If car and truck sales slow, demand for PGMs will reduce and result in volatile near-term prices. In the longer-term, we remain positive about the outlook for PGM demand and prices.

“With respect to PGMs, there is an opportunity for increased market development given the potential that remains with internal-combustion engines, the green hydrogen economy and jewellery as well as other yet-to-be-developed technological applications that our members are driving through research.

South Africa is the world’s leading source of PGMs, manganese, chrome and vanadium which are all critical as energy metals,” says Mzila Mthenjane, CEO of the Minerals Council.

On a positive note, the mining industry does provide some shield to the South African economy in these challenging times. This in the form of the gold price that remains firmly above $3,000 an ounce, or about R1.8 million per kilogram, with investor and central bank demand for gold rising during these uncertain economic times.

Another silver lining for mining is that the global uncertainties and renewed concerns about the government of national unity has weakened the rand against the dollar.

If sustained, orderly and not accompanied by notable domestic cost increases, the weaker rand should increase the competitiveness of South African mineral and other exports.

Table 1: South Africa’s mineral exports to the US

In 2024, total South African exports of mineral products and precious metals to the United States amounted to R65.3 billion, with PGMs accounting for 76.3% of the total. As mentioned, PGMs are exempt from the latest round of US import tariffs.

SOURCE:www.mineralscouncil.org.za

21 total views , 2 views today