Copper price turns higher on record Chinese imports

China’s March copper imports rose 25% from a year earlier, customs data showed on Tuesday, amid increasing demand for the metal.

Arrivals of unwrought copper and products totalled 552,317 tonnes last month, the General Administration of Customs said, up from 441,926 tonnes in March 2020, and up 34.7% from a 13-month low of 410,040 tonnes in February.

China’s manufacturing expanded at a faster-than-expected pace in March, while activity in the construction sector also increased amid warmer temperatures.

Copper imports in the first quarter totalled 1.44 million tonnes, up 11.9% year-on-year, and the highest first-quarter amount since at least 2008, according to Reuters data.

March imports of copper concentrate, or partially processed copper ore, were 2.17 million tonnes, the highest on record. Imports were up 22% from 1.779 million tonnes a year earlier, and up 20.5% from 1.8 million tonnes in February.

First-quarter shipments of concentrate, the supply of which is very tight globally, were up 7.4% year-on-year at 5.96 million tonnes. That is the highest first-quarter amount since at least 2008, Reuters data showed.

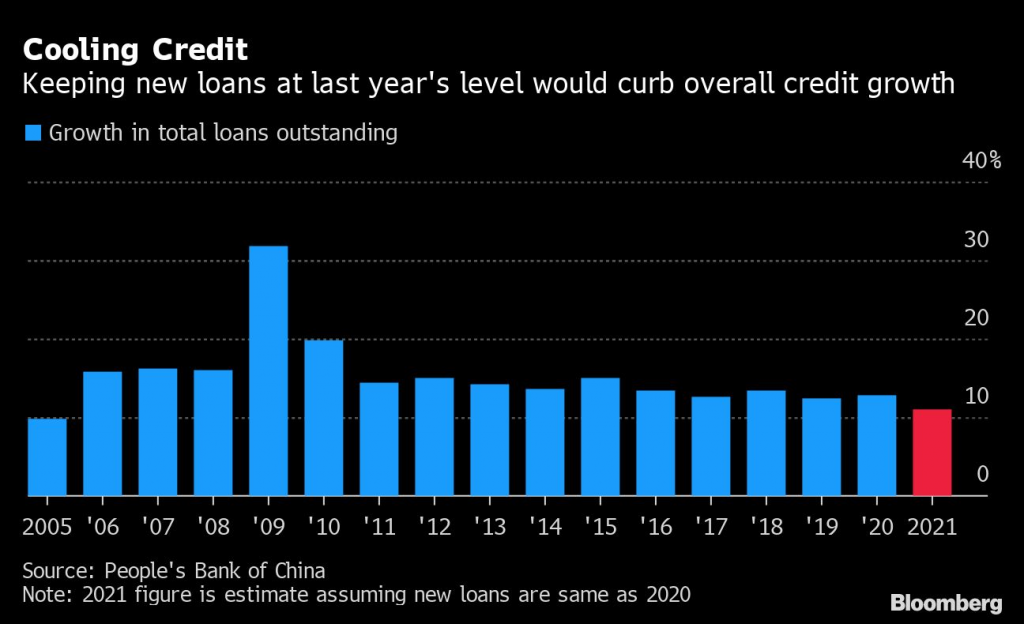

ONE OF THE BIG HEADWINDS FOR COPPER IN RECENT WEEKS HAS BEEN CONCERN OVER A POTENTIAL CURTAILMENT IN CREDIT GROWTH IN CHINA

Meanwhile, copper’s turbo-charged rally stalled over the last few weeks as funds have taken profits and physical buyers have refused to chase prices higher.

Copper for delivery in May was up 0.24% on Tuesday, with futures at $4.0280 per pound ($8,616 a tonne) on the Comex market in New York.

Analysts say the longer-term picture is still strong, even with concerns over potential curtailment in credit growth in China and the resurgence in coronavirus cases in top producer Chile.

Supplies

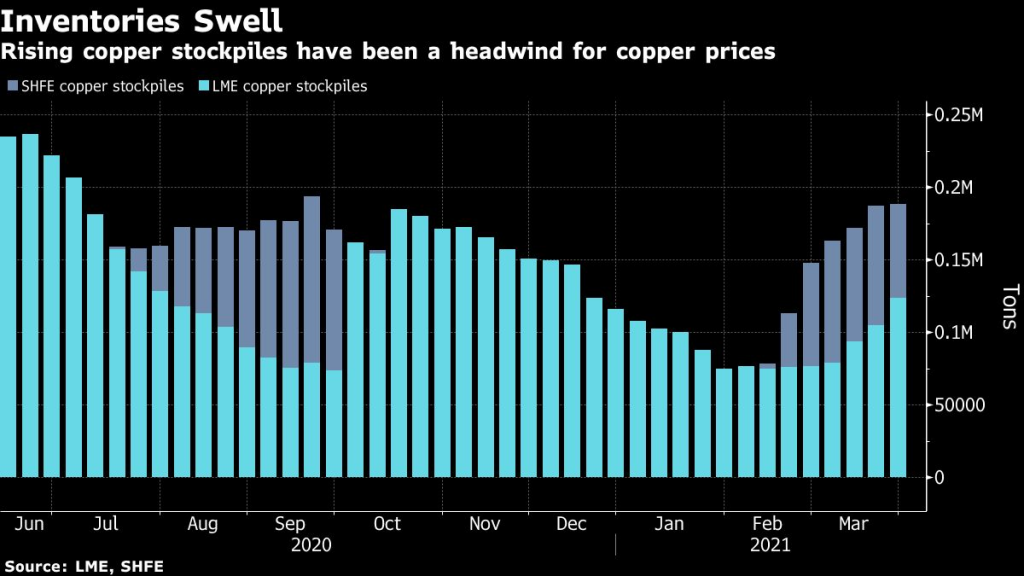

Stockpiles in warehouses tracked by exchanges in London and Shanghai have surged in recent weeks, helping ease concerns over tight supplies. Inventories monitored by the London Metal Exchange have more than doubled since late February. Stocks on the Shanghai Futures Exchange rose for nine straight weeks through early April in the longest run since 2014.

Signs of weakening are also emerging in China’s appetite for foreign copper. The Yangshan copper premium, a gauge of China’s import demand, has declined by more than 40% from this year’s high.

“The falloff could be a precursor to a broader plateauing in demand as economies emerge from the pandemic,” Ed Meir at ED&F Man Capital Markets told Bloomberg.

One of the big headwinds for copper in recent weeks has been concern over a potential curtailment in credit growth in China, as part of Beijing’s efforts to avoid asset bubbles.

“As China retools its economy on a consumer-led path, it is unlikely the country will continue to demand the same amount of commodities,” JPMorgan Chase & Co. analysts, including Natasha Kaneva, said in a note.

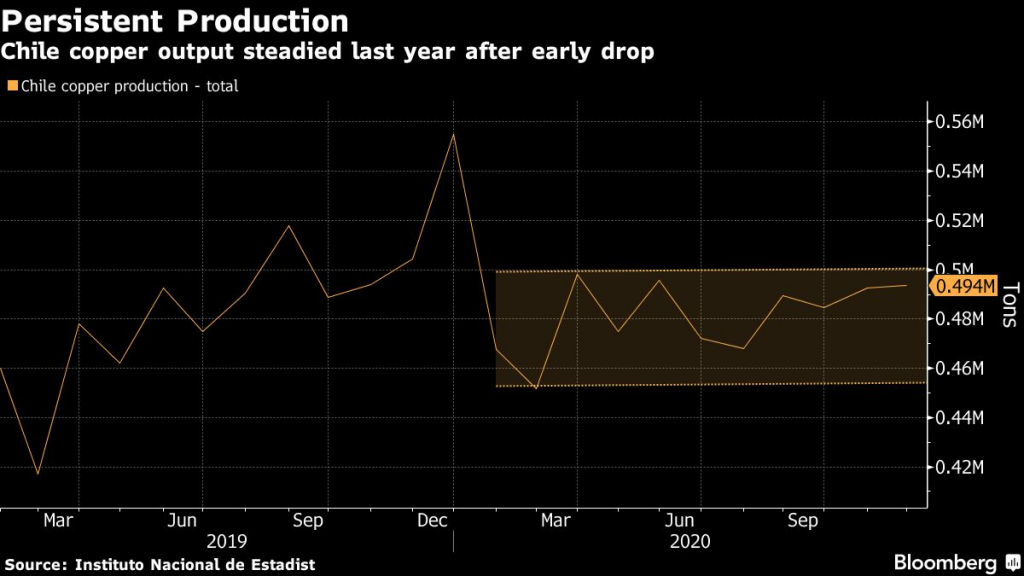

Another big concern for the copper market is that the resurgence in coronavirus cases will mean more lockdowns.

Top producer Chile announced that will keep its borders closed during April due to a spike in covid-19 cases.

![]()