Gold price nears 2-month high on stronger US retail data

Gold prices rose to their highest since late February following declines in both the dollar and bond yields Thursday, placing the precious metal on course for a second straight weekly gain.

Spot gold jumped 1.7% to $1,767.18 per ounce by 11:50 a.m. ET. Gold futures for June delivery gained 1.9%, trading at $1,769.70 per ounce in New York.

Meanwhile, a gauge of the US dollar fell as much as 0.2%, and 10-year Treasury yields dropped to the lowest in about a month. Their declines came after US retail sales accelerated in March by the most in 10 months with the help of business re-openings, increased hiring and a fresh round of stimulus checks. US industrial production also bounced back from a weather-related decline in February, though its 1.4% rise still fell below analysts’ expectations.

“Gold finally trades above recent highs behind a cocktail of lower yields, a soft dollar and a weaker-than-expected industrial production and capacity-utilization report,” Tai Wong, head of metals derivatives trading at BMO Capital Markets, told Bloomberg.

The US production report “indicates the real economy remains uncertain, while the strong retail sales report was purely stimulus-based and transitory.”

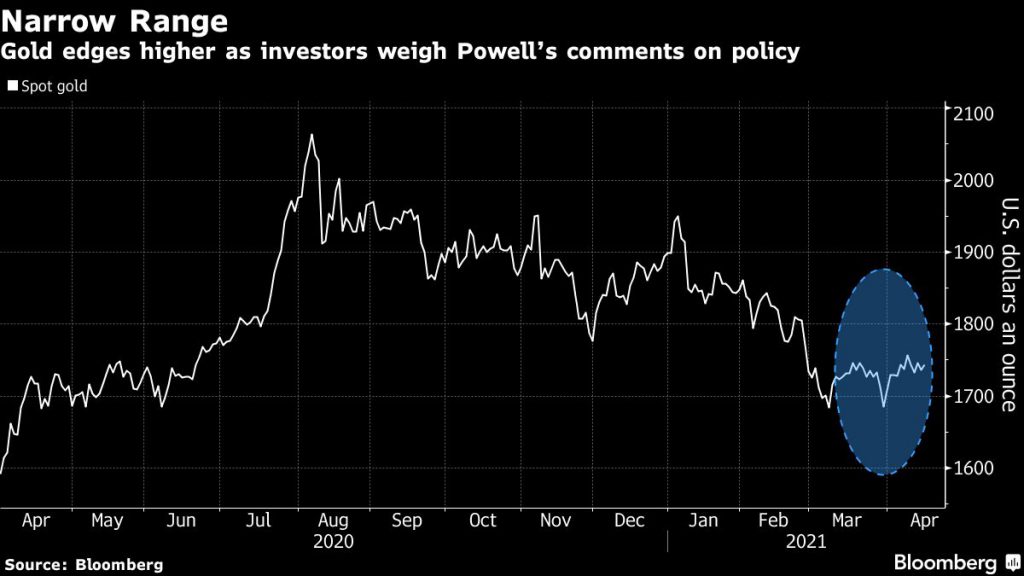

Bullion has been confined to a narrow trading range over the past month, with shifts largely driven by movements in the dollar and bond yields. The precious metal has declined more than 7% this year as gold-backed exchange-traded funds witnessed sustained outflows, after playing a crucial role in 2020’s record rally.

“Gold is unable to make any further significant and sustainable gains due to a lack of support from financial investors,” Daniel Briesemann, an analyst at Commerzbank AG, wrote in a note. “There is still no sign of any trend reversal in gold ETFs.”

Earlier in the month, economists at Citibank said they expect gold to see further sideways trading between the $1,700-$1,900 range for the rest of the year.

“Although gold has lost much of its appeal for investors in 2021 compared to 2020 and the technical picture has deteriorated in favour of bears rather than gold bulls, deep corrections of prices are still viewed as buying opportunities,” Avtar Sandu, senior commodities manager at Phillip Futures, said in a note to Reuters.

![]()