Copper price could spike to $13,000 on low stocks – BofA

Copper prices climbed back towards $10,000 per tonne on Tuesday, supported by prospects for higher demand while inventories dwindle.

Last Thursday, the copper price topped $10,000 a tonne for the first time since 2011, nearing the all-time high set that year.

Copper for delivery in July was down 0.3% by 12:57 pm (EDT) on Tuesday, with futures at $4.5230 per pound ($9,950 a tonne) on the Comex market in New York.

“It’s a tremendously positive story for copper at the moment and in the long term,” WisdomTree analyst Nitesh Shah told Reuters.

“Over the next few years we are likely to see copper demand increase and that will support prices.”

Analyst at CRU Group Robert Edwards believes copper has further to go:

”The copper price has gone stratospheric and probably has further to go, which is a boon for miners who are currently making at least two dollars for every one they spend getting metal out of the ground,”

Copper stocks in LME-approved warehouses shed 6,325 tonnes to a five-week low of 137,000 tonnes, having lost 20% from the middle of April.

In warehouses monitored by the Shanghai Futures Exchange, weekly data on Friday showed stocks fell 1.3% compared to the previous week.

Copper could spike to $13,000 a tonne in coming months, partially over low inventories, analysts at Bank of America said in a note.

The premium for cash copper over the three-month price was at only $4 a tonne, indicating concerns over metal for immediate delivery.

The global copper market should see a surplus of 79,000 tonnes this year and of 109,000 tonnes in 2022, the International Copper Study Group (ICSG) said on Monday.

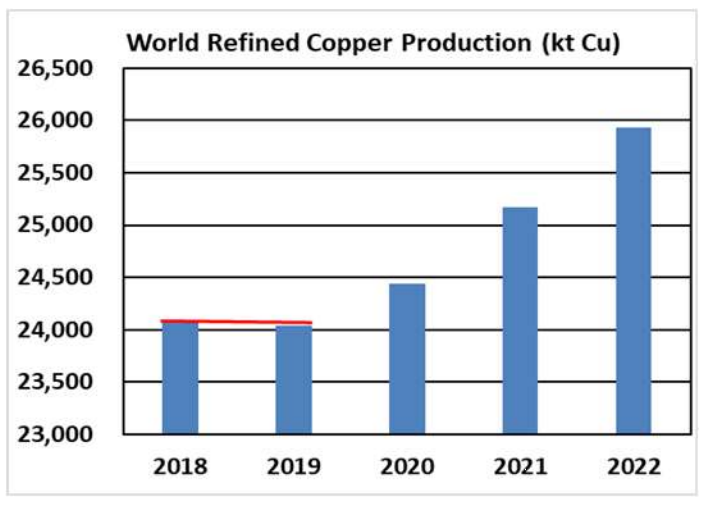

“After three years of remaining essentially unchanged, world copper mine production, adjusted for historical disruption factors, is expected to increase by about 3.5% in 2021 and 3.7% in 2022,” ICSG said in a press release.

“This assessment of the ICSG contrasts sharply with those of many other market participants, who envisage another seriously undersupplied copper market this year,” analysts at Commerzbank said.

![]()