Zambia’s irrational bet on copper can end up working in China’s favour after the country defaults

Zambia, a country once thought to be one of the most investment-friendly in the region, is now one of the most extreme examples of a surge of authoritarian governments in mining-dependent countries that are struggling to pay their bills after borrowing for infrastructure in recent years.

The landlocked nation in Southern Africa, which defaulted on bondholders in November, is doubling down on debt, betting that nationalizing one of its largest copper mines would help the country’s ailing economy.

Zambia was the primary nation on the continent to register a pandemic-era default on a sovereign debt fee late final 12 months when it missed a $42.5 million curiosity fee on a few of its $3 billion of dollar-denominated bonds.

The nation has some $12 billion in exterior debt, together with $3 billion in worldwide bonds and enormous loans from Chinese language state-owned lenders. The federal government hasn’t mentioned precisely how a lot it owes to Chinese language lenders as a complete. Johns Hopkins College’s China-Africa Analysis Initiative estimates that Zambia has signed some $9.9 billion in loans from China, though not all of that cash has been drawn.

However, in January Zambia’s state-owned mining firm took on $1.5 billion in debt to take over a Glencore PLC copper mine, Mopani Copper Mines PLC, the most recent in a string of strikes that has remade the nation into an exemplar of useful resource nationalism.

Zambia is the fourth-riskiest nation on consulting agency Verisk Maplecroft’s Useful resource Nationalism Index, which assesses the chance to commodity producers from governments searching for larger management over their nation’s mineral and power deposits. Verisk Maplecroft mentioned that the economic impact of the Covid-19 pandemic has additional inspired authorities intervention within the mining sector.

Final 12 months, Zambia started talks with the Worldwide Financial Fund on a financial program that can kind the idea of the nation’s deliberate debt restructuring. The Washington-based lender mentioned it hopes to succeed in taking care of Zambia earlier than elections scheduled for August, however, analysts say the Mopani deal might throw a wrench within the works.

“Taking over one other debt of this dimension right now is strictly what you don’t need to be doing,” mentioned Anne Frühauf, managing director at communications and advisory agency Teneo Holdings LLC. “This might effectively be one of many sticking factors within the present negotiations [with the IMF].”

The Mopani talks started final 12 months when the federal government mentioned it deliberate to revoke the corporate’s mining license, accusing Mopani of violating the phrases of its working allow by suspending operations due to the coronavirus pandemic without giving adequate discover. Mopani’s Australian chief government, Nathan Bullock, was briefly detained at Lusaka airport in Zambia’s capital earlier than being launched.

Months of talks concluded in January when Glencore introduced its subsidiary had agreed to promote its underlying 73% stake in Mopani to state-owned mining funding agency ZCCM Investments Holdings PLC for $1 and the belief of $1.5 billion in debt. The Anglo-Swiss commodities firm mentioned the debt would stay owed by Mopani to Glencore group collectors and that Glencore would retain the proper to buy Mopani’s copper manufacturing till the debt is totally repaid.

Underneath the phrases of the deal, ZCCM will repay the debt by giving Glencore collectors 3% of Mopani’s income to 2023—it then jumps to between 10% and 17.5%—along with quarterly curiosity and a 3rd of earnings earlier than curiosity, taxes, depreciation and amortization, minus some deductions.

Nevertheless, Mopani is at present shedding cash and its administration says that it wants to boost manufacturing to an annual goal of 140,000 metric tons to make the mine worthwhile.

That requires about $300 million in capital funding for growth tasks. Mopani produced simply over 34,000 metric tons in 2020, haemorrhaging money. Richard Musukwa, Zambia’s mines and minerals growth minister says the federal government is in talks with potential traders from Turkey, Canada, China and the U.S., amongst others.

“The debt burden is formally on [Mopani]’s stability sheet, however as it’s a persistently loss-making entity, it should de facto fall on the federal government,” mentioned Irmgard Erasmus, a senior economist at South Africa-based NKC African Economics.

In consequence, “it’s potential the mine operation could also be used as collateral if we don’t get a funding companion quickly,” an official on the Zambian finance ministry with direct data of the transaction mentioned.

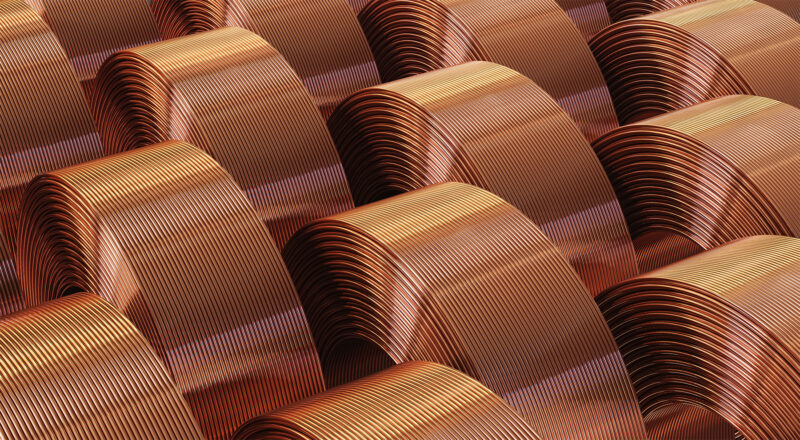

In taking on Mopani, the federal government is betting that Zambia’s economic system may very well be rescued by the sharp rise in copper costs, that are buying and selling around 10-year highs as a consequence of robust Chinese language demand for uncooked supplies that has rebounded because the worst of the pandemic. China accounts for roughly half of world copper demand.

Authorities officers publicly claimed the Glencore deal was crucial to avoid wasting 15,000 jobs on the Mopani mine in Kitwe, a mining city that has been battered since a decade-long commodity growth resulted in a spectacular 2015 crash. Zambia’s inhabitants of 18 million individuals depend on copper for two-thirds of its export income.

Mr Musukwa didn’t reply to requests for the remark in regards to the prospect of China taking on the mine.

“We merely don’t have the capability to run these financially troubled and technologically difficult mines,” mentioned Fred M’membe, the president of Zambia’s opposition Socialist Get together. “This choice has nothing to do with any strategic enterprise system.”

If Zambia fails to make the repayments, analysts and Zambian officers say, the mine may very well be exchanged as collateral with China for debt referral or forgiveness, which might put the strategic state asset into Beijing’s palms. Some U.S. officers have mentioned China is extending large and doubtlessly unsustainable debt to African countries to provide it larger regional sway.

China’s international ministry mentioned that it had signed debt aid agreements or reached a consensus on debt aid with 16 African international locations and confused it might “by no means power them to repay money owed, not to mention take over any state-owned belongings.”

Within the copper mining heartlands close to Zambia’s Congolese border, households are surviving by lowering the variety of meals they eat a day, driving up malnutrition, support officers say.

Angella Namakawa, who operates a fruit stall in Kitwe, the place the Mopani mine is situated, says she will solely afford a single meal of nshima, a sticky porridge produced from corn flour, for her household of 4 every day, after costs for the nation’s predominant staple rose by a 3rd final month.

“I can barely make ends meet as a result of costs of virtually all the pieces maintain going up,” she mentioned in a cellphone interview. “Our forex is changing into ineffective but we’ve to maintain paying payments, shopping for meals and all the pieces else.”

![]()