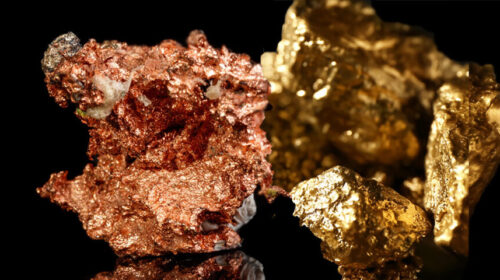

Market: China wants to free up its copper, aluminum and zinc reserves to stabilize prices

China on Wednesday announced plans to release industrial metals from its national reserves to lower commodity prices, which some analysts say could be the first such move in a decade from the world’s largest consumer of metals.

The National Food and Strategic Reserves Administration has said on its website that it will release batch copper, aluminum and zinc to non-ferrous metal processing and manufacturing companies “in the near future” via public auction .

The advice came as Beijing struggles to curb a surge in metal prices this year, fueled by a post-pandemic economic recovery, abundant global liquidity and speculative buying that has squeezed manufacturers’ margins.

Ex-factory prices in May in China rose at their fastest annual rate in more than 12 years due to the surge in commodity prices, squeezing corporate profit margins and highlighting global pricing pressures.

As speculation revolved around such a move before it was confirmed by the government, Citi said in a note Monday that it could be part of “efforts to suppress rising commodity prices by managing market expectations and deterring speculators, more than solving any physical shortages problem.

Citi said the last release of strategic stocks in China – which did not include copper – was in November 2010. State research house Antaike drew parallels between the announcement and the release in 2010.

Most base metals were trading sharply lower in Wednesday’s Asian afternoon session.

London’s benchmark copper hit a record high of $ 10,747.50 a tonne in May, after rising more than 60% since March of last year, when the coronavirus destroyed demand. Shanghai’s aluminum hit its highest level since 2010 in May, while zinc hit its highest level since 2007.

“The Chinese authorities are trying to help support the margins of (their) manufacturing industry as they struggle to pass these costs on to end users,” said commodity broker Anna Stablum at Marex Spectron.

The administration’s statement did not provide details on the quantities of metal for sale, the auction process or which manufacturers will be allowed to bid.

Citi estimates that China’s state reserves currently stand at 2 million tonnes for copper, 800,000 tonnes for aluminum and 350,000 tonnes for zinc, based on buying and selling records. earlier.

![]()