New Leader Takes Zambia from Defaulter to Investor Darling – Bloomberg

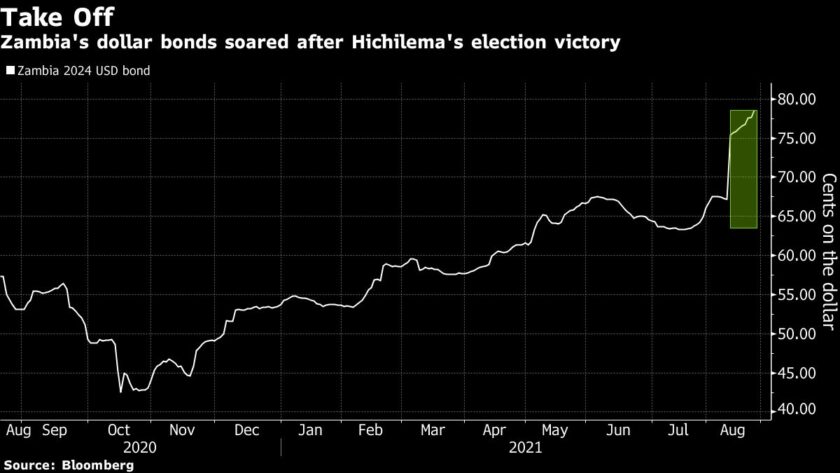

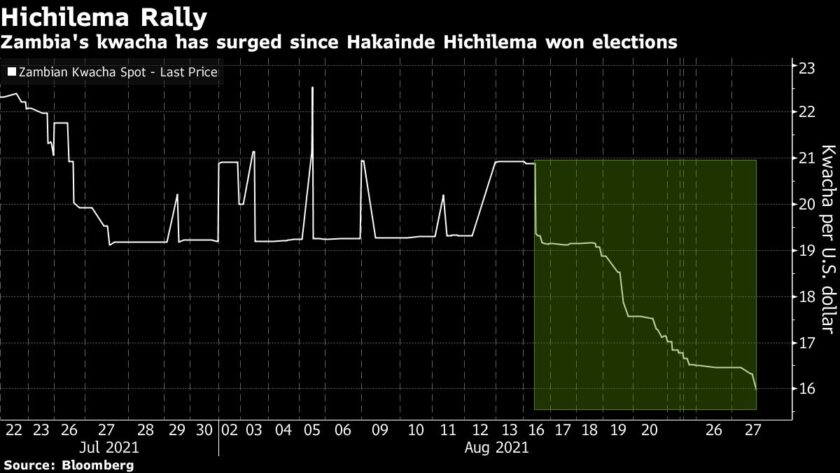

Zambia’s new president, Hakainde Hichilema, is turning the nation’s economic fortunes around barely a week into the job. The southern African nation’s currency and dollar bonds have surged to become the world’s best performers since he was announced the winner of Aug. 12 elections.

His pick of economist Situmbeko Musokotwane as finance minister has gone down well with investors, as have his pronouncements that he’ll speedily conclude a financing deal with the International Monetary Fund and court foreign investment.

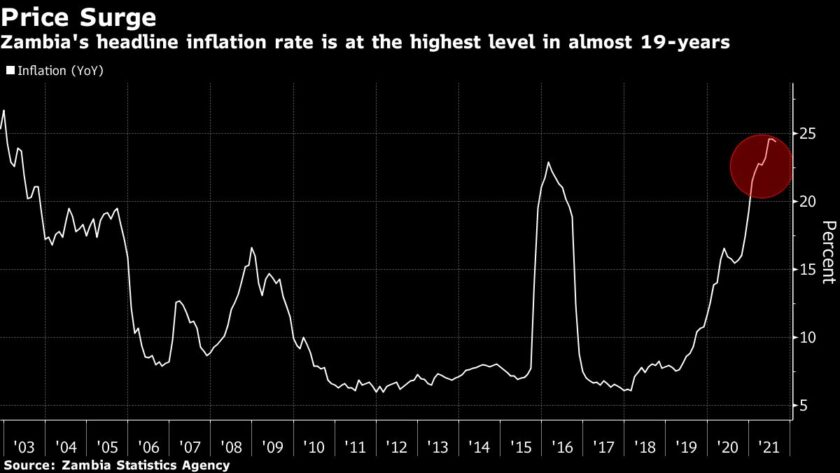

Zambians have grown used to bad news in recent years. Production of copper, which accounts for more than 70% of export earnings, stagnated as the government clashed with mining companies. The kwacha currency depreciated from 5.10 to the dollar at the end of 2011 to a record low 22.68 this year. Annual inflation reached almost 25% in July, the highest level in nearly two decades.

The change in power has brightened the nation’s economic prospects, with investors optimistic that the new administration will drive a sustained recovery, and restructure almost $13 billion in external loans after securing IMF funding. While Hichilema had said he hopes to reach a deal with the fund by April, Musokotwane is targeting October.

“It’s night and day at the moment,” said Neville Mandimika, economist and fixed income strategist at FirstRand Bank Ltd. in Johannesburg. “The expectation has been completely raised.”

Hichilema, 59, studied economics in the U.K., served as the chief executive officer of an accounting firm and unsuccessfully ran for the presidency five times before finally winning this month. The late President Michael Sata, who’s party he dislodged from power, dubbed him “calculator boy” — a snipe at his economic jargon-laden speeches.

Hichilema capitalized on widespread discontent over rampant unemployment and soaring prices especially among young voters to secure his landslide election win.

He was sworn in on Aug. 24 and pledged to stabilize the nation’s finances following years of overspending by his predecessor Edgar Lungu’s administration that culminated in Zambia becoming the first African sovereign-debt defaulter since the coronavirus pandemic struck.

Hichilema will probably need to cut fuel and farm subsidies that have contributed to repeated budget blowouts to secure the IMF funding. That will be a hard sell to an electorate that’s expecting him to lower living costs.

And even with with IMF endorsement, the new administration faces complex restructuring talks with a diverse group of creditors ranging from China Development Bank to European funds holding its dollar debt.

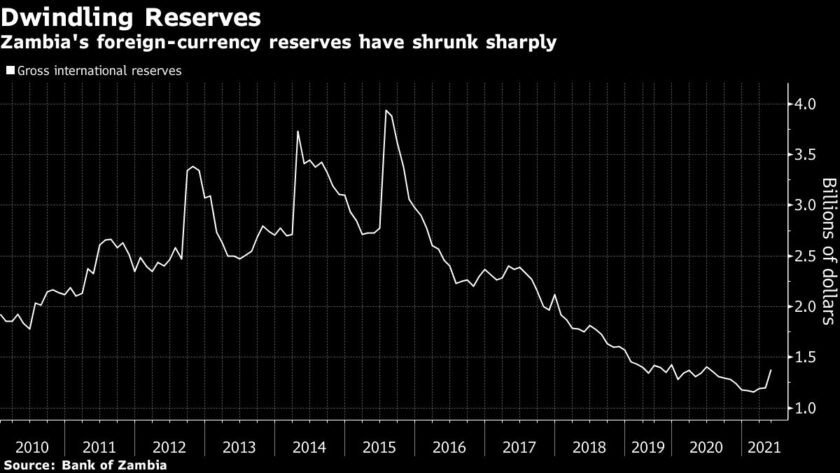

High on the government’s list of priorities is mending ties with the mining industry. Musokotwane wants to more than double annual copper production to as much as two million metric tons by 2026. That would help bolster foreign reserves, which had dwindled due to rising debt-servicing costs.

“You will be amazed how much foreign exchange this country is going to make,” the finance minister said on Friday after being sworn in. “You will not know what to do with the dollars that this country will be receiving.”

Source: Bloomberg

![]()