Soaring EV demand keeps driving lithium price

A boom in demand for electric vehicles (EVs) as countries including China work to reduce carbon emissions keeps boosting the lithium price.

The average price for lithium carbonate reached $16,500 a tonne in August (hydroxide ex-works China mid-August), according to Benchmark Mineral Intelligence, up from $6,124 a tonne last December.

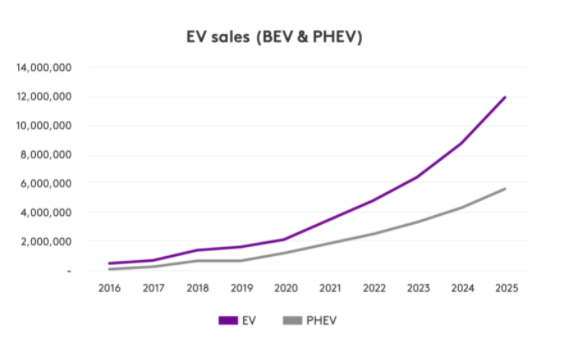

EV sales jumped in the first half of 2021, despite components shortage, pandemic-forced production interruptions, and longer-term weakness in the overall market, The Hindu reported.

Nearly 2.6 million electric cars were sold, a 160% jump compared to H1 2020.

EV sales in China jumped 164% year on year in July to 271,000 units, according to the China Association of Automobile Manufacturers (CAAM).

“EV penetration will reach 15% in 2025, and we expect to see it rise to around 35% by 2030. Add to that mix growing demand from applications such as energy storage systems (ESS), 5G devices, and Internet of Things (IoT) infrastructure,” said Fastmarkets in a recent report.

“The only way is up for lithium demand.”

“Constructive western policy and near-term supply limits [are] driving lithium and rare earths pricing higher,” StreetInsider.com reported.

“We have seen a number of new supply initiatives announced but still anticipate a relatively tight market into mid-2025 as the market underwrites new supply beyond 2025.”

Leading the way

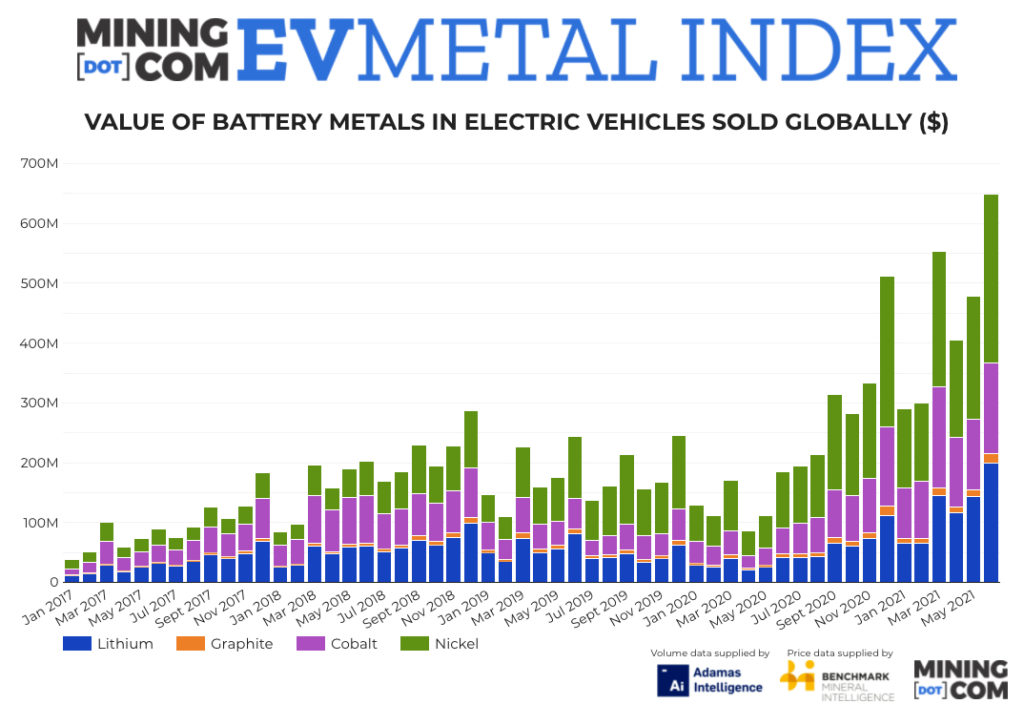

In June 2021, a record of more than 15,800 tonnes of lithium carbonate equivalent was deployed onto roads globally in batteries of all newly-sold passenger EVs according to Adamas Intelligence.

The metal led the way on MINING.COM’s EV Metal Index, which tracks the value of battery metals in newly registered passenger EVs (including hybrids) around the world, supporting a new monthly record in June.

source: Mining.com

![]()