Copper price down as labour conflicts in Chile resolved, supply concerns fade

The copper price fell again on Monday on signs that strike risks are all but over in Chile, the world’s biggest producer.

In quick succession, mining companies in Chile have resolved a series of labor conflicts.

On Friday, plant workers at Codelco’s Andina mine agreed to end a more than three-week stoppage. The next day, workers at BHP Group’s Cerro Colorado mine accepted an offer hammered out by the two negotiating teams in mediated talks, avoiding a strike.

The recent breakthroughs follow strike-ending agreements earlier this month with the two main unions at Andina and at a mine owned by JX Nippon Mining & Metals. The industry also managed to avoid stoppages at top-tier mines such as Escondida and El Teniente.

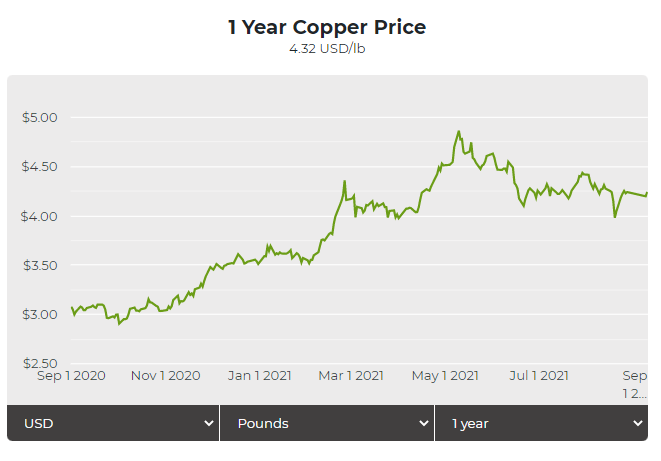

Copper for delivery in December fell 1.8% from Friday’s settlement price, touching $4.374 per pound ($9,622 per tonne) midday Monday on the Comex market in New York.

Massive global stimulus measures are keeping metals demand strong. Yet the economic bellwether has also been overshadowed lately as China’s move to curb metals production to reduce pollution and a coup in key bauxite supplier Guinea sent aluminum to a 13-year high of $3,000 a tonne.

China’s state reserves administration also released 150,000 tonnes of copper, aluminum, and zinc in the market that led to some

![]()