Copper price surges through $11,000 on supply squeeze

Copper price continued to rally towards record highs on Tuesday as signs of extremely tight supply outweighed concerns that slowing growth in China will impact demand.

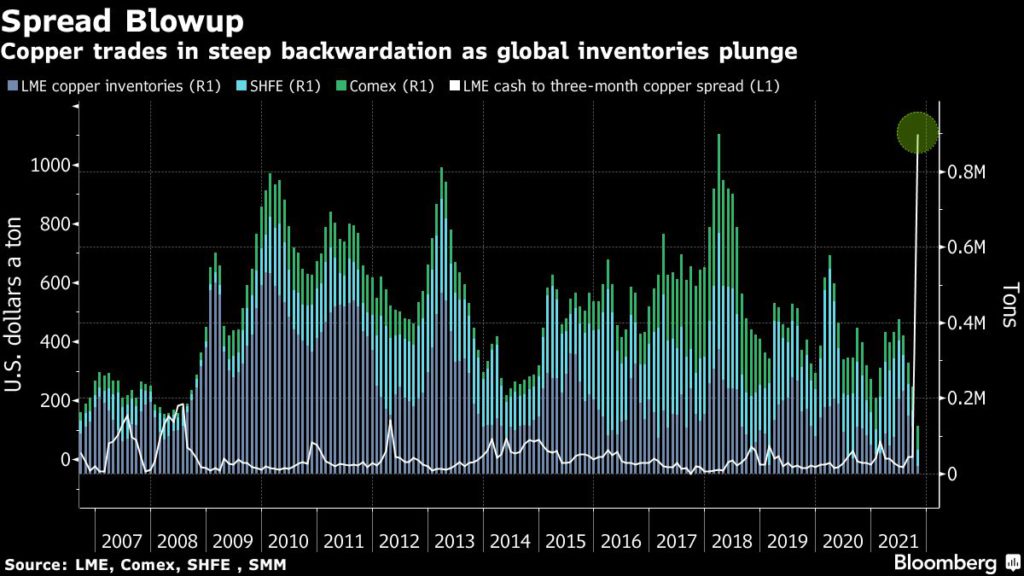

Traders were paying huge premiums for quickly deliverable copper after stockpiles in the London Metal Exchange’s (LME) warehouse system tumbled to their lowest level in decades.

The spread between cash and three-month futures surged to over $1,000 a tonne on the LME on Monday, a premium not seen since at least 1994. The spread has been widening since early October as demand outpaced supply amid dwindling global exchange inventories.

Copper for delivery in December rose on the Comex market in New York, touching $4.8055 per pound ($10,572 per tonne)

CASH copper on the London Metal Exchange also soared to a new record high overnight.

Spot copper jumped 7.2% to $11,299.50 per tonne.

Prices of the metal used in power and construction leaped 10% last week and are up and more than 30% this year after gaining 26% in 2020.

“The LME notes recent price activity in the copper market,” the exchange said in an email to Bloomberg.

“We will continue to closely monitor the situation, and have further options available to ensure continued market orderliness if these are required.”

Copper’s short-term direction will depend on whether high premiums bring more metal into LME warehouses, alleviating the supply squeeze, said independent analyst Robin Bhar.

“It is not clear if low LME stockpiles point to a genuine shortage or if metal is available in private storage, but the copper’s longer term outlook is positive due to rising demand as the world moves from fossil fuels to copper-intensive electrification. The fundamentals are bullish,”

On-warrant copper inventories in LME-registered warehouses rose to 21,050 tonnes from 14,150 tonnes, the lowest in decades, on Friday.

Copper inventories in Shanghai Futures Exchange warehouses at 41,668 tonnes are the lowest since 2009.

Fears of supply disruption also supported the market, as a Peruvian community promised to block a key mining road used by MMG’s Las Bambas copper mine in protest after failed negotiations with the Andean nation’s government.

![]()