Impala stalls Zimbabwe platinum approach over ownership concern

Zimbabwe’s plan to develop one of the world’s biggest platinum mines stalled after Impala Platinum Holdings Ltd. asked for greater transparency on the ownership of a state-run company before considering a joint venture.

Impala, the third-largest producer of platinum group metals, was approached by Great Dyke Investments Ltd. which owns the Darwendale project, said two people familiar with the talks who asked not to be identified because they aren’t public. It wants more information about the government’s Kuvimba Mining House Ltd., which is 35% owned by private shareholders the state has yet to identify.

Kuvimba and Russian tycoon Vitaliy Machitskiy’s Vi Holding each own 50% of Great Dyke.

While Zimbabwe’s government says it controls Kuvimba, its assets are the same as those that were owned until at least late 2020 by Sotic International Ltd., a company linked to Kudakwashe Tagwirei, an adviser to Zimbabwean President Emmerson Mnangagwa.

Tagwirei was sanctioned in 2020 by the U.S. Treasury, which alleged that he bribed government officials and used political influence to win lucrative state deals. Tagwirei hasn’t commented on the sanctions.

The opacity of Kuvimba’s ownership has effectively halted development of the Darwendale mine, 65 kilometers (40 miles) east of Zimbabwe’s capital, Harare, leaving the project that’s central to Zimbabwe’s economic recovery stagnant. A project by Eurasian Resources Group on land taken from Anglo American Platinum Ltd. has also stalled, as have Tharisa Plc’s plans for a new platinum mine.

The talks between Great Dyke and Impala unraveled after the Johannesburg-based mining company said its internal processes required that it conduct due diligence on the project and its ownership, the people said. Impala had contemplated taking a stake as well as processing its output, the people said.

Zimbabwe’s Ministry of Mines referred queries to the Ministry of Finance, which didn’t respond to questions. Tagwirei didn’t answer calls to his mobile or immediately respond to text messages. Impala declined to comment.

Alex Ivanov, the chief executive officer of Great Dyke, didn’t respond to a request for comment. Igor Higer, Great Dyke’s vice chairman, confirmed the receipt of questions and said he would respond. He has yet to do so.

Simba Chinyemba, Kuvimba’s CEO, said by email that the mine plan is being remodeled and an open pit rather than underground mine may be developed. While open-pit mining is cheaper, one of the people said ultimately an underground mine would need to be dug to fully exploit the orebody and a partner would be needed to process the ore.

Chinyemba said the start of construction would depend on the study and declined to comment on the talks with Impala or the identity of Kuvimba’s shareholders.

Great Dyke needs a partner to help fund the mine, which could ultimately cost $2 billion and potentially produce 860,000 ounces of platinum group metals annually, and process its ore. Its been battling to raise $650 million to get the project underway with initial production originally scheduled for next year, the people said.

Kuvimba has said that Tagwirei has nothing to do with the company but has not explained how it came to control the assets, which include gold and nickel operations.

Impala has a listing in the U.S. and assets in Canada, meaning that it will need to comply with any instructions regarding Tagwirei issued by the U.S. Treasury. Tagwirei has also been sanctioned by the U.K.

Bloomberg in May reported on a trove of emails, documents and WhatsApp messages that delineated the links between Tagwirei and Sotic and the Financial Times and The Sentry followed with reports giving details of the relationship. The documents and communication seen by Bloomberg showed his participation in company decision-making and demonstrated that he at least partially controlled Sotic.

An agreement with Impala would have made it easier for financiers led by Cairo-based African Export-Import Bank to raise the funding for the project, the people said. Afreximbank’s head of southern Africa, Humphrey Nwugo, declined to comment citing client confidentiality.

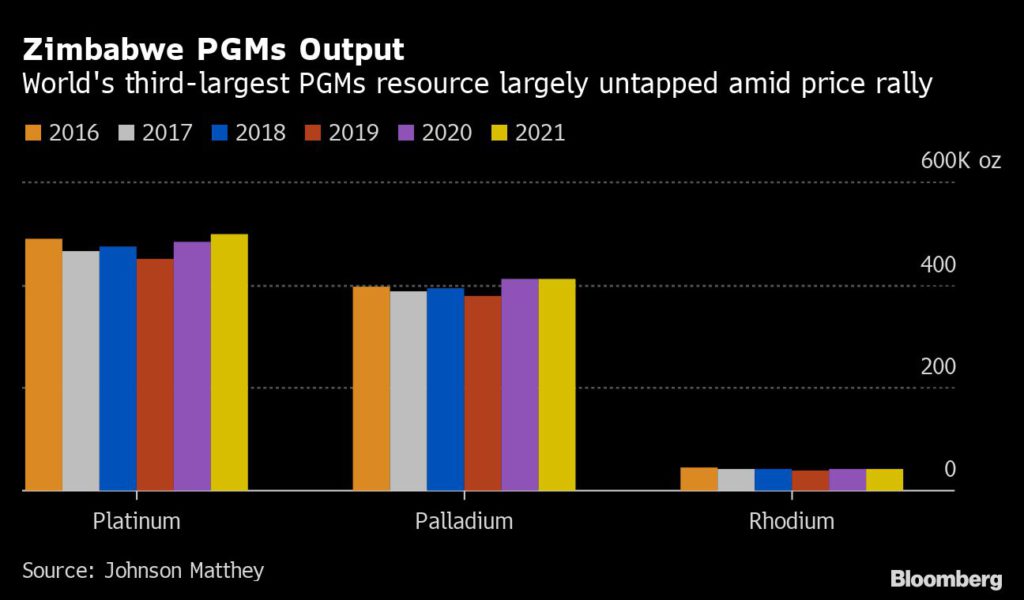

Impala owned the land upon which the Darwendale project is based until 2006, when it ceded a substantial portion of its mining concessions in the country after pressure to do so from the government of former President Robert Mugabe. Zimbabwe has the world’s third-biggest reserves of platinum group metals.

![]()