Banking activity in the DRC is one of the weakest in the region, according to the IMF

In its report published recently in August 2022 on the Congolese financial system, the International Monetary Fund (IMF) indicates the fragility of the business model of commercial banks in the Democratic Republic of Congo.

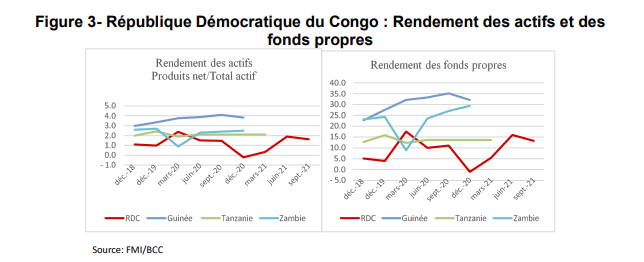

“A comparative analysis with certain peers in the region (countries very dependent on exports from the mining sector) underlines that banking activity in the DRC is one of the least profitable in the region despite very high interest margins, at more than 10 percent,” notes this Bretton Woods financial institution in this study conducted by its Monetary and Capital Markets Department (MCM).

Among the causes of this fragility of the banking activity of Congolese banks, the IMF cites a difficult business environment with an uncertain application of the rule of law. This combines with the lack of diversification of the economy, limiting the potential demand for financial services, especially credit.

Equally, interest margins do not contribute significantly to profitability insofar as banks are not active enough on credit, according to the IMF. Operating costs are high, as are fiscal and parafiscal charges, bank supervision fees (an annual amount of 0.6 percent of total deposits).

It should be noted that the DRC is among the 10 countries in the world with the lowest credit/GDP ratio, i.e. nearly 7.5% at the end of 2020 against a world average of 147.6 percent, according to the same document. The banking sector’s contribution to financing the economy remains very modest, with low portfolio diversification and a predominance of loans in foreign currency, which represented an average of 89.2% of the portfolio of loans to the economy over the five last years.

![]()