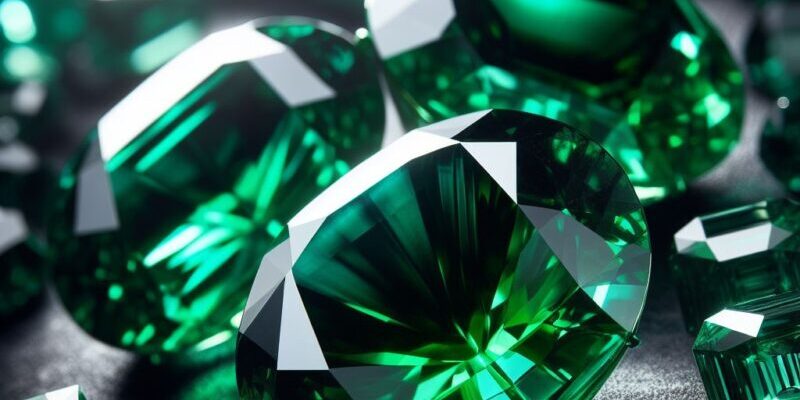

Gemfields Records Strong Revenues in 2023 Despite Production Challenges

Gemstone miner Gemfields achieved its second-highest yearly revenues in 2023, driven by record prices for rough colored gemstones sold at auction.

However, production challenges were encountered at its key operating assets, the Kagem emerald mine in Zambia and the Montepuez Ruby Mining (MRM) in Mozambique, compared to the previous year.

CEO Sean Gilbertson expressed optimism about the company’s future despite production setbacks, highlighting ongoing investments aimed at transforming the business.

He mentioned upcoming auctions in Jaipur for emeralds and rubies, indicating strong demand for colored gemstones.

In 2023, Kagem and MRM generated revenues of $89.9 million and $151.4 million, respectively. Despite hosting one less higher-quality emerald auction, total auction revenues for the year were the second-highest in the company’s history.

Gemfields’ subsidiary, Faberge, reported revenues of $15.7 million, slightly lower than the previous year due to softer luxury market conditions.

Additionally, a review of Gemfields’ shareholding in Sedibelo Resources resulted in a fair value writedown of $28 million, reflecting reduced valuations in the platinum group metals sector.

Gemfields anticipates reporting a net loss after tax of $2.8 million for 2023, primarily attributed to the Sedibelo writedown and the withdrawn higher-quality emerald auction. However, the company asserts that this loss does not reflect the overall strength of its business.

The expected loss per share for 2023 is $0.008, compared to earnings per share of $0.048 in 2022. Furthermore, the headline loss per share, which includes Sedibelo’s fair value loss, is projected to be $0.009, compared to headline earnings per share of $0.048 in 2022.

Gemfields is set to release its full financial results on March 25, signaling transparency and accountability to its stakeholders amidst evolving market conditions.

![]()