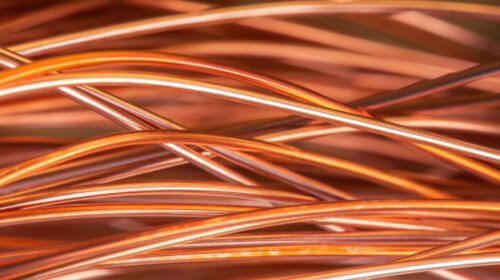

Global Copper Demand to Surge by 75% by 2050

Copper demand is projected to soar by 75%, reaching 56 million tonnes by 2050, according to a new report from data analytics firm Wood Mackenzie.

This sharp increase will necessitate significant investment and strategic changes in the global supply chain, particularly as major economies seek to reduce reliance on China.

Copper plays a critical role in electrification and decarbonization, making it indispensable for the global energy transition. However, China currently dominates the copper supply chain, including mining, downstream processing, and semi-manufacturing.

As countries look to diversify supply chains away from China, the resulting inefficiencies could drive up the cost of finished goods and slow down the energy transition.

Wood Mackenzie’s August Horizons report, titled ‘Securing Copper Supply: No China, No Energy Transition’, highlights the immense challenge of replacing China’s smelting and refining capabilities.

The report estimates that it would require nearly $85 billion to replicate China’s smelting and refining capacity outside the country to meet global demand.

“A scenario without China in the copper supply chain would demand a substantial increase in processing capacity to meet energy transition goals.

Our projections indicate an additional 8.6 million tonnes of copper demand outside China over the next decade,” said Nick Pickens, Global Mining Research Director at Wood Mackenzie.

“This demand represents 70% of smelter capacity and 55% of fabricator capacity outside China. As governments and manufacturers aim to diversify, it’s crucial to consider the entire supply chain, not just mining operations.”

China has significantly shaped the global copper supply chain, particularly in the last two decades. Since 2000, the country has accounted for 75% of global smelter capacity growth and currently controls 97% of global smelting and refining capacity. This dominance has led to over three million tonnes of production and nearly $25 billion in investment.

Moreover, China has added nearly 11 million tonnes of copper and alloy capacity since 2019, representing about 80% of global additions.

Approximately two-thirds of these facilities produce wire rods, giving China half of the world’s fabrication capacity, with more expansions underway.

“China’s copper smelting industry has undergone significant evolution. Today, Chinese smelters are low-cost and meet high environmental standards, particularly in sulphur dioxide capture, making them highly competitive,” noted Zhifei Liu, Managing Consultant for Copper Markets at Wood Mackenzie.

The report also discusses the challenges faced by copper semi-fabricators outside China, particularly in Europe, where lower usage and higher operating costs are impacting competitiveness.

Regulations like the EU’s Carbon Border Adjustment Mechanism could further reduce competitiveness by imposing higher taxes on the European copper industry.

Meanwhile, US government incentives such as the Inflation Reduction Act may not guarantee the long-term sustainability of the copper industry.

New smelting facilities are being developed outside China, with India, Indonesia, and the Democratic Republic of Congo set to add 1.6 million tonnes to global smelting capacity by 2025, driven primarily by Chinese investment.

However, there are no plans for new primary smelting capacities in North America or Europe. Instead, the US is focusing on the secondary market and scrap copper, including its first secondary smelter for complex materials in Georgia.

“While some rebalancing of the copper supply chain has begun, China’s dominance makes complete replacement unfeasible. New processing and fabrication facilities may result in higher costs and delays in the energy transition,” said Pickens.

“Financing these investments presents additional challenges, particularly with strong resistance to new smelter projects on environmental and social grounds in Europe.

Pragmatism and compromise will be essential to achieve net zero goals without imposing excessive costs on taxpayers. Easing global trade restrictions could be one necessary concession.”

115 total views , 1 views today