Sibanye-Stillwater Gains from U.S. Regulatory Changes on Critical Minerals

Sibanye-Stillwater has received a significant boost from the United States following the publication of final regulations that provide incentives for mining critical minerals, including palladium and platinum.

These incentives are part of the Inflation Reduction Act’s (IRA) Section 45X, which now allows for a 10% ‘Advance Manufacturing Production’ credit. The previous version of the Act restricted this incentive to refiners, excluding miners, but has since been amended.

“We welcome the amendments to the Section 45X regulations made by the U.S. Treasury and applaud its foresight in understanding our industry and operations,” said Neal Froneman, CEO of Sibanye-Stillwater.

He expressed confidence that such proactive legislation would benefit the mining and processing of critical minerals in the U.S., ensuring the sustainability and growth of the regional critical minerals value chain.

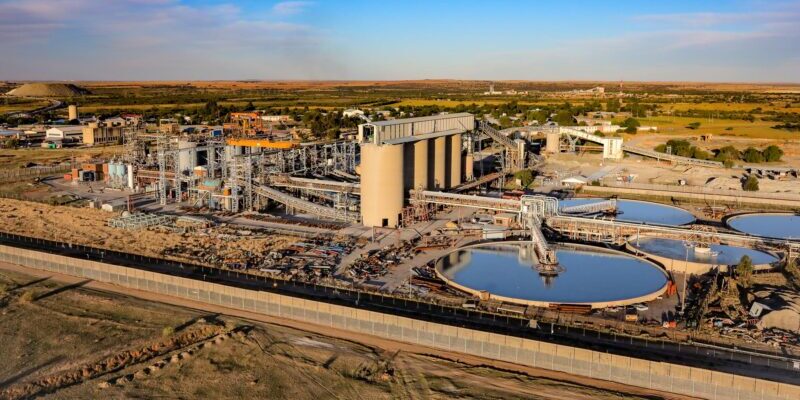

Froneman noted that these regulations would provide essential financial support for the company’s U.S. PGM operations, which have faced considerable pressure recently.

A 28% decrease in the average rand 4E PGM basket price and a 30% drop in the average U.S. dollar 2E PGM basket price led to a reduction of 200,000 ounces in annual production at the Stillwater palladium and platinum mine.

For the first half of 2023, Stillwater produced 238,139 ounces of 2E (up from 205,513 ounces in H1 2022) at an all-in sustaining cost (AISC) of $1,343 per ounce, compared to $1,737 per ounce the previous year.

Last year, Sibanye-Stillwater postponed an expansion of Stillwater to a target of 700,000 ounces per year, ultimately setting a new production target of 440,000 to 460,000 ounces for the 2024 financial year.

Additionally, the IRA incentives also extend to lithium production, coinciding with the U.S. federal government’s approval of an environmental permit for the Rhyolite Ridge lithium/boron mine, where Sibanye-Stillwater has the option to invest.

According to spokesperson James Wellsted, the company plans to complete a feasibility study for the project, after which it will decide whether to invest $490 million for a 50% stake.

The U.S. Bureau of Land Management supported the Rhyolite Ridge project in its final environmental impact statement issued in September.

Sibanye-Stillwater also experienced a short-term uptick in palladium prices following reports that the U.S. has asked G7 allies to consider sanctions on Russian exports of palladium and titanium.

On Thursday, palladium futures peaked at $1,173 per ounce, marking the highest price of the year, according to Dow Jones Market Data. As a result, shares of Sibanye-Stillwater rose nearly 8% this week.

![]()