Increasing supply from China to cap aluminum price – report

Expect to see a broader recovery in global aluminum demand alongside a forecast rebound in global economic growth, market analyst Fitch Solutions says in its latest industry report.

An increase in global supply driven by a rise in Chinese exports, Fitch says, will limit the scope of the reduction in the production balance.

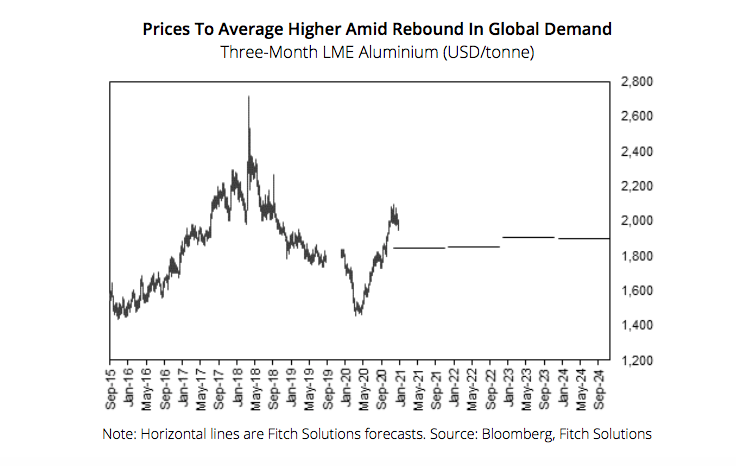

Fitch maintains its 2021 aluminum price forecast of $1,850/tonne, up from $1,731/tonne in 2020 during the covid-19 pandemic. The analyst expects to see increasing supply from China in the global market, which will cap the rise in prices.

Fitch expects to see a broader recovery in global aluminum demand alongside a forecast rebound in global economic growth, helping to narrow some of the supply surplus. Country Risk analysts forecast a sharp yet uneven recovery in the global economy of 5.4% y-o-y growth in 2021, compared with a 4.0% contraction in 2020.

Prices will trend higher on average in 2021, versus 2020, Fitch predicts, as green stimulus policies worldwide support aluminium use in construction and electric vehicle EV assembly. In 2020 the European Commission included bauxite, the precursor to aluminium, in its annual Critical Raw Materials list.

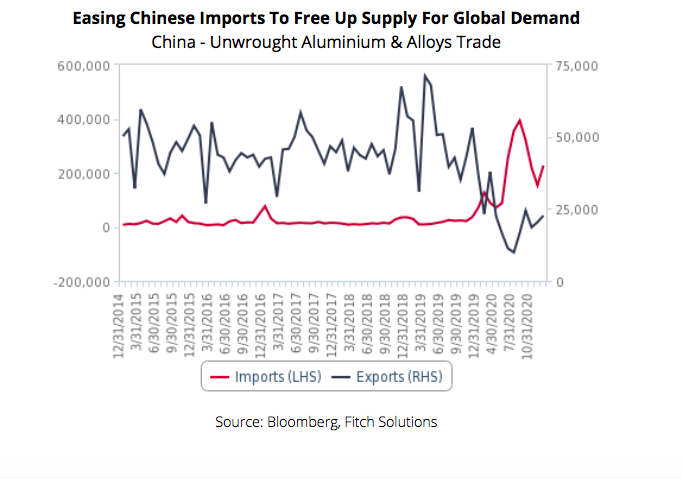

Waning import levels, and renewed exports will limit the scope of tightness in the aluminum market ex-China, and in turn cap the present price rally, Fitch forecasts.

In 2020, China’s imports reached 2009 highs, achieving 319% y-o-y growth. On the other hand, exports declined alongside an absence of global demand and high domestic demand depleting local inventories.

In 2021, Fitch expects to see an increase of Chinese supply into the market as exports have begun to rebound since September 2020. Domestic production set a record high of 37.1mnt in 2020, and Fitch forecasts Chinese aluminum production to grow by 2.0% in 2021 as the country installs approximately 3mnt of new capacity and edges higher towards its 45mnt per annum cap.

Chinese aluminum imports will return to pre-covid levels in the coming quarters as domestic aluminum demand moderates in the latter half of 2021. Although Fitch’s Country Risk team expects China to experience strong GDP growth in 2021, it forecasts government consumption to be the sole GDP expenditure category to witness slower growth in 2021 than in 2020. This is due to expectations that Beijing will likely pull back on any additional stimulus efforts and refocus its efforts on curbing debt levels, likely preventing future spikes in domestic aluminum demand.

Aluminum will be favoured in construction as China experiences a shift away from wood to aluminum for concrete casting. Eight Chinese provinces have issued policies on aluminum alloy casting since May 2020 when the Chinese government implemented new guidelines aimed at minimizing construction waste, Fitch points out.

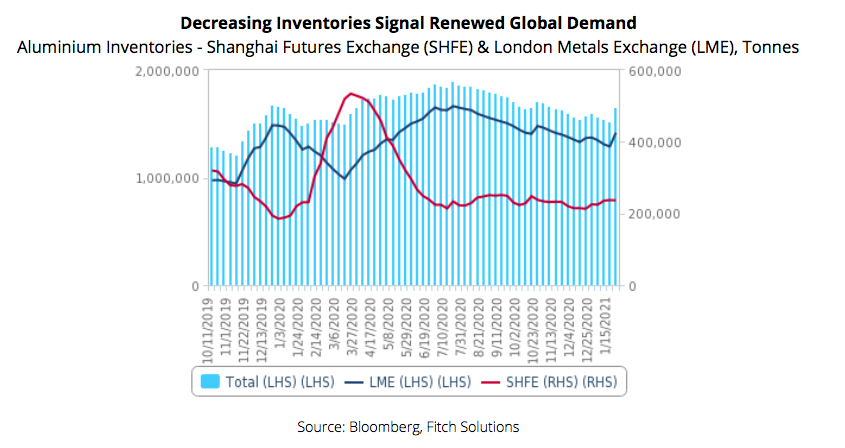

Decreasing London Metals Exchange (LME) aluminum inventories have begun to signal a shift in rebounding demand outside of China, Fitch notes.

Between October 23, 2020 and January 22 2021, Chinese inventories (SHFE) declined by 0.6%, while LME aluminium inventories contracted 4.2%. LME inventories had previously increased by 14.7% between the end of January and end of September 2020, most likely driven by the impact of covid-19 on aluminum demand for manufacturing and infrastructure.

![]()