EV metals index beats record by 54% as electric cars reach tipping point

The global vehicle market in 2020 had its worst year in decades. European sales were the lowest since 1985, 15% fewer cars left US showrooms and while the decline in China was in single digits, it was the third down year in a row for the world’s largest car market.

But 2020 turned out to be a breakthrough year for electric cars, particularly in the two largest markets. EU sales doubled to 1.3 million with penetration reaching a stunning 19% during the final quarter, just eclipsing sales figures in China for the year.

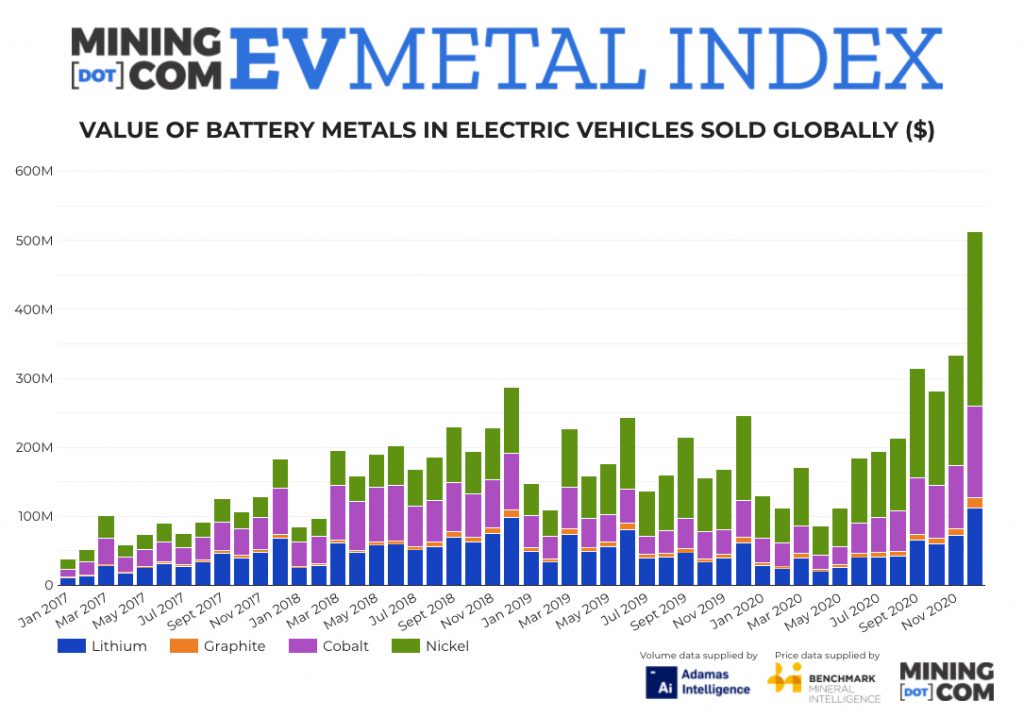

The MINING.COM EV Metal Index, which tracks the value of battery metals in newly registered passenger EVs (including hybrids) around the world set a fresh monthly record of $512.2 billion in December, racing past the previous record and doubling from a year ago.

The final month of the year always sees a rush of car registration, but as testament to the rapid growth of the industry, December 2020 equals almost half the full-year total in 2017.

After lagging 2019 for most of the year due to covid-19 disruptions, 2020 ended 23% ahead with $2.64 billion worth of battery metals finding its way into new cars.

Capacity audacity

Total battery capacity of EVs sold during the month increased 98.5% year on year to over 25 GWh, according to Adamas Intelligence, which tracks demand for EV batteries by chemistry, cell supplier and capacity in over 90 countries. December’s tally lifted the annual total to over 130 GWh, a 40% increase over 2019.

In order to produce the most accurate data, the monthly battery capacity deployed numbers in the MINING.COM EV Metal Index do not include cars leaving assembly lines, those on dealership lots or in the wholesale supply chain, only end-user registered vehicles.

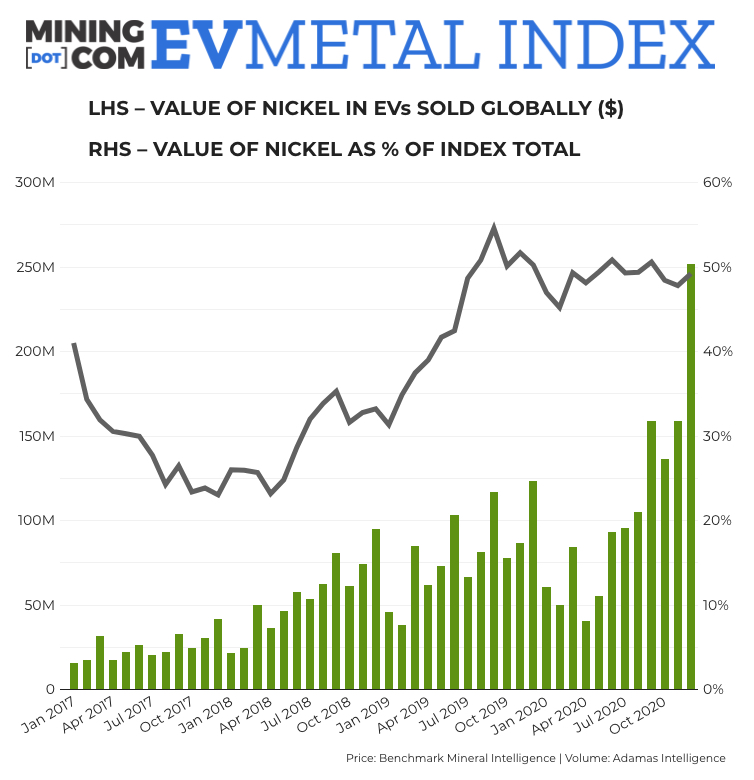

Tesla was number one in terms of battery capacity deployed, accounting for 1 out of every 4 MWh hitting roads during 2020 and also led in the deployment of nickel and cobalt, as its China-made models fitted with NCM cathodes (as opposed to NCA used in the US which use less cobalt) experienced strong sales.

The cathode mix at Tesla is likely to change significantly following the launch of its LFP (lithium-iron-phosphate) equipped Model 3 at the end of last year – in December the lower cost, lower range car for sale in China and also exported to Europe constituted 30% of the company’s global sales, according to Adamas data.

Prices catching up to demand

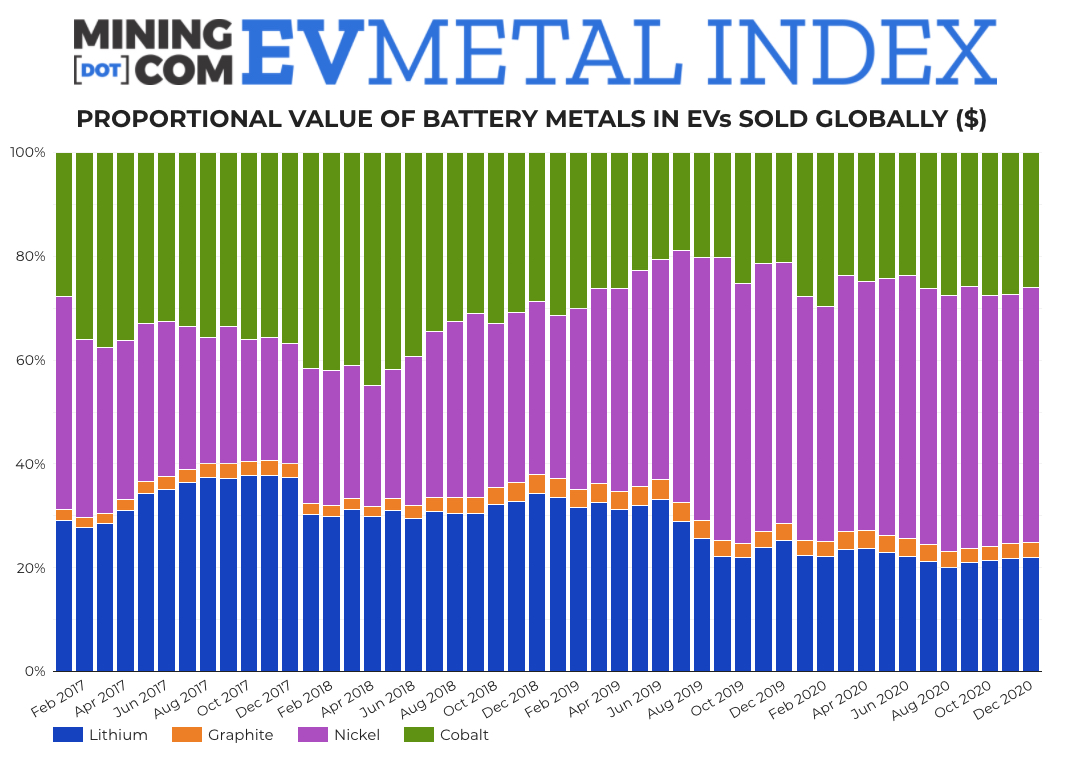

According to the Toronto-based researcher, during the month lithium used in newly-sold EVs jumped 112% year over year, topping 15,000 tonnes for the first time. With prices surging at the outset of 2021, the lithium subindex will likely increase its portion of overall value which has declined from more than a third in 2017 to just over 20% now.

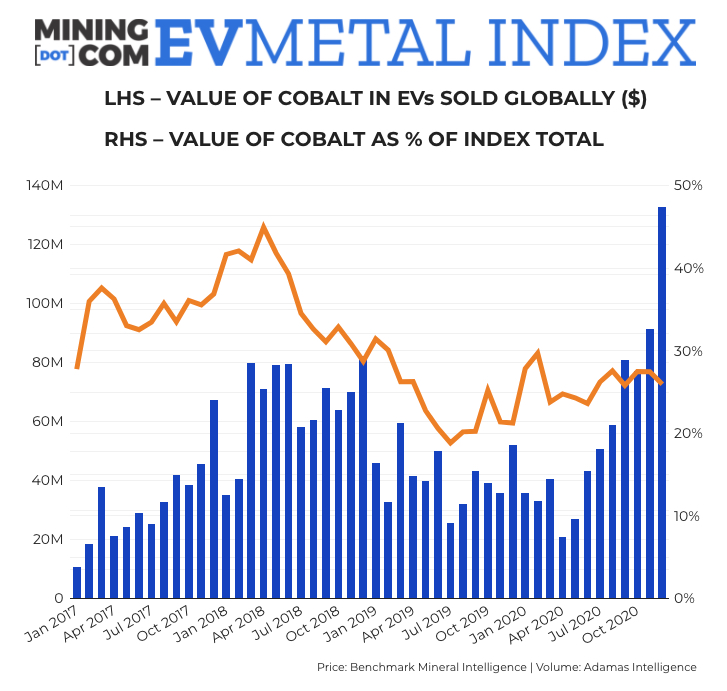

Deployment of cathode material cobalt increased 85%, while nickel use was up by 77% compared to the same month in 2019. Nickel use in battery technologies has climbed steadily and now constitutes nearly half the value of the index, while cobalt has gone from 45% when its price was peaking to 25% despite the rise in price.

Benchmark Mineral Intelligence price assessments showed month on month increases in prices of all four commodities making up the index, with cobalt up 37% over the course of last year.

The Benchmark cobalt index price jumped above $40,000 a tonne in November for the first time in two years and continued to climb into the new year. That lifted the cobalt sub-index to a monthly record of $133 million, despite the fact that prices are still 60% below levels seen early 2018.

![]()