Copper price crashes through $4.00, down 7%

Comex copper plunged on Thursday as doubts creep in about the sustainability of a rally that took the bellwether metal to within throwing distance of an all-time high.

May delivery futures contracts fell 7.1% to $3.8490 a pound ($8,486 a tonne) in early afternoon trade in New York in massive volumes of 4.5 billion pounds or more than $17 billion worth of copper traded.

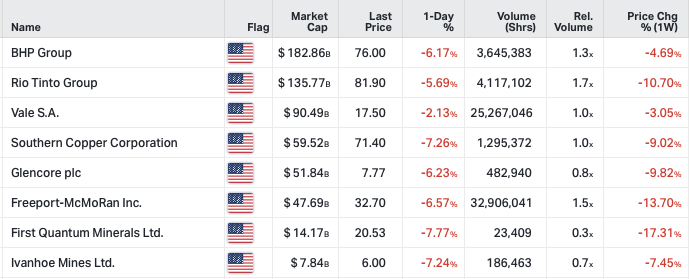

The carnage spilled over onto equity markets with top copper producers hammered. For the week number two diversified miner Rio Tinto, Phoenix-based Freeport-McMoRan and Vancouver’s First Quantum Minerals are now down by double digits on a percentage basis.

The copper price touched an intra-day high of $4.37 a pound just a week ago, not far off it’s all time record of $4.58 a pound or more than $10,000 a tonne struck in February 2011.

The peak came after a spectacular rally from the depths of the pandemic-induced slump that saw copper briefly trade below $2.00 a pound around a year ago.

Arbitrage window shut

A research note by Capital Economics, an independent London-headquartered research firm, suggests there may be more weakness ahead.

Capital Economics says that while falling stocks of copper in LME warehouses show that demand outside China is recovering, some of the fundamental factors supporting industrial metals prices are beginning to fade.

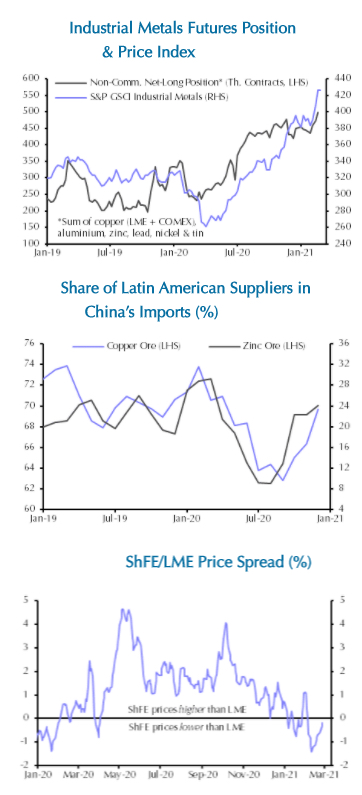

Firstly, the most recent price spikes in industrial metals have largely been driven by investor optimism as evidenced by long positions on the LME and Comex markets, and secondly, some of the fundamental supports of the rally have disappeared.

Chinese arbitrageurs are back on the sidelines and record-setting imports by the country, responsible for more than half the world’s copper consumption, are likely to ease as traders pick up cheaper domestic metal.

Significantly, mine supply from top copper producers in South America has bounced back after a year of pandemic-related disruptions and labour action.

A survey of more than 20 investment banks and research houses compiled by Focus economics in February also point to weakness ahead.

The consensus forecast is for copper to trade at under $7,500 a tonne ($3.40 a pound) in the final quarter of 2021. For nickel, the projected Q4 average is $16,550 a tonne while zinc is expected to exchange hands for around $2,640 a tonne.

![]()