AngloGold quits mining in south Africa sells assets for $300 million

Miner AngloGold Ashanti has reached an agreement to sell its remaining South African producing assets and related liabilities to South Africa’s Harmony Gold Mining Company, for around $300 million in cash, subject to subsequent performance, AngloGold Ashanti said.

The sale will help streamline AngloGold Ashanti’s portfolio to enhance its operating and financial metrics, the company said in a statement. The transaction is subject to approval by the South African competition authorities and the country’s minister of mineral resources and energy and could be completed around June 30, 2020.

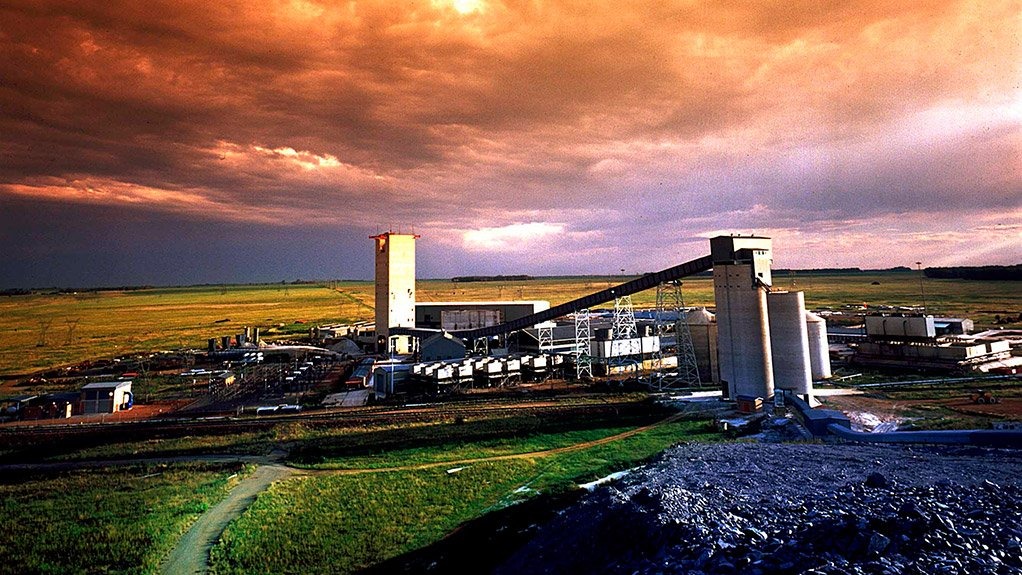

Harmony said the acquisition would consolidate its position as South Africa’s biggest gold producer. It will see Mponeng mine, described as the world’s deepest, and Mine Waste Solutions, a mine waste retreatment operation, incorporated into its portfolio, enlarging Harmony’s near-term gold production by approximately 350,000 oz a year. It will also increase Harmony’s South African reserves by 8.27 million oz (excluding Mponeng below infrastructure reserves) and improves Harmony’s portfolio mix between surface and underground operations, Harmony said.

Harmony described the acquisition as “a natural next step” following the acquisition of South Africa’s Moab Khotsong mine in 2018. “Over the past two years, Harmony has added over 500,000 quality gold ounces per annum through the acquisition of Moab Khotsong and now Mponeng and Mine Waste Solutions. The acquisition has the potential to improve our overall recovered grade and increasing our cash flow margins,” Harmony CEO Peter Steenkamp said in a statement.

AngloGold Ashanti announced in May 2019 that it was reviewing sales options for a portfolio of assets including Mponeng, where investments needed to extend the mines life would be in competition with other, higher-return AngloGold Ashanti priorities. Also included in the sale are the Tau Tona and Savuka mines, First Uranium, which owns a retreatment operation, tailings assets and a surface rock dump processing business.

As part of the same strategy, AngloGold Ashanti and joint venture partner IAMGOLD agreed in December 2019 to sell their 82% stake in Sadiola gold mine in Mali to Australian Allied Gold Corp for $105 million in cash. The company is also reviewing divestment options for its interests in Cerro Vanguardia in Argentina, while its recently restarted Obuasi gold nine in Ghana is viewed as a key growth area.

Harmony’s deep mining expertise

Harmony was identified as the most suitable party to acquire the assets currently being sold, “given its financial capacity and proven technical capability in operating ultra-deep, hard-rocking mining assets in South Africa,” AngloGold Ashanti said.

AngloGold Ashanti continues to review all aspects of its corporate structure, it said. The company has 14 gold-producing operations in nine countries, ranging from mining to refined gold production and sales. It will retain its interest in the Rand Refinery in South Africa, one of the world’s largest refining and smelter operations.

Rene Hochreiter, analyst at South Africa-based NOAH Capital Markets, viewed Harmony’s ability to get Mponeng’s costs down is the main risk in this acquisition, as the deal itself is potentially “not a dripping roast.”

However, Harmony does have a good track record in cutting costs, for instance at the Moab mine, according to the analyst. “If it can do the same this time, there is substantial upside to the profitability of Mponeng and Harmony itself,” he said.