AVZ finds power solution for DRC project

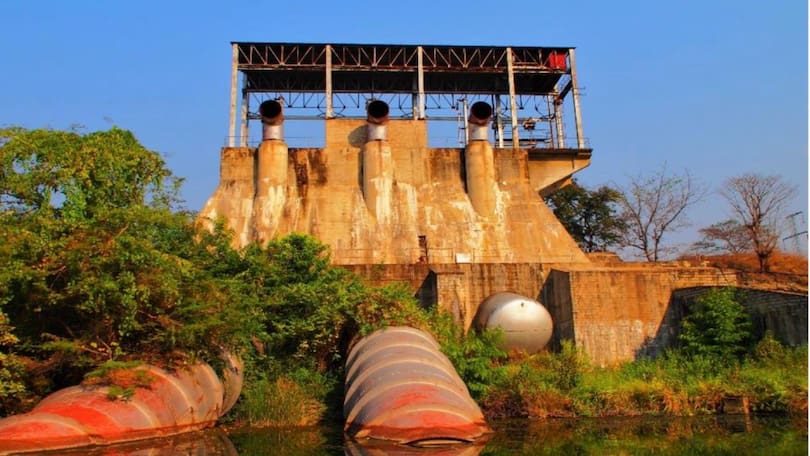

Lithium hopeful AVZ Minerals on Wednesday announced that its subsidiary AVZ power SAU had inked a memorandum of understanding (MoU) with the Ministry of Hydraulic Resources and Energy, in the Democratic Republic of Congo, to investigate the refurbishment of the Mpiana-Mwanga hydro-electric power station on the Luvua river, along with the associated power grids.

The hydro-electric power station is some 85 km from the proposed Manono mine site, and ceased operations in 1982.

AVZ is hoping to acquire a long-term, 100% exclusive lease to rehabilitate the power station, with restart feasibility studies suggesting that some 54 MW of electricity could be generated, which would be sufficient to power the Manono town site and the nearby mining camp, as well as associated infrastructure and any future expansion of the mine site, including a 25 000 t/y hydroxide plant.

“WE have been working towards securing this opportunity for several months now and we consider the rehabilitation of the Mpiana-Mwanga power station is a major step forward for the company,” said AVZ Minerals MD Nigel Ferguson.

“Controlling the refurbishment of the hydro power plant allows the company to develop the hydro plant in phases that align with AVZ’s mine expansion programme, with the first phase delivering approximately 18 MW of electricity from two turbines.

“We can then expand the existing power station, which has capacity for six turbines, to deliver additional electricity for our expanded dense media separation plus flotation operation and finally, our third expansion phase, establishing a hydroxide plant, with a combined requirement of approximately 54 MW of electricity.”

Ferguson noted that from an economic perspective, AVZ was likely to generate significant longer-term savings from generating its own electricity at an estimated 3c to 4c per kWh, as opposed to using diesel-powered generators at an estimated 42c/kWh.

“Ultimately, the electricity generated from the power station could be used for operating all of our mining equipment, making the Manono lithium and tin project a 100% ‘green’ mine, as well as providing sufficient electricity to power the entire Manono town site and rehabilitate the associated power grids in the Manono Territory.”

A scoping study at Monono estimated that a five-million-tonne-a-year operation could deliver some 1.1-million tonnes a year of lithium concentrate over a 20-year mine life, for a capital cost of between $380-million and $400-million.

The scoping study estimated a pre-tax net present value of around $2.6-billion, and an internal rate of return of more than 64%.

Source: Mining Weekly

![]()