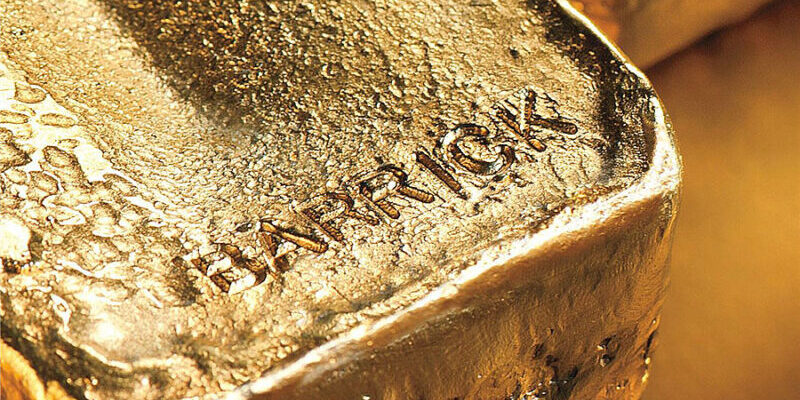

Barrick Gold Reports Lower Q3 Production Amid Challenges at Nevada Mines

Barrick Gold reported lower-than-expected gold production in the third quarter, attributed to a decline in output at its Carlin and Cortez mines in Nevada, the Canadian miner announced on Wednesday.

The Carlin and Cortez mines are part of Nevada Gold Mines, a joint venture between Barrick and U.S.-based Newmont.

Total gold output at Nevada Gold Mines decreased to 385,000 ounces in the July-September quarter, down from 401,000 ounces in the previous three months.

Despite the decline, Barrick, the world’s second-largest gold producer, anticipates a “materially stronger fourth quarter.” The completion of an operational expansion at the Carlin mine during a third-quarter shutdown is expected to enhance throughput and recovery rates in the final quarter of the year.

Overall, Barrick’s preliminary gold output for the third quarter stood at 943,000 ounces, falling short of analysts’ expectations of 975,000 ounces, according to data compiled by LSEG.

The company expects all-in sustaining costs—an industry metric for total expenses related to gold production—to be at least 2% higher than in the previous quarter.

Barrick’s preliminary copper production reached 48,000 tonnes, an 11.6% increase over the second quarter, driven by improved output at the Lumwana mine in Zambia.

Analysts from Scotiabank, led by Tanya Jakusconek, noted that Barrick would need to increase both gold and copper production by nearly 30% quarter-over-quarter to reach the midpoint of its production outlook. “We view these results as slightly negative for the shares,” she stated.

Following the announcement, Barrick’s shares declined nearly 1% to C$27.63. The miner projects gold production between 3.9 million and 4.3 million ounces and copper production between 180,000 and 210,000 tonnes in 2024.

Barrick is scheduled to release its detailed third-quarter results on November 7, with analysts anticipating an adjusted profit of 35 cents per share, up from 24 cents per share a year earlier, due to rising gold prices spurred by interest rate cuts and safe-haven demand.

![]()