Barrick’s Embedded Growth Projects to Drive Value With 30% Rise in Production

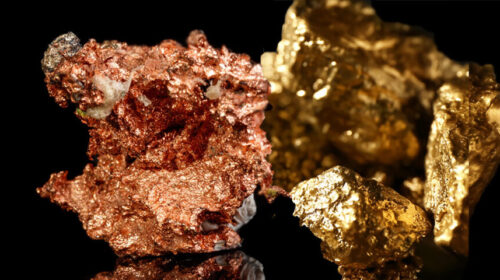

With the potential embedded in its growth project portfolio, Barrick plans to double its copper production by the end of the decade and continue to increase it to an estimated 1 billion pounds or 450,000 tonnes of copper per annum by 2031, says president and chief executive Mark Bristow.

Speaking to investors on an update call, Bristow said this substantial growth in copper production combined with the output from Barrick’s sector-leading gold portfolio was expected to increase the group’s attributable production by some 30% to 6.8 million gold-equivalent ounces by 2031.

“The value of these projects, and in particular of our substantial and growing copper business, is currently underestimated by the market. If it was properly appreciated, Barrick would be commanding a premium to our peers,” he said.

Reko Diq in Pakistan is positioned to rank as one the world’s top 10 copper mines when it reaches full production and the pre-feasibility study on the Lumwana Super Pit Expansion is projected to deliver a potential of 240,000 tonnes of copper production per annum from a 50 million tonne process plant expansion over a 36-year life of mine.

The accelerated Lumwana work program is now targeting to complete a full feasibility study by the end of 2024, which brings forward our expected production from the Super Pit to 2028.

The Reko Diq project also remains on track to deliver an updated feasibility study by the end of 2024. Together, the Reko Diq and Lumwana Super Pit feasibility studies will underpin potential reserve updates and the transition to construction.

“Within our gold growth portfolio, the wholly-owned Fourmile project is a best-in-class development project located in the world’s most prolific gold district adjacent to existing infrastructure, with ongoing drilling demonstrating significant potential to increase in grade and size.

Accordingly, we are assessing options for independent exploration decline access in support of a pre-feasibility study, which would later be re-utilized for development and production complementing the current Goldrush development.

The results of our preliminary economic assessment indicate that this could support a potential production profile of 300,000–400,000 ounces per annum, over and above the existing Cortez profile of 950,000–1.2 million ounces per year (100% basis) over 10 years,” says mineral resource management and evaluation executive Simon Bottoms.1,6

Bristow said Nevada Gold Mines, the world’s largest gold mining complex, was expected to grow its annual production to 3.7 million ounces (100% basis) towards the end of the decade driven by our three Tier One assets and near-mine exploration pointed to the extension of that horizon to 15 years and beyond. 1,7

In the Carlin District, the current 10-year production profile is expected to be between 1.4–1.6 million ounces per year (100% basis) and we have identified an exciting potential high-grade opportunity at Horsham on the northeast side of the known high-grade controlling structures in the Leeville Complex that we will advance over the next few years and is expected to extend this profile well past the 10-year window.

Similarly at Turquoise Ridge, we expect to build on the already significant reserves and resources base with multi-million ounce potential growth opportunities at Cricket Corridor to the east, BBT Corridor to the south, and Getchell Fault zone to the west.

This will potentially further add to the existing 10-year production profile of 550,000–700,000 ounces per year (100% basis).1

In Latin America, the Pueblo Viejo expansion project is transforming a Tier One mine headed for closure into a long-life, low-cost producer.

While in Papua New Guinea, we are working towards the restart of Porgera by the end of this year, and restarted drilling will target the resource definition of the Wangima Pit, with similar geology to the existing underground and open pit, which has the potential to underpin an approximately twenty year mine life.9

“The Africa and Middle East region, our most consistent production and reserve replacement performer, now also presents us with the exciting growth opportunities as we leverage our partnership model in Tanzania and Saudi Arabia,” Bristow said.

![]()