Caledonia Mining Seeks Funding from African Banks for Zimbabwe Gold Mine

Mark Learmonth, CEO of Caledonia Mining Corporation, revealed on Wednesday that African development banks are the prime candidates to finance the company’s proposed $250 million gold mine project in Zimbabwe.

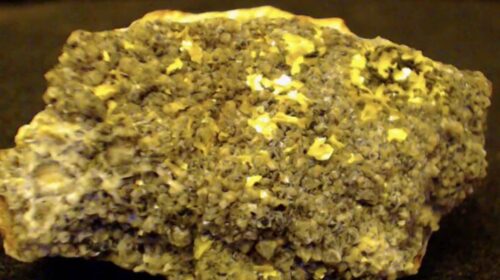

Caledonia, the owner of the Blanket gold mine in Zimbabwe, is in the process of updating a feasibility study in preparation for constructing a new mine at Bilboes.

This new venture aims to yield a minimum of 170,000 ounces per year, potentially making it the largest gold mine in the country.

Despite Zimbabwe’s abundance of mineral resources, including platinum group metals, gold, and lithium, the nation has struggled to attract investment due to economic instability and concerns over property rights stemming from the government’s seizure of white-owned farms in the early 2000s.

Caledonia, backed by investors such as BlackRock and Cape Town-based fund manager Allan Gray, stands among the select few foreign investors, alongside Anglo American Platinum and Impala Platinum, willing to navigate Zimbabwe’s challenging economic landscape characterized by foreign currency shortages and periods of hyperinflation.

During a conference call, Learmonth stated that the company is engaged in initial discussions with potential lenders, with African development banks emerging as the frontrunners due to their keen interest in the project.

Learmonth emphasized that debt financing would constitute the primary source of funding for the Bilboes project. He asserted that the company would defer seeking non-debt funding until after assessing the debt capacity, as debt financing remains the most cost-effective option.

With an optimistic outlook, Learmonth projected that once funding is secured, construction of the mine could commence within a year and would likely span over two years post-financial close.

Caledonia’s operational profit witnessed a significant decline of 62% to $15.18 million in 2023, compared to $40.28 million the previous year, primarily attributed to increased administrative and production costs.

136 total views , 1 views today