GoviEx Highlights Strong Economics and Low-Cost Potential for Muntanga Uranium Project in Zambia

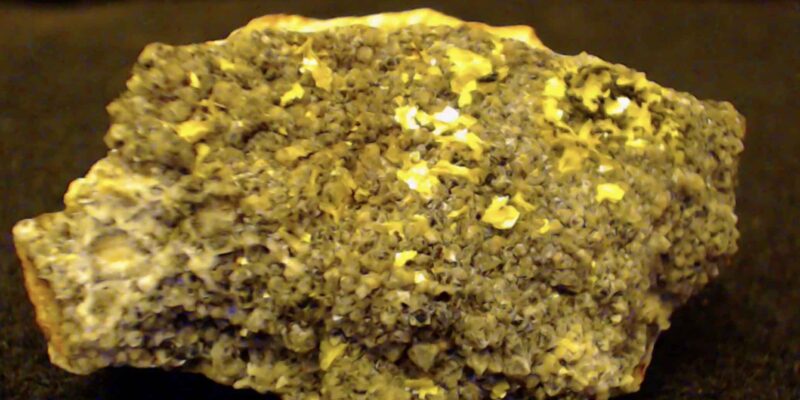

GoviEx Uranium, listed on the TSX-V, has announced robust feasibility study results for its Muntanga uranium project in Zambia. The study highlights the project’s low technical risk and confirms its potential as a shallow open-pit mine with a heap leaching operation. The feasibility study estimates an after-tax net present value (NPV) of $243 million, with an internal rate of return (IRR) of 20.8%, based on a triuranium octoxide (U3O8) price of $90 per pound. For every $5 increase in the U3O8 price, the NPV increases by $45 million. The project…

Read More Here