Chinese Copper Exports Plunge as Domestic Demand Surges

Chinese copper exports sharply declined in July, falling 40% from June to 140,940 tons, according to customs data released Sunday.

This drop follows a historic surge in June, as domestic buyers capitalized on the metal’s price drop. Despite the decline, July’s export volume remains nearly double that of the previous year, with shipments over the first seven months of 2024 up 43% compared to 2023.

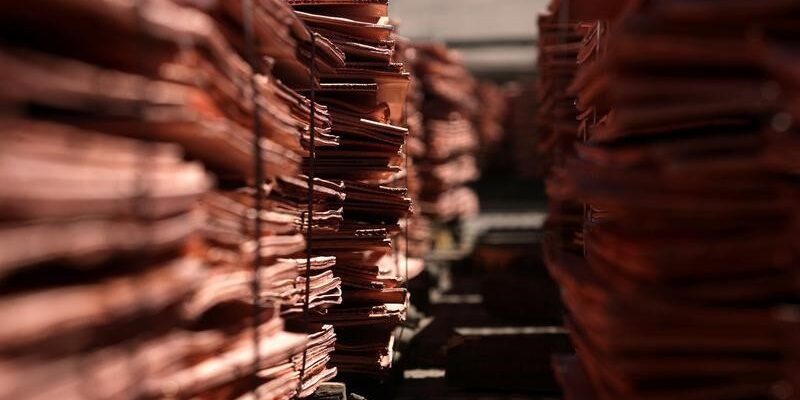

The surge in international copper prices, which reached a record high in May, had led to an unusual increase in Chinese exports, filling London Metal Exchange (LME) warehouses with Chinese copper. However, with domestic demand improving, further decreases in exports are anticipated.

The arbitrage window for importing refined copper reopened this month, as the Yangshan premium, an indicator of demand for overseas metal, rebounded. Stockpiles on the Shanghai Futures Exchange have also decreased from their June peak.

China’s copper market remains delicately balanced. While smelter output in July was reduced due to tighter global concentrate supplies, production was still 6.7% higher than the previous year.

Demand is currently influenced by the green transition’s rising copper needs and the ongoing challenges in the property market and manufacturing sector.

“Cargoes booked during the export arbitrage window were all shipped by the end of July, so August’s volume will drop further to normal levels,” said Wang Yingying, an analyst with Galaxy Futures Co. “Chinese demand has picked up since last month as power grids increase orders.”

LME copper prices rose 0.9% to $9,201 a ton in Shanghai, continuing last week’s rebound, although still nearly $2,000 below the May peak. Other metals also saw gains, with zinc up 0.9%.

![]()