Congo President heads to China amid mining contract negotiations

Democratic Republic of Congo President Felix Tshisekedi will visit China next week as the two nations look to conclude the re-negotiation of a $6.2 billion mineral-for-infrastructure deal, people with direct knowledge of the trip said.

It’s the president’s first visit to the country, Congo’s biggest trading partner. The two nations did $21.7 billion of trade in 2022, according to data compiled by Bloomberg.

The trip comes as Tshisekedi prepares for elections scheduled for December. Spokespeople for the president and the government didn’t respond to text messages requesting comment. China’s Foreign Ministry announced on Friday that Congolese Foreign Minister Christophe Lutundula would visit China May 21-24.

Tshisekedi is scheduled to travel to Beijing, Shanghai and Shenzhen May 24 through May 29 with a contingent of government officials including his ministers of mines, hydropower and defense. Besides meeting with counterpart Xi Jinping, Tshisekedi is also scheduled to visit a number of battery, energy, mining and tech companies.

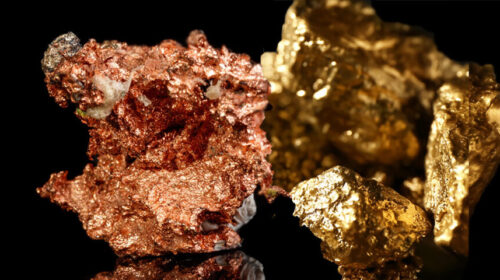

China is the primary destination for most of Congo’s copper and cobalt, a key ingredient in electric-vehicle batteries. The central African nation produces 70% of the world’s cobalt and was tied with Peru as the second-biggest source of copper last year.

In 2008, Congo signed a deal with Chinese state companies to finance $3 billion of infrastructure projects using the proceeds from a $3.2 billion copper and cobalt mine. The landmark agreement was signed at a time when Congo was struggling to secure financing after years of war.

‘Bad contract’

In January, Tshisekedi told Bloomberg the contract was “badly drawn up” and that Congo had “derived no benefit from it.” The president said the deal needed to be “rebalanced.”

While the mine is pumping out metal, the Chinese partners have only disbursed about $822 million of infrastructure funding over 14 years, the country’s inspector general said in a report in February.

The watchdog accused the Chinese companies of financial malfeasance, including transfer pricing and dumping, and called for them to be fined $100 million for breaching capital controls under the nation’s mining code by not repatriating more than $2 billion in export revenue.

The inspector general called on the Chinese partners to release $1 billion in infrastructure funding this year and amend the contract to ensure half of future infrastructure contracts go to Congolese companies.

China’s embassy dismissed the report’s conclusions at the time.

Royalty billions

Congo is also negotiating a final deal with China’s CMOC Group Ltd., which is in a dispute with its partner, state-owned Gecamines, over the Tenke Fungurume copper and cobalt mine. Gecamines says CMOC owes billions in royalties and a court-appointed administrator blocked Tenke’s exports last July.

While CMOC and Gecamines have agreed on the outlines of a resolution, they’ve yet to sign a final agreement, Gecamines Chairman Guy-Robert Lukama told Bloomberg Thursday in an interview in Kinshasa, Congo’s capital. In the interim, the joint venture has re-started exports of copper mined in 2022, but is still blocked by the finance ministry from exporting cobalt, he said.

CMOC didn’t respond to emailed questions on Friday. Officials from Gecamines, which is also a partner in the minerals-for-infrastructure contract, are also traveling to China.

76 total views , 1 views today