Congo to debate copper concentrate export waivers with miners

Mining companies, copper and cobalt buyers have been invited to a meeting in Kinshasa next week to discuss whether there is a way to maintain the waiver of an export ban, which is set to expire in September, the mining minister announced.

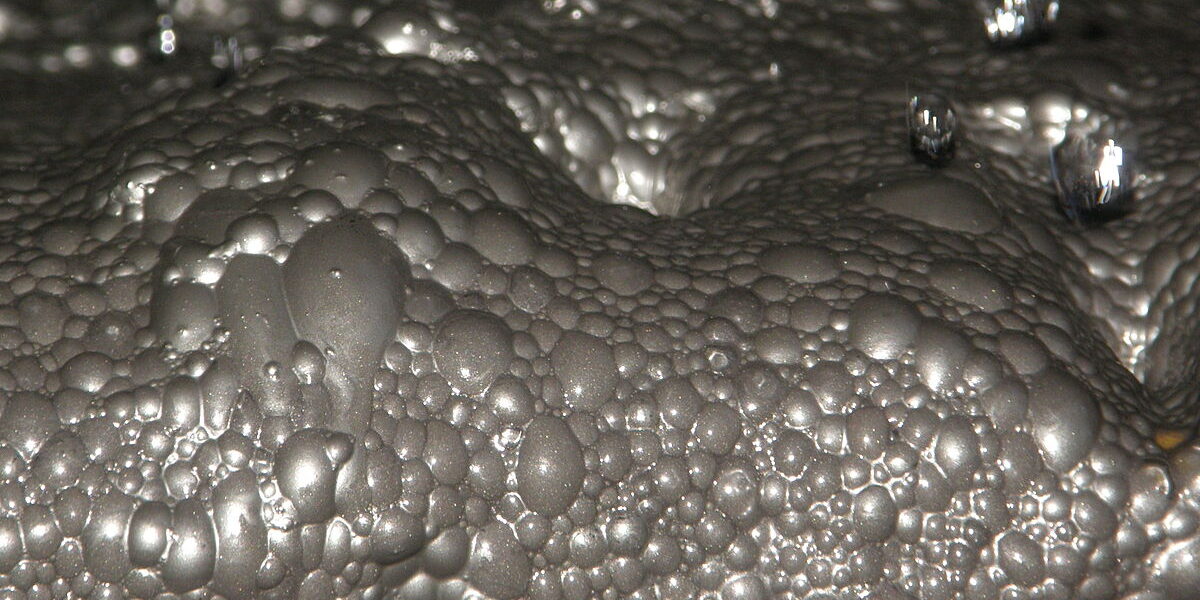

The Congo, Africa’s largest copper producer, banned the export of copper and cobalt concentrates in 2013 to encourage miners to process and refine the ore within its borders.

However, the country does not have sufficient smelting capacity and has repeatedly issued exemptions.

A comprehensive ban would lead to a drastic decline in copper exports in the Congo

It would also deal a severe blow to neighbouring Zambia, which processes Congolese copper and cobalt.

“There were exceptions for certain reasons. Every time we analyse the file with all the technical data. The applications are submitted with the reasons,” said Minister of Mines Willy Kitobo to Reuters.

“These mining companies and the processors interested in buying these concentrates were invited to Kinshasa on August 20th to see what can be done.”

In January China’s state-owned mining company CNMC launched the first large-scale smelter in the Congo, the Lualaba Copper Smelter (LCS).

The state-owned joint venture can process 400,000 tons of copper concentrate and produce around 120,000 tons of copper blisters annually.

But even at full capacity, the LCS cannot process all of the Congo’s copper production. The Congo produced 765,000 tons of copper concentrate in the first half of the year alone, an increase of 13.4% compared to the previous year.

“Our first assumption is that they will fill Lualaba’s capacity and then waive the rest,” said Indigo Ellis, director of Africa research at Verisk Maplecroft, a risk analysis firm.

“But it is not a sustainable option, the damage it will cause to the industry and the investment environment is negative.”

President of the mine chamber in the Congo, Louis Watum said he understands the government wants to increase spending in the country based on the revenue it generates, but said that most mining companies in the Congo are unable to melt due to insufficient electricity.