Copper price drops despite 65% surge in China imports

Copper prices pulled back sharply on Monday despite near-record level Chinese imports and dwindling global inventories of the metal.

Copper for delivery in September trading in New York briefly dipped below the $3.00 a pound ($6,600 a tonne) in afternoon trade, declining 2% from the more than two-year high struck on Friday.

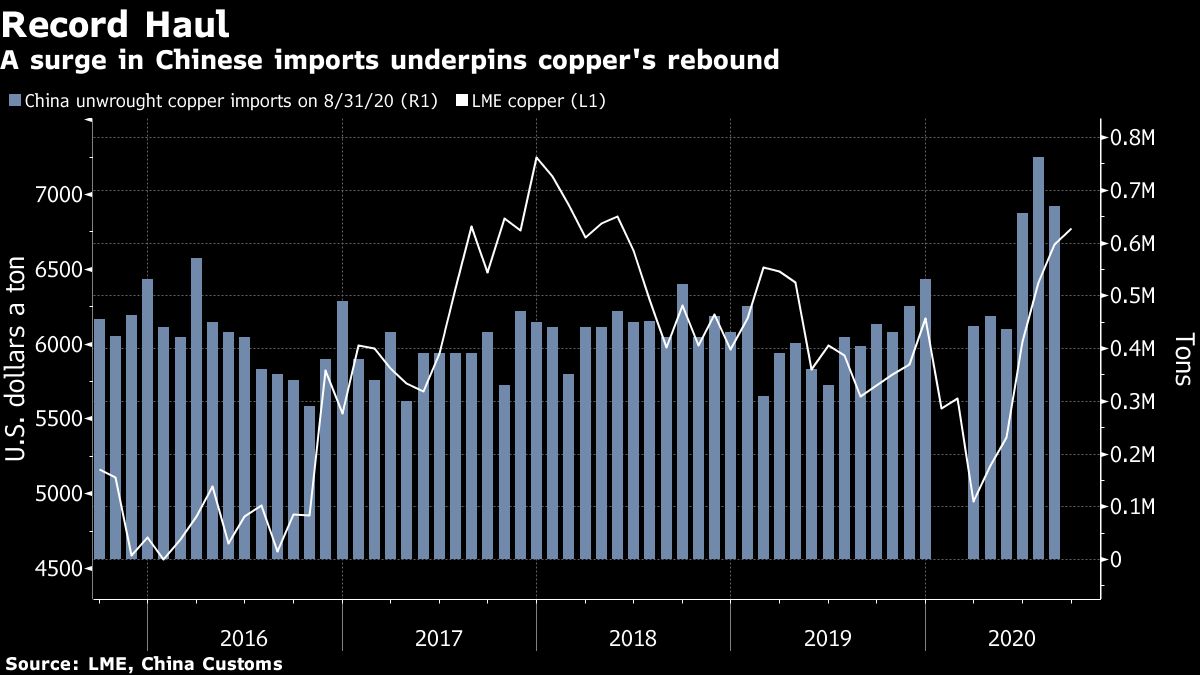

Customs data released on Monday showed China’s unwrought copper imports (anodes and cathodes) in August declined to 668,486 tonnes from July’s record haul of 762,211 tonnes, but still up 65% from August last year.

Year to date imports now total 4.27m tonnes, up 38% from 2019 and on track to easily beat 2018’s annual record of 5.3m tonnes.

August imports of copper concentrate fell by more than 12% from the same month last year to 1.59m tonnes, on lingering supply disruptions from Peru and Chile, China’s top suppliers.

Arbitrage window closed

Copper traded in London could be picked up at a steep discount to Shanghai prices earlier this year, incentivizing imports, but that arbitrage opportunity no longer exists thanks to a 50% rally in the LME price from its March lows.

China copper demand analyst He Tianyu at CRU Group told Reuters given that imports “are still higher year-on-year, and last month’s base number is already pretty high. If the arbitrage window opens again, imports could increase again.”

source: Mining.com

![]()