Copper price falls on demand concerns in China

Prices of industrial metals fell on Monday as diplomatic efforts to resolve the Russia-Ukraine conflict calmed supply-disruption fears, while demand concerns in top consumer China also weighed on the market.

Copper for delivery in May fell on the Comex market in New York to $4.5405 per pound ($9,989 per tonne), down 1.8% compared to Friday’s closing.

“Copper market sentiment is bearish as supplies are starting to ramp up. It shows some rational thinking,” said Dan Smith, managing director at Commodity Market Analytics.

Ukraine will seek to discuss a ceasefire, immediate withdrawal of troops and security guarantees with Russia after both sides reported rare progress on the weekend, despite fierce Russian bombardments.

A new report by Capital Economics argues there is weakness ahead amid a gloomier demand backdrop, particularly in China, responsible for more than half the world’s copper consumption.

The London-headquartered independent researcher has cut its 2022 growth forecasts for China as the country copes with the highest covid numbers since the start of the pandemic (and no indications the country is dropping its zero-covid policy), higher import bills as oil trades above $100 a barrel, damaged exports as Europe and Japan consume less, and higher inflation brought on by a spike in the cost of agricultural commodities.

While Beijing has set a floor of 5.3% GDP growth this year, Capital Economics says it appears to be “bracing for weaker growth in practice” and expects a policy response by officials:

“The NPC [National People’s Congress] pointed to modest easing and suggested that officials would offer more support if unemployment rises much above its current level. But that is unlikely to provide a complete offset.

Given copper’s widespread use in industry, construction and transport, the metal’s price correlates with overall economic growth and manufacturing activity and in the world’s largest economy based on purchasing price parity.

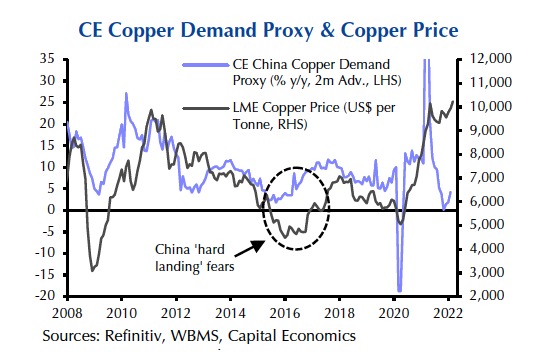

A yawning gap has now opened up between the Capital Economics Copper Demand Proxy and the ruling price.

![]()