Copper price powers on

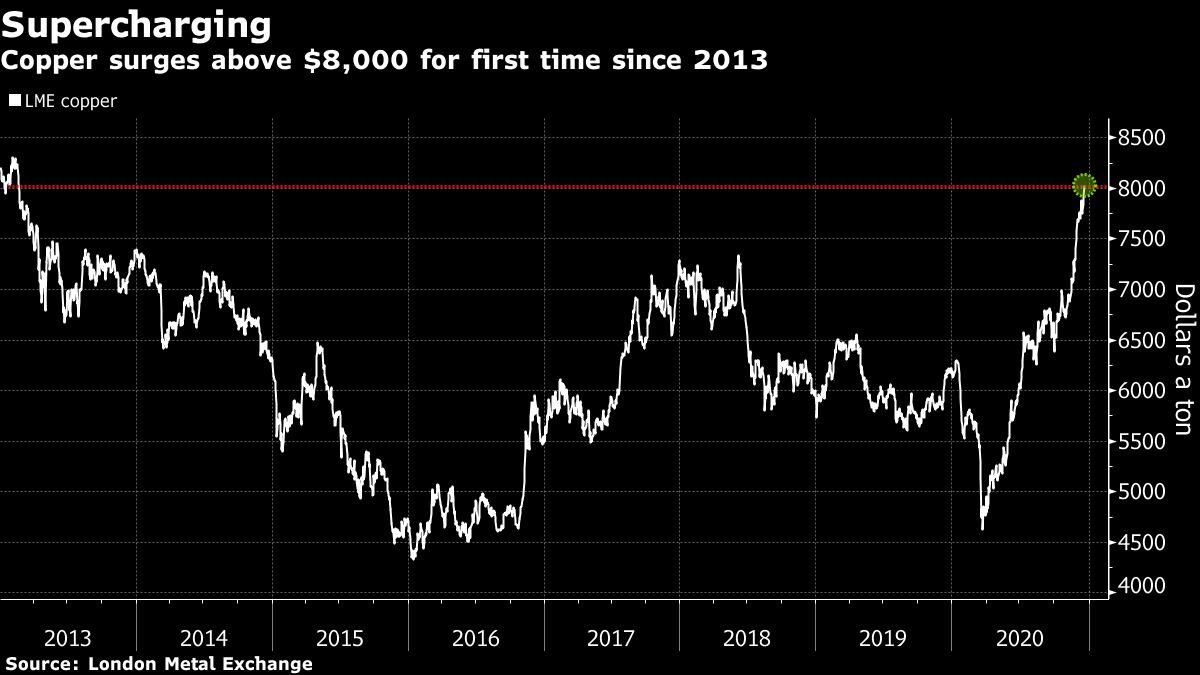

Copper prices jumped to the highest since February 2013 on Friday on hopes that economic stimulus in the US will further boost demand for the bellwether metal, already in short supply amid an Asian factory and construction boom.![]()

The US Congress is facing down a midnight deadline to pass a relief measure as part of a massive government spending bill, which would be the largest in history after the $2.2 trillion Cares Act, passed in late March.

On the Comex market, copper for delivery in March advanced 1.2% to $3.6445 a pound in New York, bringing gains in 2020 to over 30%. The metal dipped below $2.00 a pound at the height of the pandemic in March. On the LME, copper also surpassed $8,000 a tonne for the first time in nearly eight years.

The metal’s jump this week “is really boosted by hopes on the US stimulus talks,” TD Securities analyst Ryan McKay told Bloomberg.

CITIGROUP WARNED EARLIER THIS MONTH THAT THE METAL WAS “TOO HOT TO HANDLE”

“The China recovery scenario, a weaker dollar, and green-inspired reflation wave have also lifted copper, especially with the Chinese stockpiling impulse having been bigger than initially thought and more strategic in nature.”

Some banks and investors are now drawing comparisons to the spike in the early 2000s, when a jump in Chinese orders ushered in the last super-cycle for commodities.

“You have all the tell-tale signs of a supercycle,” Jeff Currie, head of commodities research at Goldman Sachs, told Bloomberg TV. He cited metals hitting multi-year highs, the weaker dollar, crude oil reaching $50, and rising global liquidity.https://www.bloomberg.com/multimedia/api/embed/iframe?id=980b1752-d5d8-4c7e-ae94-42b999c7395b

“Covid is already ushering in a new era of policies aimed at social need instead of financial stability [which] will likely create cyclically stronger, more commodity-intensive economic growth, that should create the elusive cyclical upswing in demand.” said Goldman in a recent report.

BlackRock expects copper to hit new all-time highs in the upswing of the cycle, Evy Hambro, the firm’s global head of thematic investing, told Bloomberg TV on Thursday.

Manufacturing

“The copper rally is due in large part to improved manufacturing activity in the US, China and eurozone,” said Frank Holmes, CEO of U.S. Global Investors and a contributor to MINING.COM.

For the month of November, the IHS U.S. Manufacturing PMI hit 56.7, up significantly from 53.4 in October. The month-to-month increase was the sharpest since September 2014, according to IHS Markit.

“Meanwhile, Chinese factories signaled their strongest improvement in over a decade. The Caixin China General Manufacturing PMI posted 54.9 in November as output and new orders surged to 10-year highs.”

“We expect another leg to this rally” in commodities and mining shares, with momentum extending into the first half of 2021, RBC Capital Markets analysts led by Sam Crittenden wrote in a note to clients. Governments will “do whatever it takes to ensure the global economy gets back on track.”

China’s relative success at containing the pandemic and optimism about global economic growth next year as vaccines are rolled out are fueling gains across industrial commodities from iron ore to oil.

Copper is also likely to benefit from the growing EV market because it is used in electrical wiring.

“The bullish narrative is clearly gaining traction with investors, including those who had been skeptical a few months ago,” Jefferies analysts, including Christopher LaFemina, said in an emailed note to Bloomberg.

Citigroup warned earlier this month that the metal was “too hot to handle” and that prices may retrace if gains aren’t supported by the physical market.

![]()