Copper price rebounds despite weak economic activity in China

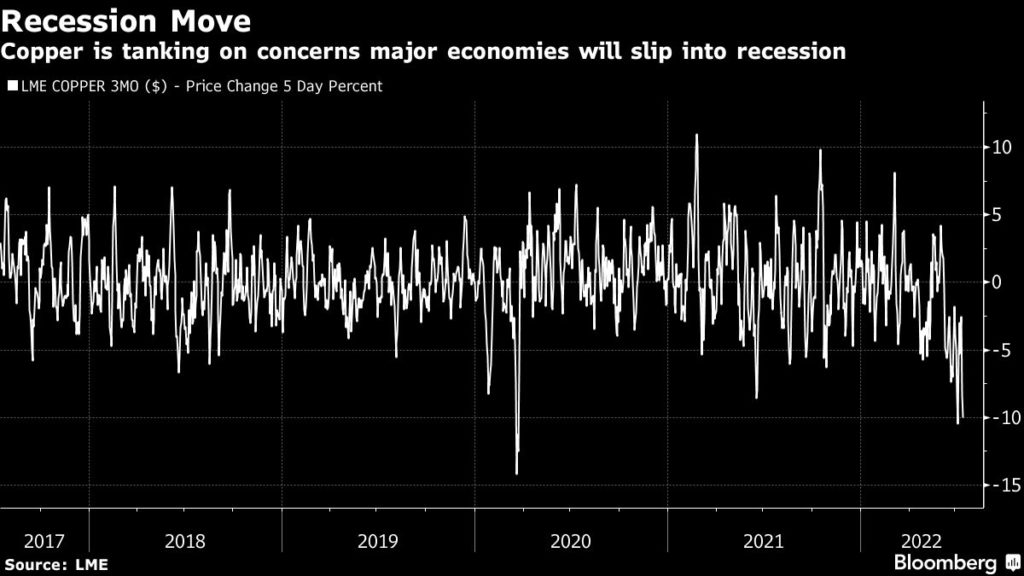

The copper price rose on Friday despite growing concerns that the world economy is headed for recession.

Central banks rushed to get on top of galloping inflation, with steep interest rate rises seen this week in Canada, New Zealand, Chile, South Korea, and the Philippines.

Fears of an economic downturn were fanned further by Chinese data showing annualized 0.4% growth in the second quarter, the worst since at least 1992, excluding early 2020 when the covid pandemic erupted.

Copper, however, rebounded at the end of the week, with the metal price up 1.9% at $3.27 ($7,210) a tonne on the Comex market in New York.

“The macro environment has definitely taken a turn for the worse,” Bank of America Corp. strategist Michael Widmer said by phone. “Every region has slightly different dynamics, but none look particularly bullish at the moment.”

Rio Tinto added to warnings on the global economy, calling headwinds in China “considerable” and saying that pressure on global supply chains needs to ease significantly before inflationary pressures soften.

Goldman Sachs Group Inc. this week forecast copper to trade at $6,700 in the next three months, a 22% downgrade from its previous outlook. The bank said a surging dollar will remain a headwind until macroeconomic risks subside.

“Unfortunately, right now trying to locate a hard bottom in copper is proving to be a difficult task,” Phil Streible, chief market strategist for Blue Line Futures LLC, said by phone.

“China, rates, recession fears and supply chain issues are still there. The dominoes are falling.”

![]()