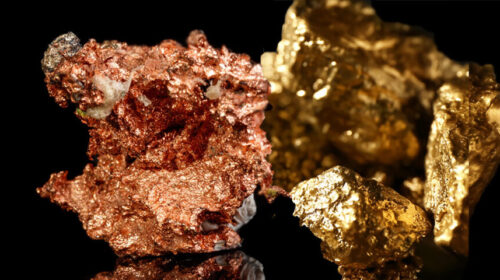

Copper price slips as dollar firms after Fed minutes

Copper price fell on Thursday as the dollar firmed after the US Federal Reserve’s signaled that may raise interest rates sooner than expected.

The Fed at its December meeting began plans to start cutting the amount of bonds it is holding, with members saying that a reduction in the balance sheet likely will start sometime after the central bank begins raising interest rates.

“A very tight job market and unabated inflation might require the Fed to raise interest rates sooner than expected,” policymakers said, fuelling expectations of a rate hike in March.

While a firmer US dollar makes greenback-priced metals more expensive to holders of other currencies, an interest rate hike could trim liquidity in financial markets and slow recovery in the world’s biggest economy.

March delivery contracts were exchanging hands for $4.36 a pound ($9,592 a tonne) on the Comex market in New York, down 1.1% compared to Wednesday’s closing.

The most-traded February copper contract on the Shanghai Futures Exchange slipped 0.7% to 69,730 yuan ($10,944.05) a tonne.

17 total views , 1 views today