Copper price stable as omicron concerns ease

The copper price was stable on Wednesday as concerns about the new omicron coronavirus variant that has rattled market sentiment in recent days eased.

Copper for delivery in March was down 0.3% on the Comex market in New York, touching $4.26 per pound ($9,372 per tonne).

The most-traded January copper contract on the Shanghai Futures Exchange eased 0.4% to 69,560 yuan ($10,932.98) a tonne.

The European Union drug regulator said on Tuesday existing covid-19 vaccines would provide protection against omicron, calming markets shaken by Moderna CEO saying existing shots would be less effective against the new variant.

“The market was too short. That (omicron) is really nothing,” a Hong Kong-based trader said.

Copper prices have been supported by low exchange warehouses supply. London Metal Exchange inventories fell to 76,450 tonnes, the lowest since March 3, while Shanghai Futures Exchange stockpiles still hovered near their lowest since June 2009.

A spokesperson for Turquoise Hill Resources said trucks were still being used to ship copper concentrate to China from the Oyu Tolgoi mine in Mongolia, meaning supply is unaffected by recent curbs on rail imports at some Chinese border cities.

Royalty bill

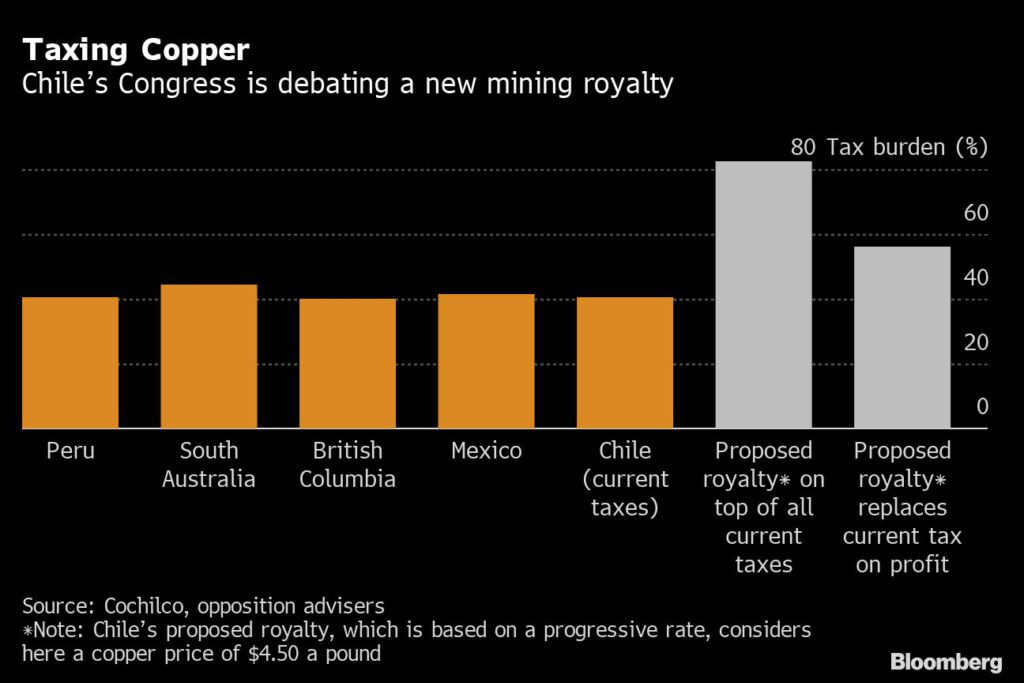

A bill that would create the heaviest tax burden for miners in Chile was approved in an initial vote on Tuesday.

Senators voted 18 to 16 in favor of the main text of the proposal. It now goes back to the committee, where members are likely to seek modifications to temper its impact. Amendments would then go back to another floor vote.

Politicians in the top copper-producing nation are looking for a bigger share of mining profits to help resolve inequalities exacerbated by the pandemic. Chile has been drafting a new constitution that may lead to tougher rules on mineral and community rights at a time when voters are moving away from mainstream parties ahead of presidential elections.

![]()