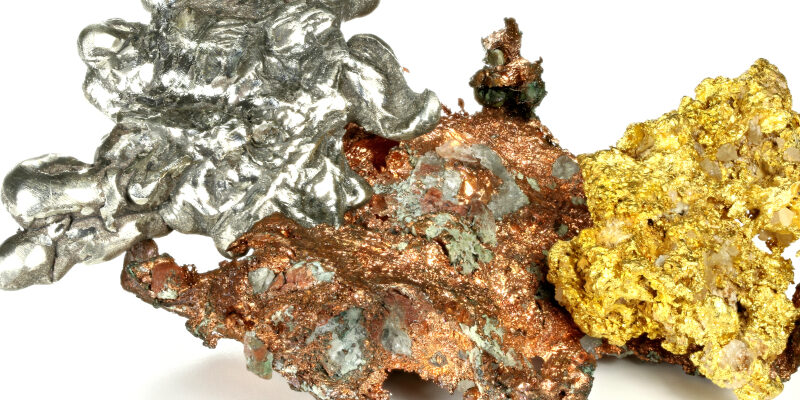

GOLD, COPPER, COFFEE … among the best rated raw materials in 2020 – DRC

The price of gold exceeded $ 2,000 this year for the first time, and industrial metals like copper also had a booming year, as appetite for agricultural commodities suffered from the pandemic. This is explained in an article published on Saturday January 02 by BFM Bourse.

The yellow metal climbed to $ 2,075.47 on August 7, in response to mounting monetary easing across the world. A new historical record. This summer, “gold was in great demand as a safe haven” but also “because rates of return plunged with the measures taken by central banks”, making gold -active without providing any return and at a cost of not insignificant holding – paradoxically more attractive, explains Daniel Briesemann, analyst at Commerzbank.

At its highest, gold was up nearly 40% from the start of the year. But the precious metal lost its luster over the following months, and experienced a serious plunge in early November. Between the election of Joe Biden in the United States and the successive announcements on vaccines against Covid-19, investors have indeed regained a taste for risk and abandoned gold.

Thursday, December 31 around 11:30 am, the ounce posted a gain of 24% on the year, to 1,889 dollars per ounce.

Much more dynamic, silver climbed 47.5% over the year, one of the best performances of 2020 among commodities, to 26.27 dollars an ounce. The gray metal benefited at the end of the year from investor interest in industrial metals, when vaccines promised a recovery in demand with a supply disrupted by the pandemic.

Metals rise from their ashes

BFM Bourse claims that industrial metal prices suffered in 2020 from the tremors of the Covid-19 pandemic before recovering, driven by demand in China. A true factory of the world, the country is certainly the cradle of the pandemic but it is also the only large economy to grow this year, according to forecasts by the International Monetary Fund (IMF).

Copper, often regarded as a good indicator of the health of the world economy – a use which has earned it the nickname “Dr. Copper”, or Doctor Copper – is the perfect illustration.

The red metal, widely used in industry, especially for making electrical circuits, first suffered the full brunt of the rapid spread of Covid-19 in China and then the seizure of world trade, falling to $ 4,371 per ton on the 19th. March on the London Metal Exchange (LME), a price lower for over four years.

But supply disruptions, particularly in the main producing countries of Chile and Peru, and the recovery in demand in China pushed prices a few months later to nearly double, to 8,028 dollars on December 18, a first since February 2013. The red metal ended an eventful year at around $ 7,833 per tonne (+ 26% over one year).

The other main base metals such as nickel and aluminum have experienced a comparable trajectory and have been evolving at higher levels for one and two years respectively.

Agricultural commodities are suffering

The prices of sugar, coffee and cocoa almost all suffered in 2020 from the drop in demand due to lower consumption linked to containment measures and other restrictions on the movement of goods and people around the world.

Sugar prices in London and New York have again shown their dependence on oil prices (due to the transformation of part of the production into ethanol).

Mistreated in March and April, they gradually recovered over the year and particularly benefited from the announcements of Covid-19 vaccines in November, ending at $ 412.40 per tonne in London and 15.05 cents per book in New York, without regaining their annual highs in February.

Cocoa prices remained under the pressure of weaker demand before experiencing a sudden but brief surge in November under the effect of tensions between the main producing countries (Côte d’Ivoire and Ghana) and manufacturers over the price of cocoa. purchase of beans.

The variety of robusta coffee, present in soluble coffees and therefore more often drunk at home, has held up better than arabica, favored in espresso and which suffers from disaffection, when it is not the closing, bars and cafes. Listed in London, the robusta is poised to end the year in equilibrium at $ 1,378 per tonne, which the arabica will fail to do at 126.05 cents per pound in New York.

![]()