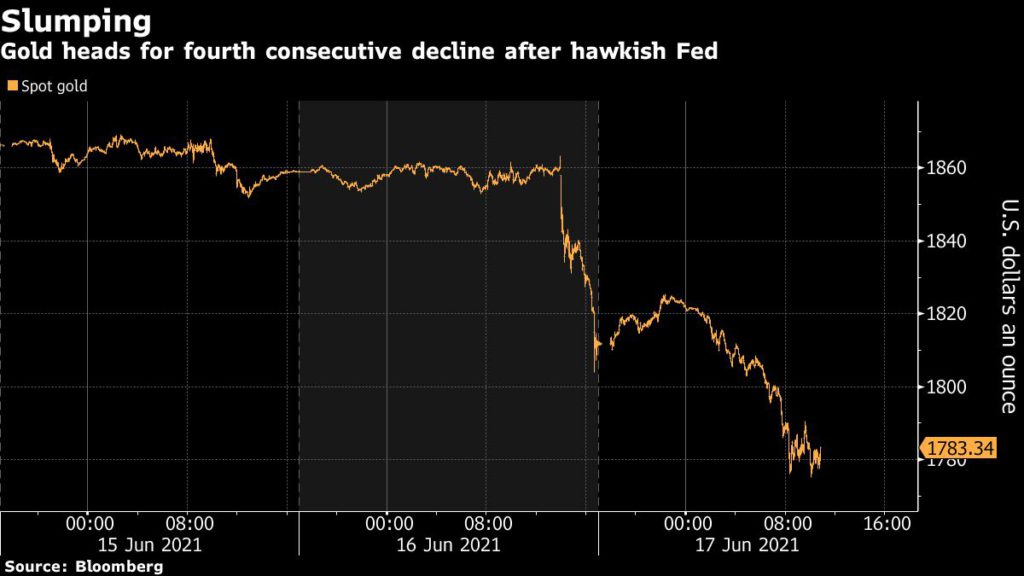

Gold price dives past $1,800 as Fed signals earlier rate increases

Gold prices slumped below $1,800 as the Federal Reserve sped up its expected pace of policy tightening amid optimism about the labor market and heightened concerns over inflation.

Spot gold fell 2.3% to $1,771.36 per ounce by 11:30 a.m. ET, near its lowest in six weeks. US gold futures saw a more significant decline, down 4.7% to $1,772.20 per ounce.

Gold’s decline comes on the on the back of Fed Chair Jerome Powell’s comments on Wednesday about potentially scaling back bond purchases. This was the first major hawkish turn from the central bank, whose deluge of stimulus has been critical to bullion’s strong performance since the start of the pandemic.

The Fed also released forecasts showing two anticipated interest rate increases by the end of 2023 — sooner than many thought — which helped boost the dollar and US bond yields. This put a dent in gold’s appeal, as a rate hike would increase the opportunity of holding bullion, which is often seen as a hedge against inflation.

Gold prices, which declined the most in five months on Wednesday, broke through a number of key technical support levels, including falling below its 100-day moving average.

“We have a negative outlook, expecting gold to fall to $1,600 an ounce over the next six to 12 months,” Giovanni Staunovo, an analyst at UBS Group AG, told Bloomberg. “At some point the Fed will not talk about taper but also implement it.”

Despite the hawkish pivot, Powell said the interest-rate forecasts “should be taken with a big grain of salt,” and cautioned that discussions about raising rates would be “highly premature.”

The central bank also upped its inflation forecasts, though the Fed chair continued to insist price pressures would prove transitory.

“Once again the million dollar question is whether inflation will be a passing phenomenon or longer lasting?” Ole Hansen, head of commodity strategy at Saxo Bank A/S, said in a Bloomberg note.

“For now the market trusts the judgment of the Federal Reserve and until data potentially proves them wrong, gold and with that also silver may face another challenging period,” Hansen added.

![]()