Gold price nears a rare 3-week high

Gold price climbed again Thursday, approaching a three-week high, propelled by investor demand for safe-haven assets due to heightened concerns over long-term economic impact of the coronavirus crisis.

Spot gold rose 1.0% to $1,733.20 per ounce, its highest since April 24. Gold futures for June delivery gained 1.5% to $1,741.80 on the Comex exchange.

SPDR Gold Trust holdings, the world’s largest gold-backed exchange-traded fund (ETF), jumped to a fresh seven-year high of 1,092.14 tonnes after Wednesday’s trading period.

Earlier, the World Gold Council (WGC) analyzed the potential performance of gold across hypothetical scenarios provided by Oxford Economics in light of covid-19 and the ensuing economic lockdowns slashing global growth forecasts for the year.

According to the Council, gold price behavior can be explained by four sets of drivers: economic expansion, risk and uncertainty, opportunity cost and momentum.

Based on the WGC analysis, high risk and uncertainty combined with lower opportunity cost (i.e. interest rates) will likely be supportive of gold investment demand in 2020, offsetting the negative effect of lower consumer demand for gold.

Thereafter, the WGC says gold’s performance may depend on the speed of the global economic recovery and the duration of monetary policy and fiscal stimuli.

Even in the best-case scenario of a swift recovery where economic activity rebounds in the second half of the year, central banks may still keep monetary policies loose and real interest rates close to zero through to 2024.

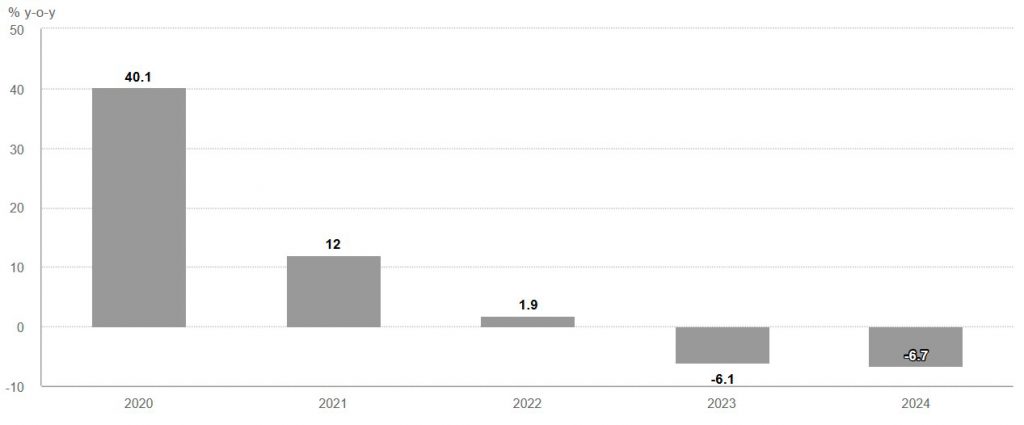

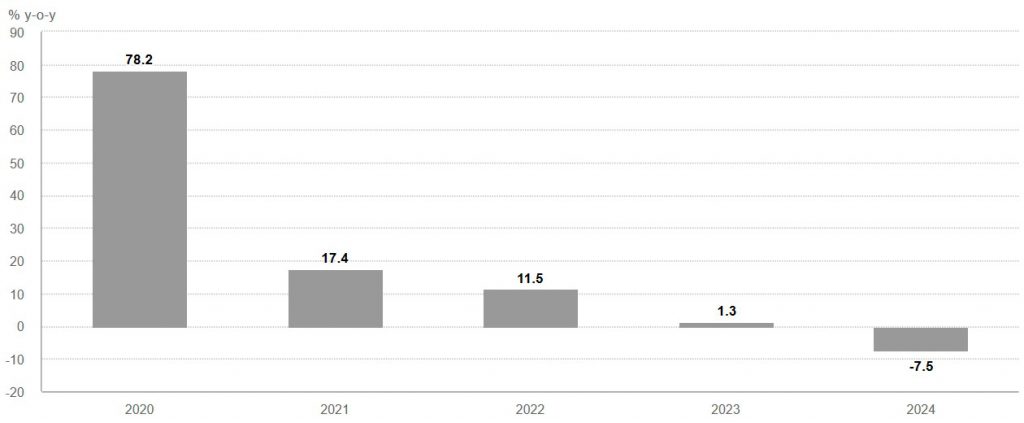

The WGC model indicates that this would keep gold’s implied returns positive through to 2022.

US Federal Reserve Chairman Jerome Powell previously warned of the possibility of an “extended period” of weak economic growth and vowed to use the central bank’s power as needed, which raised further concerns about a timely economic recovery, the Washington Post reported.

World stock markets fell Thursday for a third day in a row on disappointing employment data and signals by central banks that further government stimulus may be needed to move the global economy back on track.

Under the scenario of a deep recession where global economic output could only return to pre-pandemic levels from 2023 onwards, central banks will need to keep interest rates low or even negative for much longer, leaving gold with robust gains up until 2024 and an annualized implied return of about 20% for the five-year period, the WGC calculates.

In addition, ongoing tension between the US and China — which has been escalated further during the pandemic — casts more doubt over the global economy as it may have a “trickle-down effect” in future trade deals.

“It seems some investors turned bearish on equities, US-China relations continue to head to a downward spiral and you have very bleak data coming from the US and its all supporting safe haven (demand),” Edward Moya, a senior market analyst at broker OANDA, said in an interview with CNBC.

“Gold prices have been coiling up over the last couple of weeks but it seems now you have the macro-economic backdrop that is going to support high prices in the near-term,” Moya added.

Source: Mining.com