Gold price plummets as US employment data beat expectations

Gold prices took a hard fall on Friday after a strong US employment report boosted expectations the Federal Reserve could begin tapering its economic support sooner than previously anticipated.

Spot gold plummeted 2.5% to $1,760.88 per ounce by 11:30 a.m. ET, its lowest in over a month, while US gold futures slid 2.6% to $1,760.90 per ounce in New York.

The latest US non-farm payrolls (NFP) report showed that 943,000 jobs were added during the month of July. This figure was well above the market consensus estimate of 870,000.

“The job numbers are hitting gold because they blew away expectations, so the market is anticipating that the Fed’s taper date could be brought forward with an announcement in September and the actual tapering in early January most likely,” Phillip Streible, chief market strategist at Blue Line Futures in Chicago, told Reuters.

Speculation about the central bank cutting back on its stimulus program has been brewing in recent days. Higher interest rates arising from a potential Fed tapering would raise the opportunity cost of holding non-interest bearing assets like gold.

Edward Moya, senior market analyst at OANDA, also said that “a majority of the job gains in the report were from lower-wage leisure and hospitality sectors which [aren’t] inflationary, denting gold’s appeal as a hedge against rising prices.”

While gold could fall towards $1,700 in the near term, however “we’re still going to see a tremendous amount of support getting pumped into the global economy, and that still should support gold,” Moya said.

The dollar and benchmark 10-year treasury yields jumped after the jobs data, further denting bullion’s appeal.

However, Blue Line’s Streible added that the potential downside to gold could be limited. “We’ve already seen peak GDP, peak corporate earnings and economic data is going to be mixed at best going forward, so gold is still pretty good value,” he said.

Modest ETF inflows

Meanwhile, the latest report from the World Gold Council (WGC) showed that investment in gold assets continued to grow in July, with gold-backed ETFs and similar products adding 11.1 tonnes, or $669 million in assets under management (AUM).

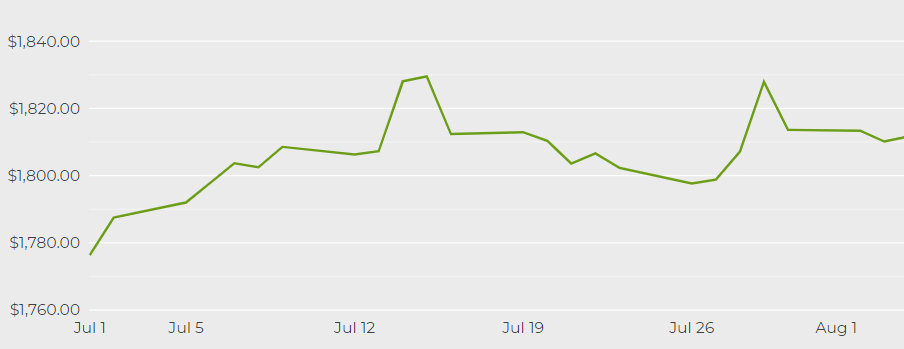

This modest increase in inflows coincided with a recovery in the gold price, driven by concerns of an uncertain global growth outlook and central banks’ reaffirmed easy monetary policies despite elevated inflation.

Globally, gold-backed ETF AUM now stands at $214 billion, approximately 7% below the record tonnage high in October 2020.

“We expect gold performance will continue to be supported by higher inflation expectations, especially if the Federal Reserve continues to prioritize employment over inflation,

“We expect gold performance will continue to be supported by higher inflation expectations, especially if the Federal Reserve continues to prioritize employment over inflation,” said WGC senior analyst Adam Perlaky.

“Looking forward, historically, September has also been a strong month for gold performance driven by seasonal consumer demand,” he added.

![]()