Gold price rally stalls as China data shows growth stabilizing

Gold steadied as investors mulled what’s next for inflation and monetary policy, while scrutinizing better-than-expected economic data from China.

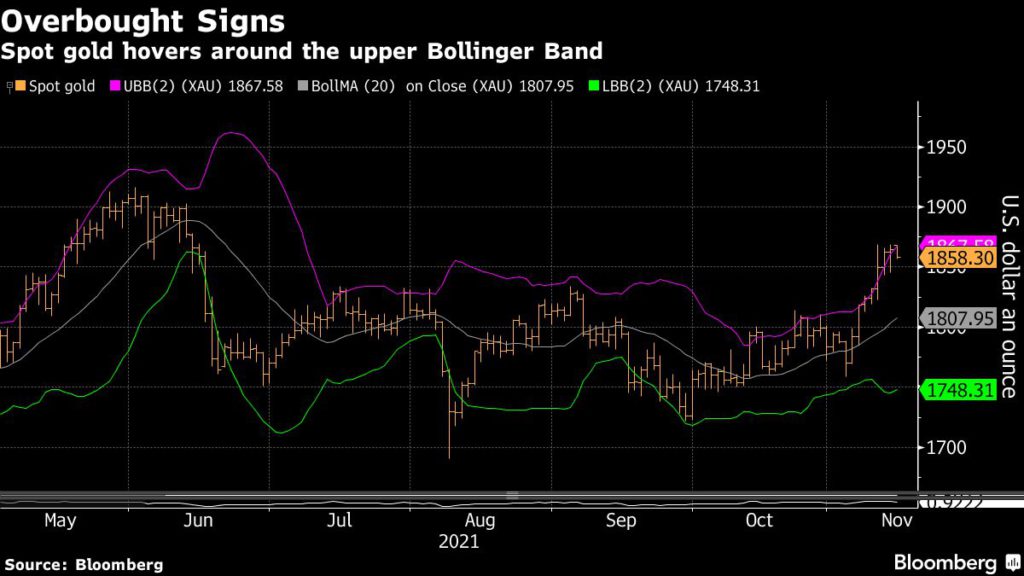

Bullion finished last week at its highest since June as accelerating price pressures rocked bond markets and fueled demand for the traditional haven. Treasuries are steadier on Monday as investors await public appearances by Federal Reserve officials and other central bankers in coming days.

In China, a flurry of figures on everything from industrial output to retail sales showed the country’s economy stabilizing as spending improved and power supply picked up. That might soften calls for bigger stimulus measures that would in turn risk more inflation.

Expected remarks from Fed policy makers will feed into the debate on whether this year’s price gains are a transitory phenomenon that don’t require the bank to change course. New York Fed President John Williams, a noted dove, speaks on Wednesday. There are also speeches from the heads of the European, U.K. and Australian central banks this week.

Bullion has benefited as soaring inflation combines with a perception that the Fed has other priorities such as boosting employment. Bond market expectations for inflation over the coming decade are at their highest since 2006.

“In the past two weeks, we have seen some tremendous gains for the yellow metal, and it seems like traders are now in the mood to continue to shave some profit off the table,” said Naeem Aslam, chief market analyst at Ava Trade Ltd.

Gold fell 0.4% to $1,857.66 an ounce by 7:25 a.m. in London, after gaining 2.6% last week. Platinum, palladium and silver all fell.

![]()