Gold price rebounds as US payroll data assuages stimulus pullback concerns

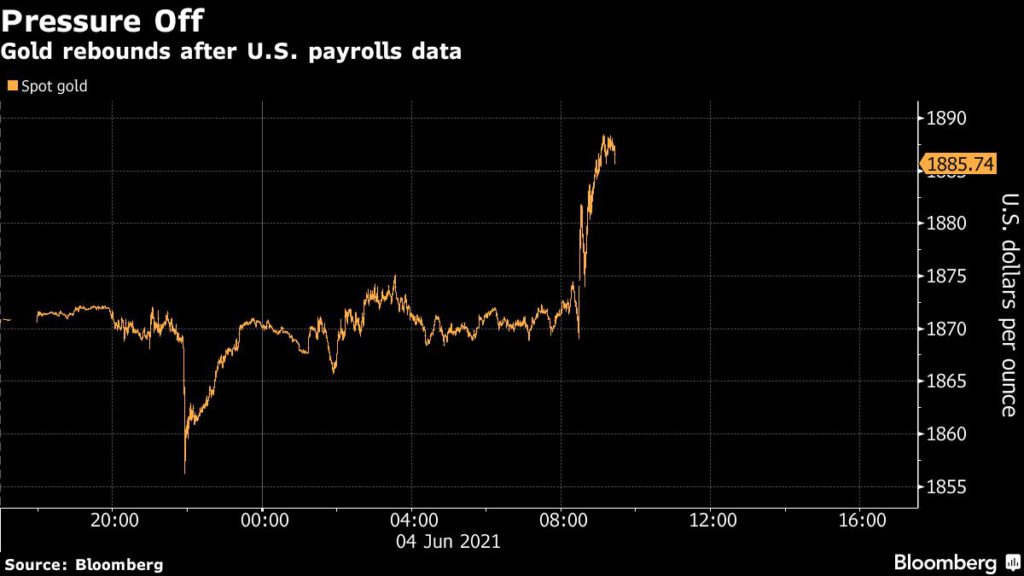

Gold prices rebounded from more than a two-week low on Friday after the latest US non-farm payrolls data fell short of expectations, though bullion is still on course to register its biggest weekly decline since March.

Spot gold advanced 1.1% to $1,892.93 per ounce by noon ET, having reached its lowest since May 19 at $1,855.59 earlier. US gold futures for August delivery also had a 1.1% gain, trading at $1,895.10 per ounce in New York.

According to the latest Labor Department report, US payrolls increased by 559,000 last month, which was below the median estimate of 675,000 by economists surveyed by Bloomberg. Both the dollar and treasury yields initially dropped after the report was released.

Bullion has wobbled after jumping the most in 10 months in May on concerns that a faster economic growth could spur inflation, leading governments and central banks to withdraw support.

While US employment numbers accelerated in May, the gains “probably aren’t enough to push the Federal Reserve to alter their policies sooner,” said Naeem Aslam, chief market analyst at Ava Trade, in an emailed note to Bloomberg

New York Fed President John Williams said on Thursday that now is not the time for the US central bank to adjust its bond-buying program, though it makes sense for the officials to be talking through options for the future.

That followed comments from his Philadelphia counterpart, Patrick Harker, who said it’s appropriate to “slowly, carefully” move back on purchases at a suitable time.

“Today’s number has confirmed the Fed’s current thesis about their monetary policy, and it is very clear that now the pressure is off,” Aslam said. “The fact that the Fed is likely to keep their monetary policy unchanged is helping the gold prices today.”

“Part of what we’re seeing in terms of the strength in gold are inflation expectations and those are partly based on the stronger economic data, like higher jobs growth, broader recovery in the US, parts of Europe and China is still doing well,” Jeffrey Christian, managing partner of CPM Group, told Reuters.

“Gold prices will probably continue to trade between $1,855 and $1,920 an ounce levels,” he added.

![]()