Gold price rebounds with stimulus talks moving forward

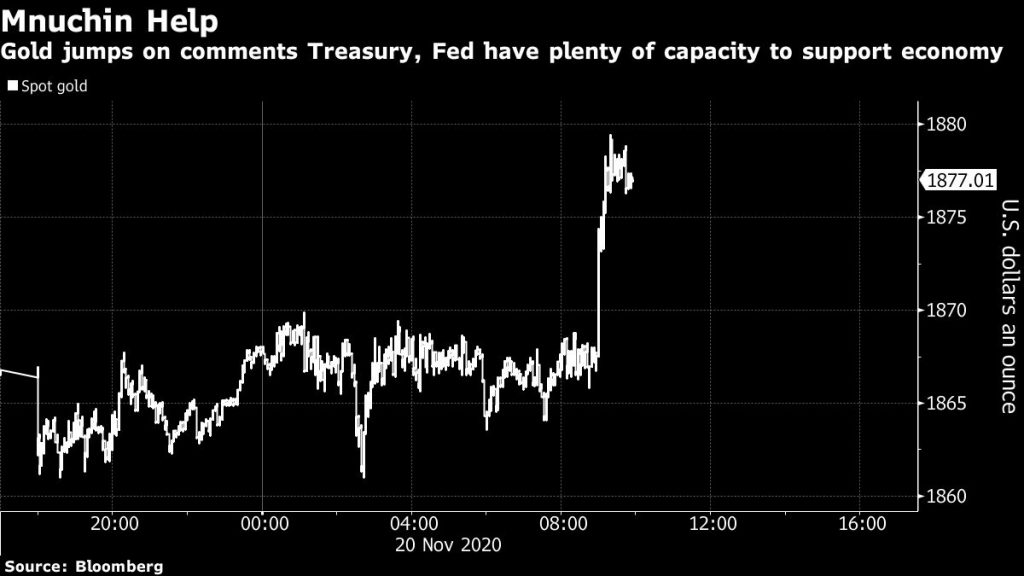

Gold prices rebounded on Friday after US Treasury Secretary Steven Mnuchin said his agency and the Federal Reserve have “enough firepower” to continue to support the economy, boosting the metal’s appeal as a hedge against inflation.

The comments came a day after Mnuchin called for several emergency lending programs to expire by the end of the year. “Markets should be very comfortable that we have plenty of capacity left,” Mnuchin told CNBC on Friday.

Mnuchin also said he and White House Chief of Staff Mark Meadows would be speaking on Friday with Republican congressional leaders on negotiations with Congress on more economic support.

Spot gold rose 0.4% to $1,873.94 per ounce by 11:30 a.m. in New York. US gold futures were up 0.6% to $1,873.20 per ounce.

The surge in gold “is just based off his comments,” Bob Haberkorn, senior market strategist at RJO Futures, said in a phone interview with Bloomberg. “When they can support it, that means there’s more money in the system.”

“The thoughts of stimulus talks moving forward once again has supported gold as we realize central bank liquidity and fiscal stimulus measures continue to be a driving force behind this market,” David Meger, director of metals trading at High Ridge Futures, told Reuters.

Still, bullion is on track for a second weekly loss following positive reports on covid-19 vaccine breakthroughs. Prices have dipped about 5% since news from Pfizer and Moderna came out over the past 12 days.

Gold-backed ETF holdings — which were crucial to gold’s rally to a record in August — are now at the lowest in more than two months.

However, gold will remain supported as “vaccines will take months and months to become well distributed enough to be effective and the US government is going to continue to be stalemated,” according to Jeffrey Christian, managing partner of CPM Group.

Earlier this week, analysts at Goldman Sachs set a price target of $2,300/oz for 2021, citing long-term inflation risks fueled by fiscal and monetary policies during the pandemic.

![]()