Gold price wavers after Japan intervention, central banks’ rate hikes

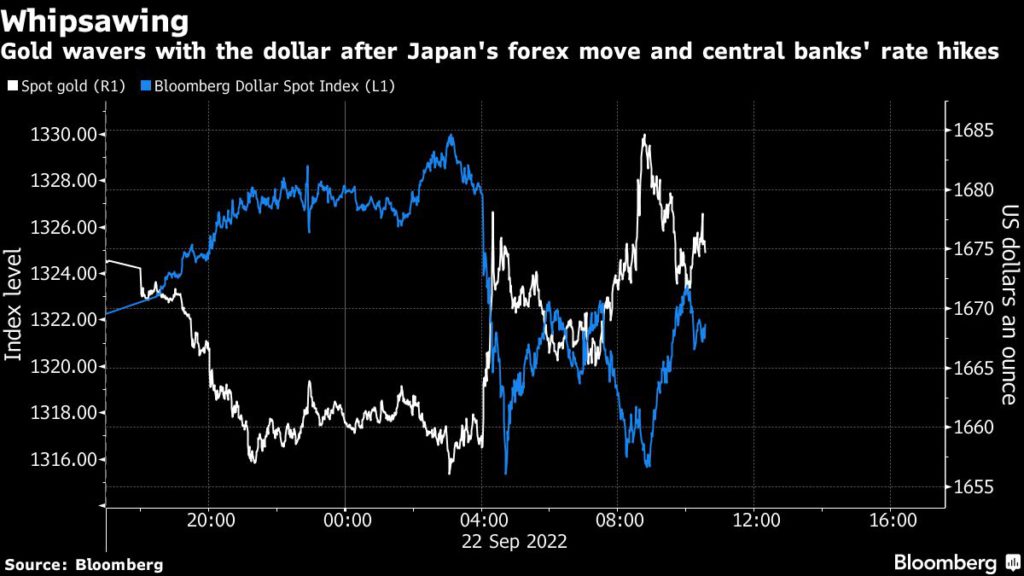

Gold fluctuated after Japan intervened in the foreign exchange market and central banks around the world followed the Federal Reserve with further monetary policy tightening.

Japan’s Ministry of Finance moved to halt a slide of the yen against the dollar, the country’s top currency official Masato Kanda said Thursday. After the Fed’s third consecutive large-sized rate hike, central banks in Switzerland, Norway and Britain announced hikes of their own as officials rush to rein in rampant price increases. The greenback fell after Japan’s intervention before clawing back most of the losses, while bond yields climbed. Bullion usually has a negative correlation with the dollar and rates as it’s priced in the US currency and doesn’t pay any interest.

The Fed’s rate hikes this year have weighed on bullion, with spot prices down 8.6% and investor holdings of exchange-traded funds — a key pillar in driving gold prices to all-time highs in 2020 — declining for four consecutive months as of August.

“Nevertheless, higher rates and continuing ETF liquidation will present headwinds for any significant move higher” in gold, said Tai Wong, a senior trader at Heraeus Precious Metals in New York.

The US central bank stuck to market expectations with its move on Wednesday, though lifted forecasts on where rates would be at the end of the year. Earlier in the week, gold’s haven appeal had been bolstered by Russian President Vladimir Putin’s escalation of the war in Ukraine.

Still, the metal continues to trade near a two-year low, and risks sliding into a bear market thanks to the dollar’s relentless rise. The Fed’s monetary tightening cycle is outpacing others, including the Bank of Japan and the European Central Bank, which strengthens the greenback. That makes gold less attractive to buyers in foreign currencies.

“Gold was stuck between Putin and Powell and now we can add Kuroda to the mix,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. “Fresh longs will not rush back in until some tailwinds from lower yields and dollar begin to emerge.”

Applications for US unemployment insurance ticked up from an almost four-month low, suggesting demand for workers remains healthy despite an increasingly uncertain economic outlook.

Spot gold fell 0.1% to $1,672.03 an ounce at 10:55 a.m. in New York after trading between a gain of 0.7% and a loss of 1.1% earlier. The Bloomberg Dollar Spot Index strengthened 0.1% after earlier rallying to a record high. Silver, platinum and palladium all gained.

103 total views , 1 views today