How Congo could become low-cost, low-emissions producer of battery materials – report

In a report launched at the DRC-Africa Business Forum 2021 taking place this week in Kinshasa, BloombergNEF (BNEF) states that the Democratic Republic of the Congo (DRC) could leverage its abundant cobalt resources and hydroelectric power to become a low-cost and low-emissions producer of lithium-ion battery cathode precursor materials.

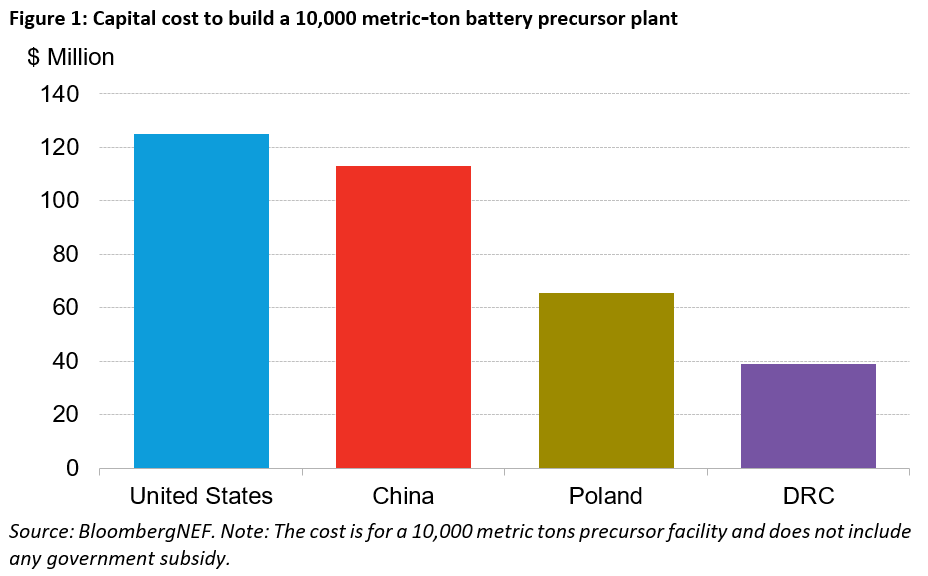

The research paper estimates that it would cost $39 million to build a 10,000 metric-tonne cathode precursor plant in the DRC. This is three times cheaper than what a similar plant in the US would cost, whereas if it were to be built in China or Poland, it would cost $112 million and $65 million, respectively.

The market analyst’s data also show that emissions associated with battery production could be cut by 30% compared with the existing supply chain that runs through China, if cathode precursor materials – the intermediate material between raw and finished cathode material – were produced in the DRC, with Poland handling the production of cathode materials and cells, and Germany the final pack assembly. This is due to the DRC’s proximity to cathode raw materials and heavy reliance on hydroelectric power plants.

“The DRC’s cost competitiveness comes from its relatively cheap access to land and low engineering, procurement and construction, or EPC cost compared to the US, Poland, and China,” Kwasi Ampofo, lead author of the report and BNEF’s head of metals and mining, said in a media statement.

“European cell manufacturers currently rely heavily on China for battery precursors. However, the raw materials for batteries are, in most cases, imported into China from Africa and refined before being exported to Europe. Automakers in Europe can lower their emissions by shortening the transport distance and capitalizing on the DRC’s hydroelectric powered grid and proximity to raw materials.”

Ampofo pointed out that electric vehicles represent a $7 trillion market opportunity between now and 2030 and $46 trillion between now and 2050.

In his view, while there are notable leading electric-vehicle and cell manufacturers today, the sheer scale of growth expected in the coming decades means that there is inherent uncertainty over which companies and countries may come to dominate this new value chain.

Ampofo believes African countries could play a major role in the lithium-ion battery supply chain by taking advantage of their abundant natural resources and onshoring more of the value chain.

Earlier this year, the African Continental Free Trade Area (AfCFTA) – a free trade area covering 54 African Union nations, went operational.

Ampofo believes the AfCFTA agreement has the potential to create the largest free trade area in the world.

“If approached correctly, African countries can capitalize on their abundant natural resources, growing demand for vehicles, and rapid urbanization to build a global hub to produce electric vehicles,” the executive wrote.

![]()