Ivanhoe Mines Releases 2024 Q1 Financials and Project Updates

Kamoa-Kakula sold 85,155 tonnes of payable copper during the quarter and recognized revenue of $618 million, as well as EBITDA of $365 million

Ivanhoe Mines recorded Q1 2024 loss of $69 million, primarily as a result of non-cash loss on convertible bonds due to 26% quarterly share price increase; normalized profit of $70 million and adjusted EBITDA of $126 million

Kamoa-Kakula produced 86,203 tonnes of copper in Q1 2024; annual production guidance for Kamoa-Kakula maintained at between 440,000 to 490,000 tonnes of copper

Kamoa-Kakula’s quarterly cost of sales total $1.50/lb. of payable copper; C1 cash cost of $1.57/lb. towards the lower end of guidance

Pre-commissioning of Kamoa-Kakula’s new 5 million-tonne-per-annum Phase 3 concentrator underway, well ahead of schedule, with first ore imminent

Kamoa-Kakula secures 15 MW of imported grid power to offset DRC grid instability, significantly improving production in April; with a further 40 MW expected from tomorrow, May 1

Pre-commissioning of Kipushi zinc concentrator underway ahead of schedule, with first ore in June; expected to produce over 270,000 tonnes as one of the world’s largest zinc mines

Ivanhoe Mines completed approx. 17,000 metres of diamond drilling in the Western Forelands during the quarter, focused on expanding the high-grade Kitoko copper discovery

Johannesburg, South Africa–(Newsfile Corp. – April 30, 2024) – Ivanhoe Mines’ (TSX: IVN) (OTCQX: IVPAF) President Marna Cloete and Chief Financial Officer David van Heerden are pleased to present the company’s financial results for the three months ended March 31, 2024.

Ivanhoe Mines is a leading Canadian mining company that is advancing its four principal mining and exploration projects in Southern Africa: the expansion of the Kamoa-Kakula Copper Complex in the Democratic Republic of Congo (DRC), which is expected to be the third largest copper mine globally; the phased development of the Platreef palladium, nickel, platinum, rhodium, copper and gold project in South Africa, which is the world’s largest undeveloped precious metals project and one of the largest nickel sulphide deposits; the restart of the historic Kipushi zinc-copper-lead-germanium mine in the DRC, which is expected to be one of the largest zinc mines globally; and exploration on Ivanhoe’s 2,650-square-kilometre Western Foreland exploration project for new sedimentary copper discoveries, as well as expanding and further defining the high-grade Makoko, Kiala, and Kitoko copper discoveries that are adjacent to Kamoa-Kakula. All figures are in U.S. dollars unless otherwise stated.

Ivanhoe Mines Founder and Executive Co-Chairman Robert Friedland commented:

“Kamoa-Kakula continues to excel, generating significant EBITDA at consistent margins and maintaining cash costs at the low end of our 2024 forecast.

This was achieved despite grid instability during the quarter that impacted copper production. Our management team has acted swiftly and decisively to resolve this issue, by securing 55 megawatts of imported power from neighboring countries via the Zambian grid, as well as by expanding our on-site backup generation capacity.

As a result of this intervention, we have seen a significantly improved start to the second quarter at Kamoa-Kakula.

“Kamoa-Kakula’s development milestones are consistently met on budget and ahead of schedule, with the Phase 3 mill and mine expansion completed two quarters earlier than planned.

Anticipating first ore in the circuit next month, Phase 3 will boost annual production to over 600,000 tonnes of copper … solidifying Kamoa-Kakula as one of the world’s leading copper producers.

With improved power supply and accelerated Phase 3 output, we stand by our annual copper production forecast of between 440,000 to 490,000 tonnes.

“Copper prices have recently reached $10,000 per tonne, signaling an impending supply shortage, which is emphasized by smelter treatment charges for copper concentrate approaching zero in the spot market.

Copper producers cannot keep up with the pace of demand for this essential metal, including from advanced technologies such as data centres, which were recently estimated to consume over 2 million tonnes of copper as soon as 2030 added to which is an unseen explosion in demand from the global military complex.

“Given this backdrop, we are looking to accelerate our growth plans at Kamoa-Kakula to produce even more ‘green’ copper. We are excited by the upcoming results of our engineering for ‘Project 95’ – increasing our metallurgical recoveries to significantly increase production.

We are also already looking at the possibility of optimizing our Phase 3 plant to increase throughput beyond 5 Mtpa, and potentially bringing forward the Phase 4 concentrator expansion.

“We have the most incredible resource endowment at Kamoa-Kakula, including our high-grade, mechanized underground operations, which are currently producing at around 5% copper head grade, and great potential to expand our underground mining footprint.

We are also evaluating in detail the opportunity for world-class open pit mining on the north of our Kamoa-Kakula mining license.

This remarkable mining complex has the capability to produce at over 20 Mtpa capacity for decades, chasing down the number one copper producer globally.

There is much more to come this year at Kamoa-Kakula, without even mentioning the new deposits we are unearthing in the Western Forelands.”

FINANCIAL HIGHLIGHTS

-Ivanhoe Mines’ normalized profit for Q1 2024 was $70 million, compared to a normalized profit of $113 million for Q1 2023. Including a $139 million non-cash loss on the $575 million convertible bond fair valuation, Ivanhoe Mines recorded a loss of $69 million for Q1 2024, compared with a profit of $82 million for Q1 2023.

The non-cash loss on the convertible bond resulted from a 26% appreciation in the Ivanhoe Mines share price to C$16.16 during the quarter.

-Ivanhoe Mines’ Adjusted EBITDA was $126 million for Q1 2024, compared with $172 million for the same period in 2023, which includes an attributable share of EBITDA from Kamoa-Kakula.

-During Q1 2024, Kamoa-Kakula sold 85,155 tonnes of payable copper, recognizing revenue of $618 million, an operating profit of $286 million and quarterly EBITDA of $365 million.

The realized copper price for the quarter was $3.82/lb. The current copper price (LME) as of April 29, 2024, is over $10,000/t ($4.54/lb.).

-Kamoa-Kakula’s cost of sales per pound (lb.) of payable copper sold was $1.50/lb. for Q1 2024 compared with $1.50/lb. and $1.25/lb. in Q4 2023 and Q1 2023, respectively.

Cash cost (C1) per pound of payable copper produced in Q1 2024 totaled $1.57/lb., towards the lower end of the guidance range of $1.50 to 1.70/lb., and compared with $1.53/lb. and $1.42/lb. in Q4 2023 and Q1 2023, respectively.

-Ivanhoe Mines has a strong balance sheet with cash and cash equivalents of $411 million on hand as at March 31, 2024, and expects Kamoa-Kakula’s Phase 1 and Phase 2 cash flow and project-level facilities to be sufficient to fund the Phase 3 expansion capital cost requirements at current copper prices.

-Concurrent with the quarterly results, Ivanhoe Mines announced the redemption of all its outstanding 2.50% Convertible Senior Notes due 2026.

The notes will be redeemed on July 11, 2024, at a price equal to 100% of the principal amount of the Notes redeemed plus accrued and unpaid interest.

The company will settle any conversions in shares, resulting in up to 79.8 million shares to be issued. Ivanhoe will reduce total debt to below $150 million following redemption of the $575 million convertible notes.

OPERATIONAL HIGHLIGHTS

-Kamoa-Kakula produced 86,203 tonnes of copper in Q1 2024, with annual production guidance maintained at between 440,000 to 490,000 tonnes of copper in concentrate. Production during the quarter was impacted by instability within the DRC power grid.

-Since mid-March, 15 megawatts (MW) of imported power has been supplied to Kamoa-Kakula from the neighboring Zambian grid. The imported power has significantly improved the stability of Kamoa-Kakula’s operations, with production in April, a 30-day month, expected to be approximately 32,000 tonnes of copper in concentrate.

Kamoa-Kakula also recently signed an agreement to secure an additional 40 MW of imported power sourced from Mozambique from tomorrow, May 1. Mozambique’s electrical generation capacity is 77% supplied by hydroelectricity.

-Pre-commissioning of the Kamoa-Kakula Phase 3 concentrator, with a nameplate capacity of 5 million tonnes per annum (Mtpa), is underway.

First ore is due to be fed imminently, over six months ahead of the initial schedule. Construction of the direct-to-blister smelter is over 80% complete and on track for the end of 2024.

-Basic engineering on “Project 95” is underway and is expected to be completed in Q2 2024. Ivanhoe’s previously announced “Project 95” is an initiative to increase the overall metallurgical copper recovery rate of Kamoa-Kakula’s operations from the current nameplate rate of 87% up to approximately 95%.

-Kamoa-Kakula signed a term sheet outlining the key terms for a Reserved Capacity Agreement for the transportation of up to 240,000 tonnes of copper products along the Lobito Corridor from 2025.

-Kamoa-Kakula completed the first 10,000-tonne trial shipment of copper concentrate along the Lobito Corridor, as per the memorandum of understanding (MOU) announced on August 18, 2023. Shipments continue under the second 10,000-tonne trial, as per the term sheet as announced on February 7, 2024.

-At Kipushi, construction of the new concentrator is ahead of schedule with pre-commissioning activities now underway. To date, approximately 260,000 tonnes of ore are stockpiled on surface near the Kipushi concentrator. First feed of ore into the concentrator is expected in June.

-At Platreef, an updated independent feasibility study (FS) on an optimized development plan for Phase 2 is planned to be completed and published in the fourth quarter of 2024.

The optimized development plan accelerates the development of Phase 2 at a total processing capacity of 4 Mtpa by equipping Shaft #3 for hoisting.

-In addition, a preliminary economic assessment (PEA) on a Phase 3 expansion is expected to be completed at the same time, increasing Platreef’s processing capacity up to approximately 10 Mtpa.

Phase 3 is anticipated to rank Platreef as one of the world’s largest and lowest-cost platinum-group metal, nickel, copper and gold producers.

-Diamond drilling on the 2,650-square-kilometre Western Foreland exploration project has been focused on Kitoko, Makoko West and Makoko East, with between five and eight drill rigs operating during the quarter. A total of 16,861 metres of diamond core has been drilled in 18 completed holes to date.

-Ivanhoe Mines published its seventh annual Sustainability Report, underscoring the company’s ongoing commitment to “mining with a greater purpose” and its pursuit to be a global leader in responsible mining.

Principal projects and review of activities

1. Kamoa-Kakula Copper Complex

39.6%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kamoa-Kakula Copper Complex operated as the Kamoa Holding joint venture between Ivanhoe Mines and Zijin Mining, has been independently ranked as the world’s third-largest copper deposit by international mining consultant Wood Mackenzie in 2027.

The project is approximately 25 kilometres southwest of the town of Kolwezi and about 270 kilometres west of Lubumbashi. Kamoa-Kakula Copper Complex’s Phase 1 concentrator began producing copper in May 2021 and achieved commercial production on July 1, 2021. The Phase 2 concentrator, which doubled nameplate production capacity, was commissioned in April 2022.

Ivanhoe sold a 49.5% share interest in Kamoa Holding Limited (Kamoa Holding) to Zijin Mining and a 1% share interest in Kamoa Holding to privately owned Crystal River in December 2015.

Kamoa Holding holds an 80% interest in the project. Ivanhoe and Zijin Mining each hold an indirect 39.6% interest in Kamoa-Kakula, Crystal River holds an indirect 0.8% interest, and the DRC government holds a direct 20% interest. Kamoa-Kakula’s employee workforce of approximately 5,000 is currently 90% Congolese.

Kamoa-Kakula summary of operating and financial data

| Q1 2024 | Q4 2023 | Q3 2023 | Q2 2023 | Q1 2023 | |||||||||||

| Ore tonnes milled (000’s tonnes) | 2,061 | 2,133 | 2,236 | 2,244 | 1,930 | ||||||||||

| Copper ore grade processed (%) | 4.80% | 4.95% | 5.37% | 5.21% | 5.42% | ||||||||||

| Copper recovery (%) | 87.4% | 87.9% | 87.2% | 87.2% | 87.1% | ||||||||||

| Copper in concentrate produced (tonnes) | 86,203 | 92,215 | 103,947 | 103,786 | 93,603 | ||||||||||

| Payable copper sold (tonnes) | 85,155 | 90,967 | 96,509 | 101,526 | 86,777 | ||||||||||

| Cost of sales per pound ($ per lb.) | 1.50 | 1.50 | 1.34 | 1.24 | 1.25 | ||||||||||

| Cash cost (C1) ($ per lb.) | 1.57 | 1.53 | 1.46 | 1.41 | 1.42 | ||||||||||

| Realized copper price ($ per lb.) | 3.82 | 3.71 | 3.84 | 3.79 | 4.04 | ||||||||||

| Sales revenue before remeasurement ($’000) | 612,496 | 625,983 | 681,821 | 729,924 | 659,529 | ||||||||||

| Remeasurement of contract receivables ($’000) | 5,824 | (8,365) | 13,014 | (27,542) | 29,594 | ||||||||||

| Sales revenue after remeasurement ($’000) | 618,320 | 617,618 | 694,835 | 702,382 | 689,123 | ||||||||||

| EBITDA ($’000) | 364,893 | 343,899 | 423,211 | 456,628 | 457,311 | ||||||||||

| EBITDA margin (% of sales revenue) | 59% | 56% | 61% | 65% | 66% |

All figures in the above tables are on a 100%-project basis. Metal reported in concentrate is before refining losses or deductions associated with smelter terms.

This release and the company’s MD&A include “EBITDA”, “Adjusted EBITDA”, “EBITDA margin” and “Cash cost (C1)” which are non-GAAP financial performance measures.

For a detailed description of each of the non-GAAP financial performance measures used herein and a detailed reconciliation to the most directly comparable measure under IFRS, please refer to the non-GAAP Financial Performance Measures section in the company’s MD&A.

C1 cash cost per pound of payable copper produced can be further broken down as follows ($ per lb.):

| Q1 2024 2024 | Q4 2023 2023 | Q3 2023 2023 | Q2 2023 2023 | Q1 2023 2023 | |||||||||||

| Mining | 0.44 | 0.38 | 0.41 | 0.39 | 0.41 | ||||||||||

| Processing | 0.23 | 0.24 | 0.20 | 0.19 | 0.19 | ||||||||||

| Logistics charges (delivered to China) | 0.50 | 0.50 | 0.46 | 0.45 | 0.46 | ||||||||||

| TC, RC, smelter charges | 0.25 | 0.26 | 0.25 | 0.25 | 0.23 | ||||||||||

| General & Administrative | 0.15 | 0.15 | 0.14 | 0.13 | 0.13 | ||||||||||

| Cash cost (C1) per pound of payable copper produced | 1.57 | 1.53 | 1.46 | 1.41 | 1.42 |

Cash cost (C1) is prepared on a basis consistent with the industry standard definitions by Wood Mackenzie cost guidelines but are not measures recognized under IFRS.

In calculating the C1 cash cost, the costs are measured on the same basis as the Company’s share of profit from the Kamoa Holding joint venture that is contained in the financial statements.

C1 cash cost is used by management to evaluate operating performance and include all direct mining, processing, and general and administrative costs.

Smelter charges and freight deductions on sales to the final port of destination, which are recognized as a component of sales revenues, are added to C1 cash cost to arrive at an approximate cost of delivered, finished metal. C1 cash cost excludes royalties, production taxes and non-routine charges as they are not direct production costs.

All figures are on a 100% project basis and metal reported in concentrate is before refining losses or deductions associated with smelter terms.

The increase in Kamoa-Kakula’s C1 cash cost per pound of payable copper produced in Q1 2024 is principally due to the decrease in copper in concentrate produced during the quarter, but also as a result of the lower grade of copper ore processed in Q1 2024.

The grid instability during the quarter not only impacted the ore tonnes milled but also impacted the copper ore grade processed due to reduced underground access to high-grade areas due to water ingress during power interruptions.

Kamoa-Kakula produced 86,203 tonnes of copper in concentrate in Q1 2024

Kamoa-Kakula produced 86,203 tonnes of copper in concentrate in the first quarter of 2024. Annual production guidance for Kamoa-Kakula is maintained at between 440,000 and 490,000 tonnes of copper in concentrate for 2024.

Kamoa-Kakula’s Phase 1 and 2 concentrators milled approximately 2.06 million tonnes of ore during the first quarter at an average feed grade of 4.8% copper.

Copper flotation recoveries for the quarter averaged 87.4%, above the Phase 1 and 2 concentrator design recovery rate of 86.0%.

A daily milling record was achieved on January 2, 2024, when 31,375 tonnes of ore was processed by the Phase 1 and 2 concentrators over 24 hours. This performance is equivalent to an annual milling rate of 10.5 million tonnes (after accounting for availability).

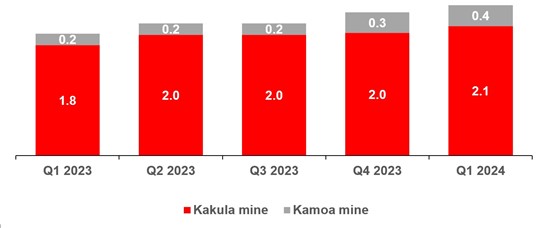

A quarterly mining record of 2.5 million tonnes of ore was achieved from the Kakula and Kamoa 1 underground mines, as shown in Figure 1.

Ore from the Kamoa 1 Mine is stockpiled on surface ahead of the commencement of the adjacent Phase 3 concentrator. The Phase 3 concentrator is tracking ahead of schedule with completion and first feed now expected next month, in May, two full quarters ahead of original schedule.

At the end of the quarter, there were 2.05 million tonnes of stockpiled ore for the Phase 3 concentrator, at an average grade of 3.1% copper.

Figure 1. Mined ore per quarter from the Kakula and Kamoa 1 underground mines (million tonnes).

First-quarter production, including throughput and head grade, continued to be impacted by the previously reported instability within the DRC’s southern power grid.

Kamoa Copper continues to work closely with the DRC’s state-owned power company, La Société Nationale d’Electricité (SNEL), to deliver solutions for the identified causes of the instability experienced across the southern DRC’s grid infrastructure since late 2022.

During the first quarter, heavier-than-usual rainfall during the wet season further contributed to grid intermittency. The rainfall led to elevated water levels in the Congo River, causing debris to block the intakes feeding the Inga hydroelectric dam complex. The blockages negatively impacted hydro-generation capacity. The wet season typically occurs between November and April.

Production at the Kamoa-Kakula Copper Complex for the first quarter of 2024 was 86,203 tonnes of copper in concentrate, compared to 92,215 tonnes in Q4 2023 and 93,603 tonnes in Q1 2023. Ore was drawn down as required from surface stockpiles to maximize copper production.

In December 2023, SNEL and Ivanhoe Mines Energy DRC, a subsidiary of Kamoa Holding Limited, signed an amendment to the existing financing agreement to fund the identified infrastructure upgrades.

The original 2014 financing agreement consisted of a loan of up to $250 million to fund the refurbishment of 78 MW of generation capacity at the Mwadingusha dam and 178 MW of generation capacity from Turbine #5 at the Inga II dam.

Infrastructure investments are underway to enable the transmission of that power over the Inga-Kolwezi connection. The refurbishment of the Mwadingusha facility was completed in September 2021, and the refurbishment of Turbine #5 at Inga II dam is expected to be completed during the first quarter of 2025.

The amendment to the financing agreement increases the loan up to $450 million. As with the existing financing agreement, the $200 million in additional funding by Ivanhoe Mines Energy to SNEL bears interest at the Secured Overnight Financing Rate plus 3% and will be repaid via a 40% discount on the tariff of grid energy consumed by Kamoa-Kakula.

The additional funding is assigned specifically for grid infrastructure upgrades, such as an increase in grid capacity between the Inga II dam and Kolwezi, a new harmonic filter at the Inga Converter Station, as well as a new static compensator at the Kolwezi Converter Station.

In addition, various smaller initiatives have been identified to strengthen the transmission capability and improve the long-term stability of the southern grid.

This includes the restringing of powerlines in the southern grid, as well as repairs to the direct current (DC) infrastructure. Funding will also be used to install preventative measures to avoid future blockages of the Inga dam intakes.

Mobilization of resources is well underway, with project delivery expected to be complete by mid-2025. In addition to this, Ivanhoe Mines Energy is working with SNEL to put in place maintenance contracts to maintain key generation capacity and transmission infrastructure.

55 MW of imported power secured to offset grid stability, with significantly improved production in April; installation of further on-site backup-power generation capacity ongoing

Since mid-March, 15 MW of imported power has been supplied to Kamoa-Kakula from the neighbouring Zambian grid. The imported power has had a significant, positive effect on the stability of Kamoa-Kakula’s operations, with production of copper in concentrate for April, a 30-day month, expected to be approximately 32,000 tonnes.

Kamoa-Kakula has recently signed an agreement that secures an additional 40 MW of imported power sourced from Mozambique, from May 1, 2024, supplied via the Zambian interconnector.

Mozambique has abundant hydroelectric-generated capacity, the majority of which is exported to South Africa. Subject to availability, it is expected that total imported power will increase up to 100 MW by year-end (see Figure 2).

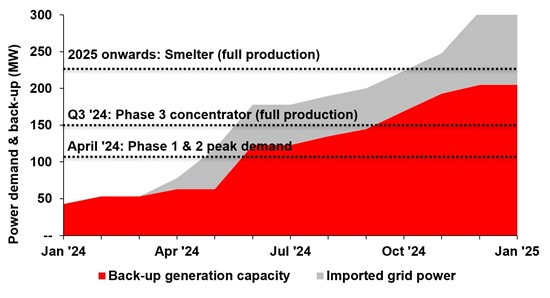

Figure 2. Kamoa-Kakula’s 2024 peak demand and phased rollout of on-site, back-up generation capacity and imported grid power, supplementing existing domestically supplied power by SNEL (MW).

Other power-generating projects have been initiated to de-risk the current and future operations over the short to medium term, while the grid infrastructure upgrades are completed.

Kamoa Copper’s engineering team is currently expanding its on-site backup generation capacity to ensure there is on-site redundancy for the current Phase 1 and 2 operations, as well as future Phase 3 operations.

On-site backup-power generator capacity is scheduled to increase, via a phased roll-out, to a total of over 200 MW in time for the completion of the direct-to-blister copper smelter in Q4 2024, as shown in Figure 2.

The generator farm sites are being built adjacent to the Phase 1 and 2 concentrators, and smelter at Kakula, as well as adjacent to the Phase 3 concentrator at Kamoa.

63 MW of on-site backup generation capacity is currently installed at Kamoa-Kakula and that is expected to increase, ahead of schedule, to a total of 123 MW by the end of the second quarter.

Peak on-site power demand from operations is currently approximately 105 MW. The Phase 3 concentrator will add an additional requirement of 45 MW once fully ramped in the third quarter. In addition, the smelter will require a further 75 MW of power once fully ramped up throughout 2025.

Construction of the Phase 3 concentrator plant and associated infrastructure is 94% complete and ahead of schedule for first-feed imminently

Kamoa-Kakula’s Phase 3 concentrator is expected to be completed imminently, in May 2024, significantly ahead of the original schedule.

The new 5-Mtpa Phase 3 concentrator is located adjacent to the Kamoa underground mines, approximately 10 kilometres north of the Phase 1 and 2 concentrators located above the Kakula underground mine.

Aerial view of Kamoa-Kakula’s Phase 3 concentrator, which is tracking two full quarters ahead of schedule for first feed in May 2024.

The Phase 3 concentrator is 30% larger in capacity compared with the Phase 1 and 2 concentrators. The process design is very similar, therefore the bulk of the equipment is the same or similar to that installed in the Phase 1 and 2 concentrators, resulting in a commonality of spare parts, while also leveraging prior operational and maintenance experience.

Following the commissioning of the Phase 3 concentrator, Kamoa-Kakula will have a total design processing capacity of 14.2 Mtpa.

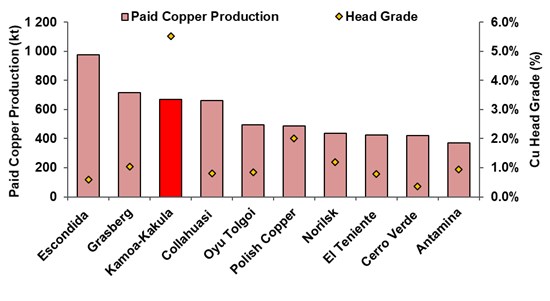

Phase 3 is expected to increase annualized copper production to over 600,000 tonnes per year over the next ten years, positioning Kamoa-Kakula as the world’s third-largest copper mining complex, and the largest copper mine on the African continent. See Figure 3.

Figure 3. World’s projected top 10 copper mines in 2027, by key metrics.

Note: Kamoa-Kakula production and grade are based on the Kamoa-Kakula 2023 PFS. The ‘Cu Head Grade’ for the projects benchmarked by Wood Mackenzie reflects the average reserve grade. Source: Wood Mackenzie, 2023 (based on public disclosure, the Kamoa-Kakula 2023 PFS has not been reviewed by Wood Mackenzie).

Kamoa-Kakula’s Phase 3 expansion consists of two new underground mines called Kamoa 1 and Kamoa 2, as well as the existing Kansoko Mine. The Kamoa 1 and Kamoa 2 mines share a single box cut with a twin service-and-conveyor decline. Construction of the twin declines to the Kamoa 1 and Kamoa 2 underground mines and excavation to access the Phase 3 mining areas is advancing well for Q2 production.

Once commissioned, copper concentrate produced from the Phase 3 concentrator will be partially sold to generate cash flow, and partially stockpiled in anticipation of the smelter commissioning scheduled for the end of 2024.

Construction of the direct-to-blister copper smelter project is 81% complete and on target for completion by the end of 2024

The Phase 3 expansion also includes the construction of Africa’s largest smelter, which will have a capacity of 500,000 tonnes of >99%-pure blister-anode copper per annum.

The direct-to-blister flash smelter is being built adjacent to the existing Phase 1 and Phase 2 concentrator plants. The smelter will incorporate leading-edge technology supplied by Metso Finland and will comply with the world-leading International Finance Corporation’s (IFC) emissions standards.

The smelter project is 81% complete and on schedule for completion at the end of Q4 2024. Detailed engineering and procurement activities for the smelter are complete.

Approximately 23,000 tonnes of the total approximately 26,000 tonnes of structural steel have been delivered to site, with over 14,000 tonnes already installed.

Of a total of approximately 73,000 tonnes of equipment and materials, 49,000 tonnes have been delivered to site with an additional 24,000 tonnes en route.

The remaining equipment will be delivered in the next three months. Civil construction is nearing completion with structural steel erection and mechanical equipment installation well advanced.

In April, a major milestone was achieved with the delivery and installation of the three anode furnaces and steam drier drums, each weighing approximately 200 tonnes.

Electrical installation has commenced in all areas. Recruitment and training of the operational team is well advanced and ongoing.

Construction of Kamoa-Kakula’s Phase 3 smelter concentrate blending building. The smelter project is on track for completion in Q4 2024.

The smelter will have a processing capacity of approximately 1.2 Mtpa of dry concentrate feed and is designed to run on a blend of concentrate produced from the Kakula (Phase 1 and 2) and Kamoa (Phase 3 and future Phase 4) concentrators.

As per the Kamoa-Kakula 2023 Integrated Development Plan, the smelter is projected to process approximately 80% of Kamoa-Kakula’s total concentrate production.

Kamoa-Kakula will also continue to toll-treat concentrates under a 10-year agreement with the Lualaba Copper Smelter (LCS), located approximately 50 kilometres from Kamoa-Kakula, near the town of Kolwezi. Approximately 180,000 tonnes of copper concentrate per year is toll-treated at LCS.

First feed into Kamoa-Kakula’s Phase 3 ball mills and flotation cells is expected to commence ahead of schedule in May 2024.

As a by-product, the smelter will also produce approximately 700,000 tonnes per year of high-strength sulphuric acid. There is a strong demand for sulphuric acid in the DRC, as it is used to leach copper from oxide ores through the SX-EW (solvent extraction and electrowinning) process.

In 2023, approximately 6 million tonnes of acid were consumed by mining operations in the DRC. Domestic acid demand is expected to increase to over 7 million tonnes in the short to medium term.

The market price for acid in the DRC is comparatively high, as most of the high-strength sulphuric acid consumed is imported first as sulphur, with high associated transportation costs, and burned in domestic acid plants to produce liquid high-strength sulphuric acid.

Offtake contracts for the high-strength sulphuric acid produced by the smelter are well-advanced with local purchasers.

Kamoa-Kakula is well-advanced with preparations for smelter operations. Recruitment of the 950-strong team of operators, and hiring and training of the operational management team and key operators is well underway. Procurement of maintenance spares and start-up consumables has also started.

The on-site smelter will offer transformative financial benefits for the Kamoa-Kakula Copper Complex, most significantly a material reduction in logistics costs, and to a lesser extent reduced concentrate treatment charges and local taxes, as well as revenue from acid sales.

Logistics costs accounted for approximately one-third of Kamoa-Kakula’s total cash cost (C1) during Q1 2024, and the volume of required trucks is expected to approximately halve following the smelter start-up as each truck will transport 99+%-pure blister copper anodes, instead of wet concentrate with 40-50% contained copper. Smelting on-site is expected to drive a decrease in average cash cost (C1) of approximately 20%.

Refurbishment of hydropower at Inga II approximately 62% complete, now on track for Q1 2025 completion

The refurbishment of Turbine #5 at the Inga II hydroelectric facility is approximately 62% complete and advancing within budget to generate 178 MW of hydroelectric power for the DRC grid from Q1 2025.

Wet commissioning and synchronization to the grid were delayed by two months due to the late delivery in the first quarter of the turbine runner and shaft, as well as related components for assembly.

All critical-path equipment packages have now been delivered to the site, with all contractors fully mobilized and assembly work underway.

The later commissioning of Turbine #5 is not expected to impact the ramp-up of the direct-to-blister smelter from the end of 2024, due to additional imported power secured, as well as the availability of back-up generation capacity.

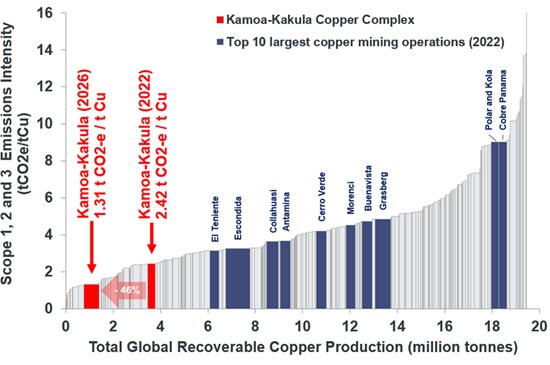

Figure 4. 2022 Scope 1, 2 & 3 copper GHG emissions intensity curve, highlighting Kamoa-Kakula and the top 10 largest copper mining operations. Following the completion of the on-site smelter, as part of the Phase 3 expansion, the GHG emissions intensity is expected to almost halve.

Source: Skarn Associates and WSP Group. For full footnotes reference the original news release dated November 3, 2023.

Phase 3 underground infrastructure expansion at Kakula, Kamoa and Kansoko mines progressing well

Engineering and procurement of the project is mostly complete with the focus now on fabrication, construction and commissioning.

During the first quarter of 2024, the Kakula multistage west dam was commissioned, providing an additional pumping capacity of 1,500 litres per second (l/s), a 30% increase overall, thus significantly de-risking the water management of the Kakula Mine.

The Kamoa 1 overland conveying system from the bulk reclaim tip to the run-of-mine stockpile was successfully commissioned allowing early material for the commissioning of the Phase 3 concentrator front end.

The overland conveying system has a design capacity of 3,000 tonnes per hour and will initially transfer the stockpiled rock from the Kansoko Mine to the Kamoa 1 concentrator.

Basic engineering for ‘Project 95’ expected to be complete in May 2024, aiming to increase Kamoa-Kakula’s copper recoveries to 95%

Ivanhoe’s previously announced “Project 95” is an initiative launched to increase the overall metallurgical copper recovery rate of Kamoa-Kakula’s operations.

The grade of Kamoa-Kakula’s tailings in 2023 averaged approximately 0.8% copper, which is higher than the average head grade of major global copper mines.

By liberating unrecovered copper from the tailings stream of the concentrators, as well as from the deposited tailings, Kamoa’s engineering team aim to increase recoveries to approximately 95%, thereby reducing the copper in tailings.

For context, in 2023 the Kamoa-Kakula Copper Complex milled approximately 8.54 million tonnes of ore, producing 393,551 tonnes of copper in concentrate at an 87.3% metallurgical recovery rate, in line with design parameters.

Therefore, over 50,000 tonnes of contained copper were not recovered into concentrate and diverted to the tailings storage facility, or used underground as backfill.

Using conventional fine grinding, highly promising test work results indicated that approximately 65% of the remaining contained copper in the tailings stream can be recovered, taking the overall recovery rate up to 95%. Basic engineering on the tailings-stream recovery plant is underway and is expected to be completed in May 2024.

Kamoa-Kakula completes first 10,000-tonne trial shipment of copper concentrate along the Lobito Corridor

During the quarter, Kamoa-Kakula signed a term sheet outlining the key terms for a Reserved Capacity Agreement for the transportation of up to 240,000 tonnes of copper products along the Lobito Corridor from 2025.

The Reserve Capacity Agreement, to be based on the non-binding term sheet, will allocate Kamoa-Kakula the right to transport along the Lobito Corridor a minimum of 120,000 tonnes and a maximum of 240,000 tonnes per annum of blister anode or concentrate.

The term sheet outlines a minimum term for the agreement of five years commencing in 2025, following a ramp-up year in 2024.

The costs of exporting mineral products along the Lobito Corridor are expected to be cheaper than the current market price for trucking via the existing export routes, and the rates are anticipated to reduce further as volumes transported along the line increase.

After quarter end, Kamoa-Kakula completed the first 10,000-tonne trial shipment of copper concentrate along the Lobito Corridor, as per the memorandum of understanding (MOU) announced on August 18, 2023.

Shipments will now continue under the second 10,000-tonne trial, as per the term sheet as announced on February 7, 2024. To date, 10,825 tonnes of copper concentrate have been transported along the railway line. As such, Kamoa-Kakula is the first industrial customer of the Lobito Corridor in the modern era.

Health & Safety at Kamoa-Kakula Copper Complex

After quarter end, a fatal accident occurred underground during development at the Kansoko Mine, when Mr. Mpata Kazala Magloire, a general worker, was struck by the drill string of an underground drill rig.

Kamoa Copper is undertaking a comprehensive internal investigation into the accident, which resulted from a serious breach of protocol, and is working with the DRC authorities on their investigation of the accident.

Once the investigations are complete, management will review and implement any additional safety measures recommended to prevent such an accident from recurring. Production activities at the Kamoa-Kakula concentrators were not affected by the incident.

On behalf of the Kamoa Copper Joint Venture, Ivanhoe Mines extends its deepest condolences to the grieving family and friends of Mr. Magloire.

In April, contractor Mining Services & Supplies (MSS) celebrated 7 million lost time injury (LTI) free manhours on the same day as the World Day for Safety and Health. MSS are contracted for the construction of the Phase 3 concentrator.

Copper production and cash cost guidance for 2024

| Kamoa-Kakula 2024 Guidance | |||

| Contained copper in concentrate (tonnes) | 440,000 to 490,000 | ||

| Cash cost (C1) ($ per pound of payable copper produced) | 1.50 to 1.70 | ||

The figures are on a 100% project basis and metal reported in concentrate is before refining losses or deductions associated with smelter terms.

Kamoa-Kakula’s 2024 guidance is based on several assumptions and estimates and involves estimates of known and unknown risks, uncertainties and other factors that may cause the actual results to differ materially.

Production guidance is based on assumptions for the completion of the Phase 3 concentrator and the reliability of the DRC grid power supply, among other variables.

The Kamoa-Kakula joint venture produced a total of 86,203 tonnes of copper in concentrate for the three months ended March 31, 2024.

Cash cost (C1) per pound of payable copper amounted to $1.57/lb. for the three months ended March 31, 2024. Cash cost guidance is based on assumptions including copper ore grade processed, completion of the Phase 3 concentrator, reliability of DRC grid power supply and prevailing logistics rates, among other variables.

Cash cost guidance includes a provision for the use of on-site, backup generator capacity during 2024 to support the Phase 1 and 2 operations during periods of intermittent power from the grid, particularly due to the early commissioning of Phase 3.

On-site backup power is approximately four times greater in cost than the grid-supplied power by SNEL and twice as expensive as imported power, on a cents per kilowatt hour basis.

Increased reliance on backup power can increase cash costs by up to approximately $0.20/lb., which is captured in the guidance range.

Cash cost guidance is impacted by the timing of Kamoa-Kakula’s Phase 3 concentrator, which is well ahead of schedule for first production in May 2024.

Copper in concentrate produced by the Phase 3 concentrator is expected to have a higher cash cost when compared to Phase 1 and Phase 2 due to the lower average copper grade expected from the Kamoa 1 and Kamoa 2 mines feeding the Phase 3 concentrator, compared to the Kakula Mine feeding the Phase 1 and Phase 2 concentrators.

Completion of the on-site smelter, on schedule for Q4 2024, is expected to drive a decrease in average cash cost (C1) over the first five years post-completion (from 2025) by approximately 20%.

Kipushi’s 800,000-tonnes-per-annum concentrator is ahead of schedule for first feed in June 2024. Shaft P5 (background) will provide ore to the mill via the overland conveyor. Approximately 260,000 tonnes of ore are already stockpiled on surface ahead of first-feed into the concentrator.

Kipushi concentrator pre-commissioning commenced ahead of schedule, with first ore expected in June 2024

Construction of the new 800,000-tonne-per-annum concentrator facility is nearing completion. The concentrator includes dense media separation (DMS) and a milling and flotation circuit and is expected to produce more than 270,000 tonnes of zinc in concentrate over the first five years of production. Design recoveries are targeted at 96%, with a concentrate grade averaging 55% contained zinc.

With overall project progress approximately 90% complete to date, the Kipushi concentrator is ahead of schedule for first feed in June 2024. All 2,139 tonnes of steel and 254 tonnes of platework required for the concentrator structures have been delivered to site and erection is nearly complete.

Electrical installation is advancing well with some of the substations already energized and ready for equipment commissioning in the coming weeks.

The erection of the concentrate warehouse structural steel is complete and final sheeting installation nearing completion. The installation of the concentrate bagging plant is also complete.

The construction of the tailings storage facility is complete and commissioned. The tailings storage facility has been designed in accordance with Global Industry Standards on Tailings Management (GISTM).

Underground development continues to open multiple access levels into the Big Zinc orebody, while decline development is well-advanced. A total of 5,580 metres of lateral and decline development has been completed to date.

Underground development 15% ahead of schedule, with 5,580 metres completed to date and 1,015 metres completed during the first quarter

In line with the Kipushi 2022 Feasibility Study, mining will focus on the zinc-rich Big Zinc and Southern Zinc zones, with an estimated 11.8 million tonnes of Measured and Indicated Mineral Resources grading 35.3% zinc.

The underground mining and development are fully mechanized, highly efficient and designed to enable a quick ramp-up to a steady state of 800,000 tonnes per annum.

Five mining crews are deployed underground. Each mining crew is made up of five miners per shift and equipped with a primary fleet supplied by Epiroc of Stockholm, Sweden; a 282 Twin Boomer, a ST 14 Scooptram (LHD) and two MT42 dump trucks with a Simba long hole stope drill rig for the stoping crew.

Underground development continues to open multiple access levels into the Big Zinc orebody, from the top down, while decline development continues to spiral down parallel to the plunging Big Zinc deposit. The main decline is currently at a depth of 1,420 metres below surface.

Stoping of ultra-high grade Big Zinc orebody began ahead of schedule; approximately 260,000 tonnes of development ore stockpiled on surface

The mining method of the Big Zinc orebody is transverse sublevel open stoping, with high-grade ore extracted from the stopes in a primary and secondary sequence.

The void of the mined-out stopes will be filled with cemented aggregate fill (CAF) to maximize the extraction of the ultra-high-grade ore.

The height of each long-hole stope is approximately 60 metres, comprising an upper 30-metre-high stope and a lower 30-metre-high stope. Stopes will be separated by a 15-metre-high sill pillar.

The long-hole stopes will be mined with a bottom-up mining sequence, with the lower stope extracted first, followed by the upper stope.

Stoping of Kipushi’s ultra-high-grade Big Zinc orebody commenced in December 2023, ahead of schedule. Stoping started on a trial mining basis to complete the training of the underground mining crews in preparation for the commencement of commercial operations in the coming months.

The first stoping block was successfully mined out during the first quarter. A total of 18,733 tonnes were mined at the 1,245-metre level, with an average grade of 18.7% zinc. Mining panels have been established between the 1,290-metre level and the 1,320-metre level.

Ore from underground development and trial stoping is being stockpiled on surface ahead of first feed into the concentrator. To date, approximately 260,000 tonnes of ore is stockpiled on surface near the Kipushi concentrator, at an average grade of 23% zinc. This includes 75,600 tonnes of “medium-grade” ore at an average grade of 32% zinc.

3. Platreef Project

64%-owned by Ivanhoe Mines

South Africa

The Platreef Project is owned by Ivanplats (Pty) Ltd (Ivanplats), which is 64%-owned by Ivanhoe Mines. A 26% interest is held by Ivanplats’ historically disadvantaged, broad-based, black economic empowerment (B-BBEE) partners, which include 20 local host communities with approximately 150,000 people, project employees and local entrepreneurs.

A Japanese consortium of ITOCHU Corporation, Japan Oil, Gas and Metals National Corporation (JOGMEC), and Japan Gas Corporation, owns a 10% interest in Ivanplats, which it acquired in two tranches for a total investment of $290 million.

The Platreef Project hosts an underground deposit of thick, platinum-group metals, nickel, copper, and gold mineralization on the Northern Limb of the Bushveld Igneous Complex in Limpopo Province – approximately 280 kilometres northeast of Johannesburg and eight kilometres from the town of Mokopane in South Africa.

On the Northern Limb, platinum-group metals mineralization is primarily hosted within the Platreef, a mineralized sequence traced for more than 30 kilometres along strike.

Ivanhoe’s Platreef Project, within the Platreef’s southern sector, is comprised of two contiguous properties: Turfspruit and Macalacaskop.

Turfspruit, the northernmost property, is contiguous with, and along strike from, Anglo Platinum’s Mogalakwena group of mining operations and properties.

Since 2007, Ivanhoe has focused its exploration and development activities on defining and advancing the down-dip extension of its original discovery at Platreef, now known as the Flatreef Deposit, which is amenable to highly mechanized, underground mining methods.

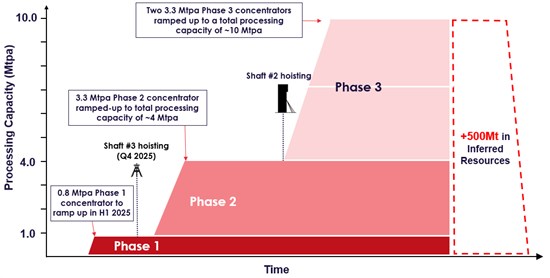

Optimized Platreef development plan to accelerate and re-scope Phase 2 to 4-Mtpa capacity by equipping Shaft #3 for hoisting

In 2023, Ivanhoe’s engineering team completed an internal optimization study of the phased expansion of the Platreef Project. Current underground development and operations are dependent on the initial 1-Mtpa Shaft #1 until the 10-metre-diameter, 8-Mtpa Shaft #2 is commissioned. The study concluded that accelerating the startup of Phase 2 will create significant project value.

Phase 2 expansion will be accelerated by re-purposing ventilation Shaft #3 for hoisting. Shaft #3 will generate additional hoisting capacity of approximately 4 Mtpa, bringing total hoisting capacity to approximately 5 Mtpa.

The reaming of Shaft #3 down to the 950-metre level commenced in 2023. Reaming is the process of boring, or excavating, a vertical shaft from the bottom up, and it is the quickest and safest method of constructing a shaft.

Reaming is expected to be completed during the second quarter of 2024. Once equipped, Shaft #3 is expected to be ready for hoisting in the fourth quarter of 2025, well ahead of the completion of the much larger Shaft #2.

The internal study concluded that equipping Shaft #3 for hoisting de-risks Phase 1 underground operations ahead of the completion of Shaft #2 and accelerates the underground development for Phase 2. In addition, the Phase 2 concentrator would have an increased processing capacity of 3.3 Mtpa, up from 2.2 Mtpa, as per the first module of Phase 2 defined in the Platreef 2022 Feasibility Study.

Therefore, the Phase 1 and Phase 2 concentrators will have a total combined processing capacity of approximately 4.0 Mtpa, with ore fed by Shaft #1 and Shaft #3.

Additional underground ventilation will now be provided by a new 5.1-metre-diameter shaft, named Shaft #4. The drilling of the pilot hole for Shaft #4 commenced in April 2024.

Once reaming is complete and the ventilation fans are installed, Shaft #4 is expected to be operational during the third quarter of 2025.

Following the completion of the optimization study, work is well underway on an updated independent Feasibility Study for the Phase 2 expansion, which will be completed and published in the fourth quarter of 2024.

Figure 5. Platreef’s updated phased development strategy following optimization. An updated Feasibility Study and PEA, covering the scope of optimized Phase 2 and the new Phase 3 expansion is expected to be completed and published in Q4 2024

Study work in progress for new Phase 3 expansion to 10 Mtpa, expected to rank Platreef as one of the world’s largest PGM producers

In parallel with the release of the updated Feasibility Study, Ivanhoe has also commissioned a preliminary economic assessment for an additional expansion, Phase 3, taking the total Platreef processing capacity up to approximately 10 Mtpa (as shown in Figure 5).

The new Phase 3 expansion is expected to consist of two additional 3.3-Mtpa concentrator modules, to be located adjacent to the Phase 1 and 2 concentrators.

Phase 3 is anticipated to rank Platreef as one of the world’s largest and lowest-cost platinum-group metal, nickel, copper and gold producers.

The 10-Mtpa concentrator capacity of the Phase 3 expansion will be 12.5 times greater than that of Phase 1 and 2.5 times greater than the processing capacity of the optimized Phase 2 expansion.

The completion of Shaft #2 will increase the total hoisting capacity for ore and waste development, across all three shafts to over 12 Mtpa.

Construction of Shaft #2 headgear approximately 55% complete

Construction activities are advancing well on the installation of 1,124 tonnes of internal structural steel inside Shaft #2’s headgear.

In addition, all long-lead order equipment packages for the headgear have now been placed. The installation contract for the sinking winders and related infrastructure was also recently placed, with contractor onboarding well advanced.

The production winder, as well as the man and material winder, are expected to be delivered to site early in the third quarter of 2024.

The Shaft #2 sinking contract is currently out for tender and planned to be placed later this year, once the reaming of the shaft to an initial diameter of 3.1 metres is complete.

Reaming is on schedule to be complete in the third quarter, after which enlargement out to a diameter of 10 metres will commence.

Offtake agreement with Sibanye-Stillwater to support Phase 2 expansion of Platreef

During the first quarter, Ivanplats signed a Purchase of Concentrate Agreement with Western Platinum Proprietary Limited, a subsidiary of Sibanye-Stillwater Limited, for Phase 2 concentrate production.

Sibanye-Stillwater is one of the world’s largest primary PGM producers and operates the Marikana complex in North West province, South Africa, which includes a smelter plant with five furnaces, a base metal refinery plant, and a precious-metal refinery plant.

The offtake agreement is for eight years from first production of Phase 2 and is for an initial volume of 60,000 tonnes of concentrate per annum, which is expected to represent between one-third and one-half of the re-scoped Phase 2 volume. Separately, Ivanplats and Sibanye-Stillwater are exploring the possibility of increasing the annual volume to 100,000 tonnes or more.

As previously disclosed, Platreef’s Phase 1 concentrate production, for 10 years, will be purchased by Northam Platinum Limited (Northam).

Northam is an independent, fully empowered, integrated PGM producer, with primary operations in South Africa including the wholly owned Zondereinde Mine and metallurgical complex, and Booysendal Mine.

Platreef’s Phase 1 is expected to produce approximately 40,000 tonnes per year of concentrate, containing six payable metals, including palladium, nickel, platinum, rhodium, copper and gold.

Ivanhoe Mines signs term sheet with leading industrial partner to explore downstream processing of PGM-nickel-copper concentrate in South Africa

During the first quarter, Ivanhoe Mines signed a term sheet with a leading industrial partner to jointly explore the viability of a new PGM-nickel-copper smelter in South Africa.

The agreement outlines a technical and commercial collaboration to jointly study the construction of a facility to smelt PGM-nickel-copper concentrate produced during Phase 3, as well as third-party concentrates, into a converter matte.

Converter matte is an intermediary smelter product that typically consists of approximately 40 to 50% nickel and 20 to 30% copper by content, with up to 750 grams per tonne of PGM content.

Converter matte can be further processed into refined metal in South Africa, as well as at many refineries abroad. In addition, converter matte receives significantly better terms from its purchasers compared with PGM concentrates.

Both parties have committed to undertake a pre-feasibility study on the development of the facility. The facility may be a greenfield site or may re-purpose an existing facility in South Africa.

The collaboration is designed to draw on the respective skills of both parties. The smelter would be jointly owned, with Ivanhoe owning no less than 50% and a mechanism to increase its ownership in the future.

Construction activities for the Phase 1 concentrator are advancing on schedule for Q3 2024 cold commissioning, with first feed deferred to mid-2025

Construction of the Phase 1 concentrator is advancing on schedule at almost 90% complete and is on track for cold commissioning in the third quarter of 2024.

All engineering and procurement activities for the Phase 1 concentrator are essentially complete, with all long lead items delivered to site.

Cold commissioning of the Phase 1 concentrator is expected to continue as planned in Q3 2024. However, first feed and ramp-up of production will be deferred until mid-2025.

The waste generated from the increased lateral development required for fast-tracking Phase 2, as well as from the reaming of Shaft #2 and Shaft #3 will be prioritized for hoisting up Shaft #1 over the next 12 months.

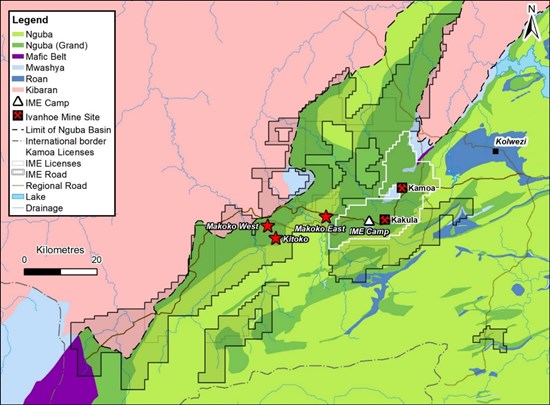

4. Western Foreland Exploration Project

90%- to 100%-owned by Ivanhoe Mines

Democratic Republic of Congo

Ivanhoe’s DRC exploration group is targeting Kamoa-Kakula-style copper mineralization on its Western Forelands exploration licences.

The 17 licences in the Western Foreland cover a combined area of approximately 2,407 square kilometres to the north, south and west of the Kamoa-Kakula Copper Complex. An additional 4 licences under joint venture bring the exploration area to approximately 2,654 square kilometres.

The exploration group is using models that successfully led to the discoveries of Kakula, Kakula West, and the Kamoa North Bonanza Zone at the Kamoa-Kakula Copper Complex.

More recent discoveries at Makoko, Kiala and the 2023 Kitoko mineralization confirm the effectiveness of these models.

The wet season in the DRC starts in November and continues until early April, with field access often restricted until May. All-weather access to drill sites at Kitoko, Makoko West and Makoko East was established ahead of the wet season so that drilling could continue uninterrupted.

Eight contractor-operated diamond rigs were operating at the end of the quarter. A total of 16,861 metres of diamond core has been drilled in 18 completed holes, one abandoned hole and eight continuing holes.

The potential for mineralization at depth between Makoko and Kakula has been tested with deep holes drilled with the assistance of a directional drilling company.

Two holes were completed during Q1 2024 with one intersecting a mafic intrusive on the contact between the Nguba sediments and Kibaran basement. The second hole intercepted copper sulphide mineralization in a Nguba siltstone in direct contact with the Kibaran basement.

Drilling at Kitoko continued to define the extent of mineralization and develop an understanding of the system. Between three and five diamond drill rigs were active on the prospect from mid-January to the end of the quarter with a total of 10 holes completed, including three wedges from deeper parent holes.

Drilling has confirmed the occurrence of mineralization within Nguba sediments in direct contact with the Kibaran basement. This represents a new geological setting for high-grade mineralization on the Western Foreland and will be incorporated into targeting models across the land package.

Drilling at Makoko West (up-dip of Kitoko) continued with between two and four rigs during the quarter. The drilling at Makoko West is targeting the up-dip area of the Kitoko mineralized system, particularly where pyritic siltstones have been deposited close to the Kibaran basement. Six drill holes have been completed and two are underway.

The wet season is expected to end in April and allow access to more regional locations from May onwards. This program will include air core drilling to collect a sample at the top of residual rock below exotic Kalahari sands and diamond drilling at regional targets.

A passive seismic program is scheduled for Q2 2024 at both Kitoko and the Lupemba area, which is located southwest of the Kitoko discovery.

The program aims to identify the thickness of Kalahari sand, basement architecture and the location of thick mafic rocks below the Nguba sediments.

Figure 6. Map of the Western Forelands exploration licences (black outline), showing the prospects worked on by the exploration team during the first quarter.

The area of the Western Forelands exploration licences is almost seven times as large as the Kamoa-Kakula Copper Complex licences (white outline).

5. The Mokopane Feeder Exploration Project

100%-owned by Ivanhoe Mines

South Africa

Three new 100%-owned exploration rights were granted on the Northern Limb of the Bushveld complex in South Africa during Q4 2022.

The three new exploration rights (Blinkwater 244KR, Moordrift 289KR and Lisbon 288KR) cover 80 square kilometres forming a continuous block situated on the southwest border of the existing Platreef Project’s mining rights.

A gravity-high anomaly based on wide-spaced historical Council for Geoscience data was interpreted to represent a primary feeder zone to the Rustenburg Layered Suite of the Northern Limb of the Bushveld Complex.

The working hypothesis for this large gravity anomaly (the Mokopane Feeder) is that it represents a significant thickening of the Rustenburg Layered Suite, particularly of the denser Lower Zone units associated with regional scale crustal faults, with significant potential for nickel, copper and platinum-group metals mineralization.

Detailed high-resolution fixed-wing airborne magnetic and Falcon airborne gravity gradiometer geophysical surveys were completed in 2023 to map the subsurface petrophysical characteristics of the anomaly. Detailed inversion modeling of the two high-resolution datasets was completed in December 2023.

The collection, interpretation and review process of all geological and geophysical data continued in Q1 2024. A thesis for drill targeting has been developed using industry experts and three broad areas of drill targeting have been identified.

A geological project team has been established, and field investigations of these areas will be conducted in Q2 2024 to finalize drilling locations.

The drilling program is expected to commence in Q2 2024 and will consist of 4,000 metres of diamond core drilling, split over two or three drill holes depending on results.

SELECTED QUARTERLY FINANCIAL INFORMATION

The following table summarizes selected financial information for the prior eight quarters. Ivanhoe had no operating revenue in any financial reporting period.

All revenue from commercial production at Kamoa-Kakula is recognized within the Kamoa Holding joint venture. Ivanhoe did not declare or pay any dividend or distribution in any financial reporting period.

| Three months ended | |||||||||||||

| March 31, | December 31, | September 30, | June 30, | ||||||||||

| 2024 | 2023 | 2023 | 2023 | ||||||||||

| $’000 | $’000 | $’000 | $’000 | ||||||||||

| Finance income | 62,457 | 63,110 | 56,671 | 61,956 | |||||||||

| Share of profit from joint venture | 45,165 | 49,272 | 69,829 | 73,066 | |||||||||

| Deferred tax recovery | 3,221 | 4,201 | 1,212 | 1,965 | |||||||||

| (Loss) gain on fair valuation of embedded derivative liability | (139,271) | (39,961) | 12,218 | (26,618) | |||||||||

| General administrative expenditure | (14,001) | (14,947) | (9,841) | (10,474) | |||||||||

| Exploration and project evaluation expenditure | (8,901) | (8,637) | (6,264) | (4,375) | |||||||||

| Share-based payments | (8,933) | (7,715) | (6,732) | (7,120) | |||||||||

| Finance costs | (8,944) | (6,741) | (8,752) | (5,539) | |||||||||

| (Loss) profit attributable to: | |||||||||||||

| Owners of the Company | (65,552) | 27,739 | 112,510 | 92,042 | |||||||||

| Non-controlling interests | (3,858) | (1,980) | (4,988) | (4,859) | |||||||||

| Total comprehensive (loss) income attributable to: | |||||||||||||

| Owners of the Company | (73,648) | 37,155 | 109,681 | 86,588 | |||||||||

| Non-controlling interest | (4,728) | (1,003) | (5,250) | (5,443) | |||||||||

| Basic (loss) profit per share | (0.05) | 0.02 | 0.09 | 0.08 | |||||||||

| Diluted (loss) profit per share | (0.05) | 0.02 | 0.08 | 0.07 | |||||||||

| Three months ended | |||||||||||||

| March 31, | December 31, | September 30, | June 30, | ||||||||||

| 2023 | 2022 | 2022 | 2022 | ||||||||||

| $’000 | $’000 | $’000 | $’000 | ||||||||||

| Share of profit from joint venture | 82,659 | 83,324 | 34,057 | 49,690 | |||||||||

| Finance income | 57,826 | 58,477 | 46,720 | 38,596 | |||||||||

| (Loss) gain on fair valuation of embedded derivative liability | (30,900) | (66,600) | (27,700) | 183,600 | |||||||||

| General administrative expenditure | (8,571) | (11,870) | (9,199) | (8,957) | |||||||||

| Finance costs | (10,465) | (10,457) | (10,223) | (10,013) | |||||||||

| Share-based payments | (7,702) | (7,809) | (7,381) | (4,637) | |||||||||

| Exploration and project evaluation expenditure | (3,381) | (3,887) | (4,312) | (13,470) | |||||||||

| Deferred tax (expense) recovery | 926 | (3,839) | 4,252 | 114,184 | |||||||||

| Profit (loss) attributable to: | |||||||||||||

| Owners of the Company | 86,637 | 41,884 | 26,344 | 316,242 | |||||||||

| Non-controlling interests | (4,157) | (4,705) | (2,477) | 35,278 | |||||||||

| Total comprehensive income (loss) attributable to: | |||||||||||||

| Owners of the Company | 74,154 | 53,078 | 4,588 | 306,381 | |||||||||

| Non-controlling interest | (5,420) | (3,621) | (4,678) | 34,495 | |||||||||

| Basic profit per share | 0.07 | 0.03 | 0.02 | 0.26 | |||||||||

| Diluted profit per share | 0.07 | 0.03 | 0.02 | 0.11 | |||||||||

DISCUSSION OF OPERATING RESULTS

Review of the three months ended March 31, 2024 vs. March 31, 2023

The company recorded a loss for Q1 2024 of $69 million and total comprehensive loss of $78 million compared to a profit of $82 million and total comprehensive income of $69 million for the same period in 2023.

The main contributor to the loss for the quarter was the loss on the fair valuation of the embedded derivative liability of $139 million compared to the loss on the fair valuation of the embedded derivative liability of $31 million for the same period in 2023.

The Kamoa-Kakula Copper Complex sold 85,155 tonnes of payable copper in Q1 2024 realizing revenue of $618 million for the Kamoa Holding joint venture, compared to 86,777 tonnes of payable copper sold for revenue of $689 million for the same period in 2023.

The company recognized income in aggregate of $101 million from the joint venture in Q1 2024, which can be summarized as follows:

| Three months ended | ||||||

| March 31, | ||||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Company’s share of profit from joint venture | 45,165 | 82,659 | ||||

| Interest on loan to joint venture | 55,391 | 47,592 | ||||

| Company’s income recognized from joint venture | 100,556 | 130,251 | ||||

The company’s share of profit from the Kamoa Holding joint venture was $37 million less in Q1 2024 compared to the same period in 2023 and is broken down in the following table:

| Three months ended | ||||||

| March 31, | ||||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Revenue from contract receivables | 612,496 | 659,529 | ||||

| Remeasurement of contract receivables | 5,824 | 29,594 | ||||

| Revenue | 618,320 | 689,123 | ||||

| Cost of sales | (282,341) | (239,577) | ||||

| Gross profit | 335,979 | 449,546 | ||||

| General and administrative costs | (47,028) | (30,646) | ||||

| Amortization of mineral property | (2,765) | (2,596) | ||||

| Profit from operations | 286,186 | 416,304 | ||||

| Finance costs | (73,716) | (88,673) | ||||

| Foreign exchange loss | (8,730) | (4,885) | ||||

| Finance income and other | 4,051 | 4,995 | ||||

| Profit before taxes | 207,791 | 327,741 | ||||

| Current tax expense | (60,299) | (76,473) | ||||

| Deferred tax expense | (14,332) | (39,617) | ||||

| Profit after taxes | 133,160 | 211,651 | ||||

| Non-controlling interest of Kamoa Holding | (41,918) | (44,663) | ||||

| Total comprehensive income for the period | 91,242 | 166,988 | ||||

| Company’s share of profit from joint venture (49.5%) | 45,165 | 82,659 | ||||

The realized and provisional copper prices used for the remeasurement (mark-to-market) of contract receivables for the three months ended March 31, 2024, and for the same period in 2023, can be summarized as follows:

| Three months ended | ||||||

| March 31, | ||||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Realized during the period – open at the start of the period | ||||||

| Opening forward price ($/lb.)(1) | 3.84 | 3.79 | ||||

| Realized price ($/lb.)(1) | 3.81 | 4.07 | ||||

| Payable copper tonnes sold | 99,913 | 51,178 | ||||

| Remeasurement of contract receivables ($’000) | (6,040 | ) | 32,625 | |||

| Realized during the period – new copper sold in the current period | ||||||

| Provisional price ($/lb.)(1) | 3.78 | 4.08 | ||||

| Realized price ($/lb.)(1) | 3.85 | 4.01 | ||||

| Payable copper tonnes sold | 55,529 | 56,121 | ||||

| Remeasurement of contract receivables ($’000) | 8,801 | (8,551) | ||||

| Open at the end of the period – open at the start of the period | ||||||

| Opening forward price ($/lb.)(1) | – | 3.79 | ||||

| Closing forward price ($/lb.)(1) | – | 4.05 | ||||

| Payable copper tonnes sold | – | 6,625 | ||||

| Remeasurement of contract receivables ($’000) | – | 3,748 | ||||

| Open at the end of the period – new copper sold in current period | ||||||

| Provisional price ($/lb.)(1) | 3.94 | 4.02 | ||||

| Closing forward price ($/lb.)(1) | 3.99 | 4.05 | ||||

| Payable copper tonnes sold | 29,626 | 30,307 | ||||

| Remeasurement of contract receivables ($’000) | 3,063 | 1,772 | ||||

| Total remeasurement of contract receivables ($’000) | 5,824 | 29,594 | ||||

| (1) Calculated on a weighted average basis | ||||||

Of the $74 million (Q1 2023: $89 million) finance costs recognized in the Kamoa Holding joint venture for Q1 2024, $46 million (Q1 2023: $74 million) relates to shareholder loans where each shareholder-funded Kamoa Holding in an amount equivalent to its proportionate shareholding interest before generating sufficient operational cashflow.

Of the remaining finance costs, $21 million (Q1 2023: $12 million) relates to the provisional payment facility and advance payment facility available under Kamoa-Kakula’s offtake agreements, $3 million (Q1 2023: $3 million) relates to the equipment financing facilities, $2 million relates to bank overdraft facilities and $2 million relates to unwinding of lease liabilities.

Ivanhoe’s exploration and project evaluation expenditure amounted to $9 million in Q1 2024 and $3 million for the same period in 2023 and related mainly to increased exploration activities at Ivanhoe’s Western Foreland exploration licences.

Finance income for Q1 2024 amounted to $62 million and was $4 million more than for the same period in 2023 ($58 million). Included in finance income is the interest earned on loans to the Kamoa Holding joint venture to fund past development which amounted to $55 million for Q1 2024, and $48 million for the same period in 2023, and increased due to the higher interest rates and accumulated loan balance.

The company recognized a loss on the fair valuation of the embedded derivative financial liability of $139 million for Q1 2024, compared to a loss on the fair valuation of the embedded derivative financial liability of $31 million for Q1 2023, which is further explained in the accounting for the convertible notes in the company’s MD&A.

Financial position as at March 31, 2024, vs. December 31, 2023

The company’s total assets increased by $76 million, from $5,000 million as at December 31, 2023, to $5,076 million as at March 31, 2024.

The increase in total assets was mainly attributable to the increase in the company’s investment in the Kamoa Holding joint venture by $101 million, the increase in property, plant and equipment of $105 million as project development continued at the Platreef and Kipushi projects, as well as the increase in deferred tax assets by $7 million, offset by the decrease in cash and cash equivalents of $163 million.

The company’s investment in the Kamoa Holding joint venture increased by $101 million from $2,518 million as at December 31, 2023, to $2,618 million as at March 31, 2024. The company’s investment in the Kamoa Holding joint venture can be broken down as follows:

| March 31, | December 31, | |||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Company’s share of net assets in joint venture | 830,430 | 785,265 | ||||

| Loan advanced to joint venture | 1,787,677 | 1,732,286 | ||||

| Total investment in joint venture | 2,618,107 | 2,517,551 |

The company’s share of net assets in the Kamoa Holding joint venture can be broken down as follows:

| March 31, 2024 | December 31, 2023 | ||||||||||||

| 100% | 49.5% | 100% | 49.5% | ||||||||||

| $’000 | $’000 | $’000 | $’000 | ||||||||||

| Assets | |||||||||||||

| Property, plant and equipment | 4,712,533 | 2,332,704 | 4,195,216 | 2,076,632 | |||||||||

| Mineral property | 775,657 | 383,950 | 778,423 | 385,319 | |||||||||

| Indirect taxes receivable | 452,156 | 223,817 | 419,779 | 207,791 | |||||||||

| Current inventory | 416,751 | 206,292 | 435,212 | 215,430 | |||||||||

| Run of mine stockpile | 348,591 | 172,553 | 304,261 | 150,609 | |||||||||

| Long-term loan receivable | 325,468 | 161,107 | 306,594 | 151,764 | |||||||||

| Other receivables | 275,019 | 136,134 | 320,143 | 158,471 | |||||||||

| Trade receivables | 211,416 | 104,651 | 241,944 | 119,762 | |||||||||

| Cash and cash equivalents | 126,070 | 62,405 | 72,486 | 35,881 | |||||||||

| Prepaid expenses | 82,294 | 40,736 | 81,802 | 40,492 | |||||||||

| Right-of-use asset | 55,441 | 27,443 | 56,966 | 28,198 | |||||||||

| Non-current deposits | 1,872 | 927 | 1,872 | 927 | |||||||||

| Deferred tax asset | 519 | 257 | 606 | 300 | |||||||||

| Liabilities | |||||||||||||

| Shareholder loans | (3,611,976) | (1,787,928) | (3,500,105) | (1,732,552) | |||||||||

| Advance payment facility | (402,784) | (199,378) | (150,449) | (74,472) | |||||||||

| Deferred tax liability | (336,458) | (166,547) | (322,194) | (159,486) | |||||||||

| Trade and other payables | (351,418) | (173,952) | (471,377) | (233,332) | |||||||||

| Long-term loan facilities | (297,877) | (147,449) | (111,193) | (55,041) | |||||||||

| Income taxes payable | (258,405) | (127,910) | (217,028) | (107,429) | |||||||||

| Overdraft facility | (100,151) | (49,575) | (177,775) | (87,999) | |||||||||

| Rehabilitation provision | (95,081) | (47,065) | (95,081) | (47,065) | |||||||||

| Provisional payment facility | (63,815) | (31,588) | (51,501) | (25,493) | |||||||||

| Lease liability | (51,050) | (25,270) | (51,913) | (25,697) | |||||||||

| Other provisions | (48,269) | (23,893) | (33,344) | (16,505) | |||||||||

| Non-controlling interest | (488,868) | (241,990) | (446,950) | (221,240) | |||||||||

| Net assets of the joint venture | 1,677,635 | 830,430 | 1,586,394 | 785,265 | |||||||||

Before commencing commercial production in July 2021, the Kamoa Holding joint venture principally used loans from its shareholders to develop the Kamoa-Kakula Copper Complex through investing in development costs and other property, plant and equipment.

No additional shareholder loans were advanced from 2022 to date with joint venture cashflow and facilities funding its operations and expansions.

Overdraft facilities represent drawn unsecured financing facilities from DRC financial institutions at an attractive cost of capital, utilized to augment cash generated from operations for Kamoa-Kakula’s continued expansion and working capital. Total available overdraft facilities amount to $224 million, with an interest rate of approximately 6.5%.

The long-term loan facilities represent Kamoa’s equipment financing facilities, as well as a $200 million term facility with a DRC financial institution with a 4-year tenor and an interest rate of 5.75% over SOFR.

The cash flows of the Kamoa Holding joint venture can be summarized as follows:

| Three months ended | ||||||

| March 31, | ||||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Net cash generated from operating activities | 338,388 | 273,421 | ||||

| Change in working capital items | (104,231) | – | ||||

| Net cash used in investing activities | (531,587) | (253,156) | ||||

| Net cash generated from financing activities | 430,465 | 2,398 | ||||

| Effect of foreign exchange rates on cash | (1,827) | 1,328 | ||||

| Net cash inflow | 131,208 | 23,991 | ||||

| Cash and cash equivalents — beginning of the year | (105,289) | 365,633 | ||||

| Cash and cash equivalents — end of the period | 25,919 | 389,624 | ||||

The Kamoa Holding joint venture’s net increase in property, plant and equipment from December 31, 2023, to March 31, 2024, amounted to $517 million and can be further broken down as follows:

| Three months ended | ||||||

| March 31, | ||||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Kamoa Holding joint venture | ||||||

| Expansion capital | 447,679 | 209,824 | ||||

| Sustaining capital | 69,801 | 46,250 | ||||

| 517,480 | 256,074 | |||||

| Depreciation capitalized | 13,110 | 8,401 | ||||

| Total capital expenditure | 530,590 | 264,475 | ||||

| Borrowing costs capitalized | 65,626 | 22,588 | ||||

| Total additions to property, plant and equipment for Kamoa Holding | 596,216 | 287,063 | ||||

| Less depreciation, disposals and foreign exchange translation | (78,899) | (44,336) | ||||

| Net increase in property, plant and equipment of Kamoa Holding | 517,317 | 242,727 | ||||

Ivanhoe’s cash and cash equivalents decreased by $163 million, from $574 million as at December 31, 2023, to $411 million as at March 31, 2024. The Company spent $121 million on project development and acquiring other property, plant and equipment and $20 million on its operating activities.

The net increase in property, plant and equipment amounted to $105 million, with additions of $125 million to project development and other property, plant and equipment.

Of this total, $53 million pertained to development costs and other acquisitions of property, plant and equipment at the Platreef Project, while $72 million pertained to development costs and other acquisitions of property, plant and equipment at the Kipushi Project as set out on page 39.

The main components of the additions to property, plant and equipment – including capitalized development costs – at the Platreef and Kipushi projects for the three months ended March 31, 2024, and for the same period in 2023, are set out in the following tables:

| Three months ended | ||||||

| March 31, | ||||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Platreef Project | ||||||

| Phase 1 construction | 23,601 | 22,692 | ||||

| Phase 2 construction | 16,025 | 10,346 | ||||

| Salaries and benefits | 4,169 | 3,407 | ||||

| Administrative and other expenditure | 2,167 | 1,924 | ||||

| Depreciation | 1,932 | 1,713 | ||||

| Site costs | 900 | 980 | ||||

| Studies and contracting work | 821 | 886 | ||||

| Social and environmental | 234 | 403 | ||||

| Total development costs | 49,849 | 42,351 | ||||

| Other additions to property, plant and equipment | 3,621 | 2,830 | ||||

| Total additions to property, plant and equipment for Platreef | 53,470 | 45,181 | ||||

| Three months ended | ||||||

| March 31, | ||||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Kipushi Project | ||||||

| Mine construction costs | 54,278 | 14,168 | ||||

| Salaries and benefits | 4,476 | 4,269 | ||||

| Administration and overheads | 3,717 | 2,995 | ||||

| Other expenditure | 2,861 | 1,220 | ||||

| Depreciation – development | 1,676 | 2,031 | ||||

| Electricity | 1,952 | 1,872 | ||||

| Studies and contracting work | 2,675 | 1,718 | ||||

| Other additions to property, plant and equipment | – | 200 | ||||

| Total project expenditure | 71,635 | 28,473 | ||||

| Accounted for as follows: | ||||||

| Additions to property, plant and equipment | 54,278 | 14,368 | ||||

| Development costs capitalized to property, plant and equipment | 17,357 | 14,105 | ||||

| Total project expenditure | 71,635 | 28,473 | ||||

The Company’s total liabilities increased by $145 million to $1,565 million as at March 31, 2024, from $1,419 million as at December 31, 2023, with the increase mainly due to the loss on the fair valuation of the embedded derivative liability of $139 million.

On May 22, 2023, Kipushi Corporation SA (Kipushi), a subsidiary of the Company and the operator of the Kipushi Project, entered into a loan agreement with Rawbank SA (Rawbank), a financial institution in the Democratic Republic of the Congo.