Ivanhoe’s Ivanplats arranging $420m project financing

Ivanhoe Mines’ (TSX: IVN; OTCQX: IVPAF) Co-Chairs Robert Friedland and Yufeng “Miles” Sun are pleased to announce that the company’s South African subsidiary, Ivanplats, has signed a non-binding term sheet with Orion Mine Finance, a leading international provider of production-linked stream financing to base and precious metals mining companies, for a US$300 million gold, palladium and platinum streaming facility.

Ivanplats also has appointed two prominent, international commercial banks – Societe Generale and Nedbank – as mandated lead arrangers for a senior project debt facility of up to US$120 million. Both the stream financing and project debt facility will be used to advance the development of Ivanplats’ tier one Platreef palladium, platinum, rhodium, nickel, copper and gold project in Limpopo province, South Africa, toward initial production.

The appointment and proposed financings follow the November 30, 2020 issuance of the outstanding findings of an independent Platreef Integrated Development Plan 2020 (Platreef IDP20) for the Platreef Project, which consists of an updated feasibility study (Platreef 2020 FS) and a preliminary economic assessment (Platreef 2020 PEA). The initial capital cost for the phased development plan envisaged under the Platreef 2020 PEA, starting at a mining rate of 700,000 tonnes per annum (700 ktpa), is estimated at US$390 million.

The US$300 million stream financing remains subject to completion of legal due diligence and structuring, as well as negotiation and execution of definitive documentation. The streaming facility is planned to be drawn down in four separate tranches, as needed, in parallel with the engineering studies to upgrade the Platreef 2020 PEA to a feasibility study and the changeover of Platreef’s Shaft 1 to a production shaft.

Detailed engineering is underway on the mine design, 770-ktpa concentrator and associated infrastructure for the phased development plan, which is scheduled to be incorporated into an updated feasibility study before the end of 2021. The Shaft 1 changeover is progressing well in preparation for permanent hoisting by early 2022.

Platreef’s budget for 2021 is US$59 million, which includes US$10 million for commencement of headframe construction for Shaft 2. The first draw from the streaming funds, which is expected to occur shortly after establishment of the facility, is expected to fully cover Platreef’s 2021 budget.

The senior project debt facility of up to US$120 million is scheduled to be utilized only after the streaming facility is fully drawn down. Definitive terms and conditions of the debt facility are subject to the completion of the feasibility study for Platreef’s phased development plan, completion of due diligence and structuring, as well as negotiation and execution of definitive documentation. Terms and conditions of the debt facility will be made available when finalized.

“This is very auspicious timing for the Platreef financing announcement as it coincides with the celebration of Chinese New Year, which signifies the start of spring, and the Year of the Golden Ox,” said Mr. Friedland. “The Ox is an animal that is symbolic of a silent hard worker who strives for self-improvement and endeavours to get out of 2020’s challenges. Tradition also says the Year of the Ox will bring prosperity and success in business.”

We are excited to work with Orion, Societe Generale, Nedbank and our other long-term investors to unlock Platreef’s world-scale potential. The production of key ‘green metals’ needed to reduce greenhouse gas emissions is at a critical inflection point as businesses are pressed to secure long-term supplies. We are confident that this project-level funding will be the catalyst needed to launch Platreef to become a leading, long-life supplier of palladium, platinum, rhodium, nickel, copper and gold.”

“Platreef’s Shaft 1 has been sunk to its final depth and is within a few hundred metres of the initial high-grade mining zone. The deposit has an enormous endowment of palladium, platinum, rhodium, nickel, copper and gold in a thick, high-grade, flat-lying underground orebody that is ideal for modern, bulk-scale, mechanized mining,” Mr. Friedland continued.

The Platreef 2020 PEA is an alternate, phased development plan that fast-tracks Platreef into production. The plan uses the project’s first shaft (Shaft 1) for initial hoisting and mine development, with 825-ktpa total rock-hoisting capacity, of which 700 ktpa are earmarked for ore hoisting and a further 125 kpta for development rock during the ore extraction phase. The phased plan envisions building an initial concentrator with a capacity of 770 ktpa for first concentrate production in mid-2024.

The recently-completed sinking of Shaft 1 creates the opportunity to access early, high-grade tonnes in this scenario. While the 700-ktpa initial mine is being operated using Shaft 1, there would be opportunities to refine the timing of subsequent phases of expanded production, which is driven by the sinking of Shaft 2. Once completed, two 2.2-Mtpa concentrator modules would be commissioned, and the initial concentrator would be ramped up to its full capacity of 770 ktpa – increasing the steady-state production to 5.2 Mtpa.

The Platreef IDP20 reflects the first phase of development for the Platreef Mine. It is designed to establish an operating platform to support potential future expansions up to 12 Mtpa, as demonstrated in previous studies. This would position Platreef among the largest platinum-group-metals producing mines in the world, producing in excess of 1.1 million ounces of palladium, platinum, rhodium and gold per year.

Ivanhoe Mines indirectly owns 64% of the Platreef Project through its subsidiary, Ivanplats, and is directing all mine development work. The South African beneficiaries of the approved broad-based, black economic empowerment structure have a 26% stake in the Platreef Project. The remaining 10% is owned by a Japanese consortium of ITOCHU Corporation; Japan Oil, Gas and Metals National Corporation; ITC Platinum Development Ltd., an ITOCHU affiliate; and Japan Gas Corporation.

Platreef operational update

The Shaft 1 changeover is progressing to plan and is on schedule for commencement of rock hoisting early in 2022. All equipment for the shaft changeover has been procured and is on site. The detailed engineering designs for the shaft changeover have been completed, reviewed and approved. The changeover work within the shaft will be conducted by Platreef’s experienced owners team.

The winder that was used to successfully sink Shaft 1 will be converted and re-equipped to function as the permanent rock, personnel and material winder for the life of mine. The shaft will be equipped with two 12.5-tonne skips (with hoisting capacity of 825,000 tonnes per year) and an interchangeable cage to accommodate the movement of personnel and materials up and down the shaft during the initial phase of mining.

The shaft will be equipped using rope guides for the main rock, personnel and materials conveyances. The stage and winder ropes used during the sinking phase have been removed, and the equipping stage, new permanent guide-ropes and the new permanent hoisting ropes have been delivered to site. Further to this, an auxiliary winder will be installed to mainly function as a man winder during the main rock-hoisting cycle.

The construction of the winder foundations is underway and will be completed in time for the auxiliary winder installation and commissioning. The head gear, both winders, equipping stage, conveyances and control systems will comply with the highest industry safety standards, with proven and tested safety and redundancy systems in place.

Newly-designed rock chutes will connect the conveyors feeding the concentrator plant and the waste rock area, from where the rock will be converted to cemented back-fill and also used for protection berms to contain storm water and reduce noise emissions.

The new ropes and the newly-designed and constructed equipping stage will be installed in the shaft by specialist contractors. The equipping in the shaft barrel is scheduled to commence at the end of March 2021 for completion by end of February 2022. Following the completion of the changeover work in the underground stations, and establishment of the ore and waste passes, lateral underground mine development will commence toward high-grade ore zones.

Inoccent Nchabeleng (Rigger) operating the rope reeler to remove the stage and winder ropes used during the sinking phase.

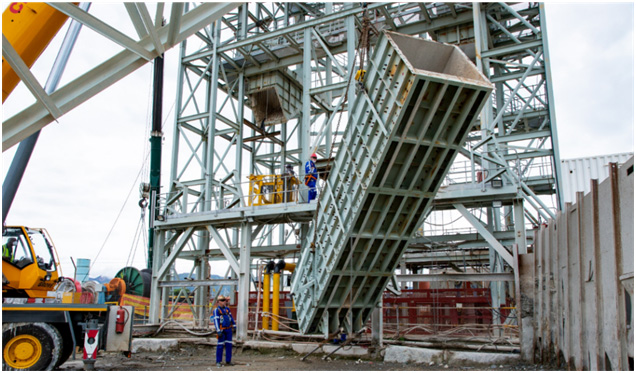

Murray Roberts, a South Africa-based engineering and mining contractor, removing the rock chutes from the headframe as part of Shaft 1 changeover.

Victor Skinner (Winder Technician) installing cables at Shaft 1 new winder house.

About Ivanhoe Mines

Ivanhoe Mines is a Canadian mining company focused on advancing its three principal joint-venture projects in Southern Africa: the development of major new, mechanized, underground mines at the Kamoa-Kakula discoveries in the Democratic Republic of Congo (DRC) and at the Platreef palladium-platinum-nickel-copper-rhodium-gold discovery in South Africa; and the extensive redevelopment and upgrading of the historic Kipushi zinc-copper-germanium-silver mine, also in the DRC. Kamoa-Kakula and Kipushi will be powered by clean, renewable hydroelectricity and will be among the world’s lowest greenhouse gas emitters per unit of metal produced. Ivanhoe also is exploring for new copper discoveries on its wholly-owned Western Foreland exploration licences in the DRC, near the Kamoa-Kakula Project.

![]()