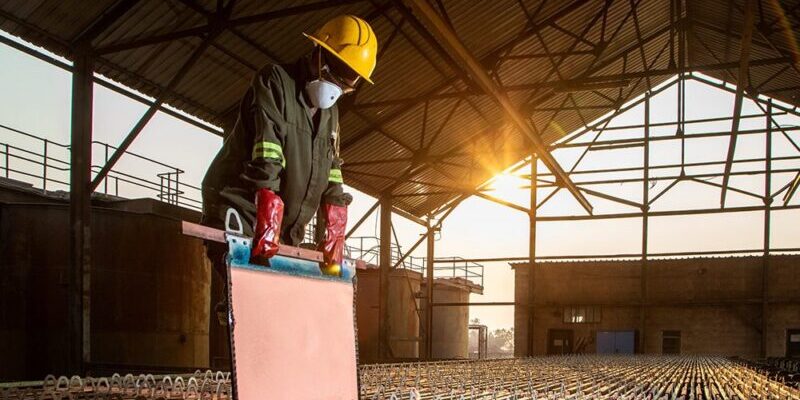

Jubilee Metals Boosts Copper Production in Zambia with High-Grade Feed at Roan

London- and Johannesburg-listed Jubilee Metals has restarted its Roan operations in Zambia following stable power restoration. The company is also accelerating copper production by prioritizing the processing of newly secured high-grade copper feed.

In response to power outages that disrupted operations in December and January, Jubilee implemented a new power agreement on January 20. With production stability restored, the company has shifted its focus to maximizing output and operational efficiency.

Jubilee is prioritizing high-grade copper feed while reviewing options to trade surplus lower-grade stock that does not align with short- to medium-term production plans.

The Roan facility’s unique ability to process both high-grade mined material and tailings simultaneously enables increased copper yields and higher operating margins.

To support this shift, Jubilee has secured rights to an initial 200,000 tonnes of copper feed with an expected grade of 1.6% copper—more than double the grade of current waste material. The company also holds an option to expand this supply, potentially securing a long-term high-grade feedstock.

Roan has the capacity to process up to 45,000 tonnes per month, but initially, 30,000 tonnes will be allocated to high-grade material. Processing is set to begin within the next week, with the potential to sustain full-capacity production for over three years.

Under the agreement terms, Jubilee will settle the copper material acquisition with a $2.7 million payment and the issuance of 51.77 million new Jubilee ordinary shares at 4.20p per share.

Additionally, the company is finalizing due diligence on the Large Waste Project, with the transaction expected to conclude in March.

Jubilee CEO Leon Coetzer emphasized that the company’s investments in Roan’s processing capabilities have proven invaluable, allowing the rapid integration of high-grade resources.

“Our ability to process both run-of-mine and waste copper material simultaneously is once again validated as we capitalize on this high-grade opportunity,” Coetzer stated. He confirmed that the new material had been tested within Jubilee’s facilities, demonstrating strong metallurgical performance.

Despite recent power-related setbacks, Coetzer commended the team’s swift response in securing stable power and acquiring high-grade copper feed. “This ensures we can recover lost production and enhance cash flow in the short term,” he added.

Jubilee remains committed to its Zambian copper strategy, leveraging existing surface resources, two open-pit mining operations, and a fully operational refining network. The company is also reviewing opportunities to monetize non-core, lower-grade assets.

Jubilee will reassess its copper production guidance after a four- to six-week operational run on the new high-grade material.

![]()