Lotus Resources Confirms Viability of Letlhakane Uranium Project in Botswana

ASX-listed Lotus Resources has completed a scoping study for the Letlhakane uranium project in Botswana, confirming its commercial viability with the potential to produce 3 million pounds of uranium per year and extend the project’s operational lifespan.

The base case for the open-pit mine projects a total production of 42.3 million pounds of uranium oxide over 15 years at a cash cost of $42/lb. Lotus CEO Greg Bittar stated that optimization efforts could reduce costs to $36/lb.

Bittar also highlighted the “blue sky” potential at Letlhakane, noting that at a uranium price of $100/lb, the project could recover up to 65 million pounds of uranium, increasing to 83 million pounds by including low-grade stockpiles in the later stages of operation.

The study estimates an initial capital investment of A$465 million.

Lotus has identified potential for in-situ recovery (ISR) in deeper mineralized zones at Letlhakane. ISR, commonly used in the US, involves injecting a solution into the ground to dissolve and extract minerals without traditional excavation.

ERM Australia Consultants has confirmed that Letlhakane’s geological conditions are favorable for ISR, due to its location below the water table, flat tabular structure, and suitable aquitards to control fluid movement.

Although still in the early evaluation phase, Lotus sees significant potential for ISR to complement the planned open-pit heap leach process, especially in higher-cost mining areas.

Bittar indicated that further exploration of the ISR option will take place over the coming months, with the aim of reducing operating costs.

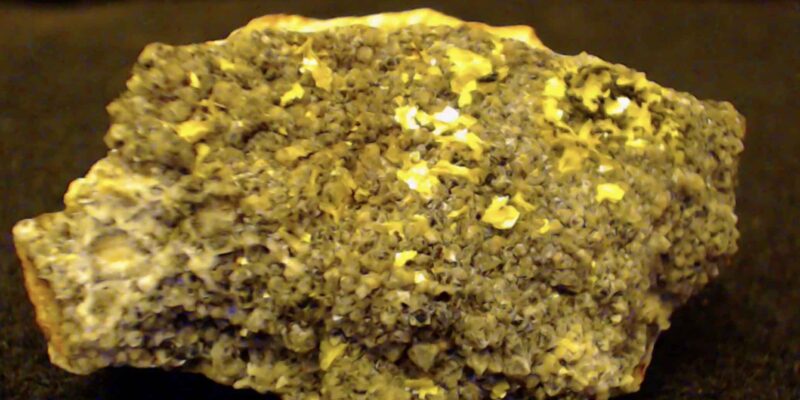

Lotus is developing Letlhakane, one of the largest undeveloped uranium projects globally, with a resource base of 155 million tonnes at 345 parts per million, amounting to 118 million pounds of contained uranium. This project is being developed in parallel with plans to restart production at the Kayelekera uranium project in Malawi.

“Our scoping study clearly demonstrates Letlhakane’s potential as a second, long-term uranium project that can address future supply shortfalls. In a stronger uranium price environment, which experts predict, Letlhakane will extend Lotus’ mine life,” said Bittar.

“With Kayelekera aiming to restart production next year, Lotus is positioned to become a 5.5-million-pound-a-year uranium producer, potentially one of the largest on the ASX,” he added.

Lotus’ share price rose by 5%, reaching A$0.24 on Thursday.

![]()