Lucara reports strong third-quarter production, revenue growth

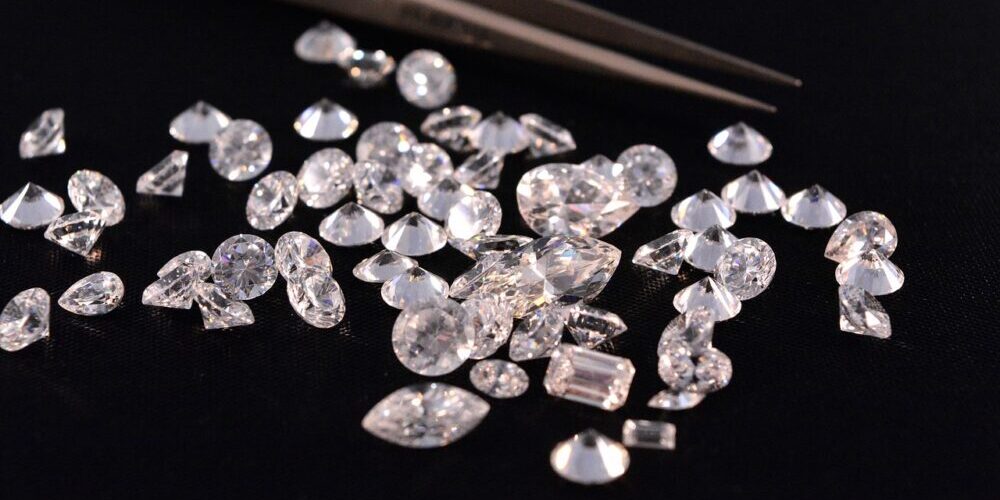

Diamond miner Lucara Diamond Corp’s Karowe mine, in Botswana, produced 97 412 ct of diamonds in the third quarter ended September 30, compared with the 88 909 ct produced in the third quarter of 2020.

Production included 212 “special” diamonds weighing more than 10.8 ct each.

Also of significance was the recovery of four pink diamonds from direct milling from the EM/PK(S) unit of the South Lobe. This included a 62.7 ct high-quality, fancy pink Type IIa gem diamond and a 22.21 ct pink gem of similar quality, along with two additional pink gems of similar colour and purity weighing 11.17 ct and 5.05 ct, respectively.

In addition, Lucara recovered a 393.5 ct top white Type IIa gem-quality diamond from direct milling of ore sourced from the M/PK(S) unit of the South Lobe. This is the third gem-quality diamond weighing more than 300 ct produced from the M/PK(S) unit this year.

“Strong production, including a high volume of ‘specials’, combined with our innovative and optimised approach to sales of rough and polished diamonds into a strengthening market for diamond jewellery, has delivered a 57% increase in revenues quarter-on-quarter,” Lucara president and CEO Eira Thomas highlights.

Lucara generated revenues of $72.7-million in the third quarter, compared with revenue of $41.3-million in the third quarter of 2020 and $45.9-million in the second quarter of this year.

Diamond sales continued to be held through a combination of regular tenders, and the Clara platform, for diamonds less than 10.8 ct, and through European diamond manufacturing and technology company HB Antwerp under a supply agreement for those diamonds greater than 10.8 ct, which are manufactured and sold as polished.

Lucara sold 117 162 ct of diamonds in the third quarter, compared with the 112 741 ct sold in the third quarter of 2020.

It recorded net income of $12.8-million for the third quarter, compared with a loss of $5.4-million in the third quarter of 2020.

Adjusted earnings before interest, taxes, depreciation and amortisation increased to $36.8-million, compared with $9.9-million in the third quarter of 2020, mainly as a result of the high proportion of “special” diamonds recovered and sold.

Lucara notes that the diamond market continued to be in a healthy balance this year as a result of robust demand and lower rough diamond supply.

UNDERGROUND EXPANSION

The Lucara board in early September formally approved the $534-million expansion of its Karowe mine.

The Karowe underground expansion proejct (UGP) will extend the mine life to at least 2040, with mining predominately from the highest value EM/PK(S) unit, and forecast to contribute about $4-billion in additional revenues, using conservative diamond prices.

Mine ramp-up is expected in the first quarter of 2026 with full production from the UGP expected in the fourth quarter of 2026.

By September 30, Lucara had spent $64.6-million on the project, primarily in relation to engineering and procurement of long lead items and the start of construction activities. The total planned spend for the full 2021 is up to $120-million.

During the quarter under review, the company spent $32-million on project execution activities, including full mobilisation of the pre-sink shaft sinking contractor, starting pre-sinking of the ventilation and production shafts, ventilation shaft scotch derrick erection and installation, continued surface infrastructure construction for shaft development, the second phase of a 200-person camp and the start of bush clearing on the route for the 29 km 132 kV transmission line bulk power upgrade.

![]()