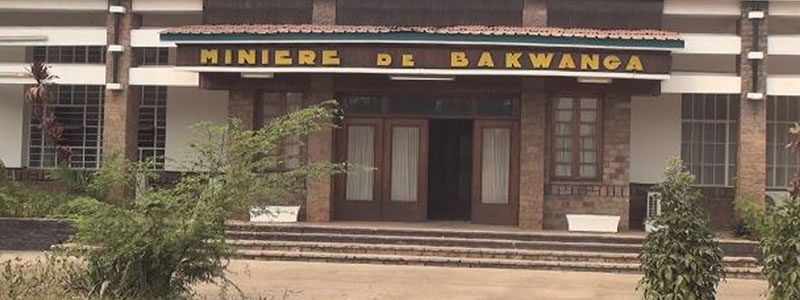

MIBA Faces Major Revival Challenges Amid Diamond Production Halt and Financial Struggles

The situation at Société Minière de Bakwanga (MIBA), a major mining company in Kasaï-Oriental province, remains critical. According to the latest data from the Cellule Technique de Coordination et de Planification Minière (CTCPM) within the Congolese Ministry of Mines, MIBA did not produce any diamonds in the second quarter of 2024 (April to June).

In stark contrast, Société Anhui Congo d’Investissement (Sacim), another diamond producer in the region, reported over 873,000 carats produced during the same period, accounting for nearly 98% of the region’s industrial output, according to the Ministry.

MIBA’s Director General, André Kabamba Kana, attributed the company’s ongoing challenges to prolonged operational shutdowns and severe financial difficulties. “MIBA is bankrupt. We are striving to keep operations going while awaiting state funding. My greatest hope is for MIBA’s revival,” he shared with ACTUALITE.CD.

However, a union representative argued that poor leadership and a lack of effective production mechanisms within MIBA’s management are also to blame.

Claude Mianzuila, a former MIBA consultant and experienced diamond evaluator, emphasized a recurring problem of diamond theft within the company, which he says continues to impact MIBA’s finances and the welfare of local communities.

As economic conditions worsen, more residents, particularly young people, are migrating to larger cities like Lubumbashi and Kinshasa in search of opportunities.

According to official budget documents presented in the 2025 Finance Bill, MIBA is classified among public companies facing undeclared bankruptcy, alongside CADECO, LMC, and SOKIMO.

The Ministry of the Budget reports that these companies’ equity has dropped below the 50% threshold required by the OHADA regulations.

On August 23, the Congolese government approved a $70 million recovery plan for MIBA, focusing on five priority areas: certifying mining reserves, securing concessions, production investments, personnel costs, and monitoring and evaluation.

The plan envisions significant production increases by 2026, with an annual output of 2.4 million carats and projected revenues of $58.9 million.

Still, MIBA’s Director General remains skeptical of meeting these goals, pointing out that the government has yet to fulfill its financial commitments.

“Right People in the Right Roles” – A Call for Structural Reform

Mianzuila advocates for a more comprehensive reform approach, arguing that financial support alone will not resolve MIBA’s issues.

Instead, he suggests prioritizing organizational reforms at the administrative, financial, and technical levels, with a focus on placing skilled personnel in key roles rather than rewarding political allies with managerial positions.

Impact of MIBA’s Decline on National Revenue

The government’s budget documents underscore that MIBA’s near-zero activity significantly impacts state revenue. Tax and non-tax revenues are directly affected, as companies like MIBA are expected to pay various duties, including mining royalties and establishment taxes. With diminished production, fulfilling these obligations becomes challenging, affecting the state’s revenue stream.

In response, the Congolese government plans to strengthen oversight of public companies through enhanced monitoring, external audits, and improved governance practices, particularly in the selection of management.

MIBA’s path to recovery is complex and demands more than financial support; structural reforms, effective management, and enhanced accountability will be critical for sustainable revival.

![]()