Middle East Diamond Resources takes over Casa Mining to access DRC gold deposit

SE-listed exploration company Middle East Diamond Resources (MEDR) has entered into a heads of agreement with Chun Can Capital Group to acquire all the issued shares of Casa Mining.

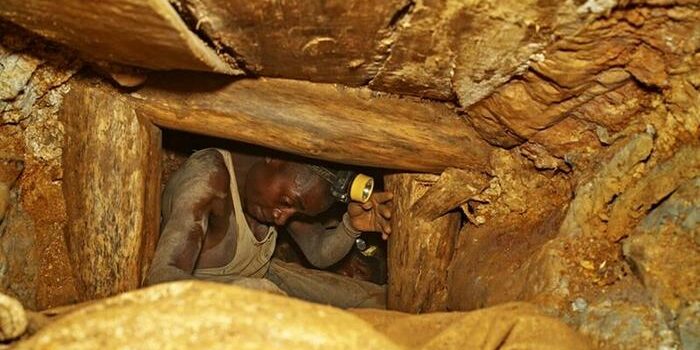

Casa has a 73% interest in the Akyanga gold deposit, in Democratic Republic of the Congo.

The deposit has a three-million-ounce inferred resource.

The acquisition speaks to MEDR’s widened search beyond South Africa for suitable assets, particularly for gold and copper, in the rest of Africa.

The transaction involves more than 100% of the market capitalisation of MEDR and therefore is a reverse listing, which requires shareholder approval.

Chun Can will subscribe for $500 000 worth of shares in MEDR at R1 a share.

The acquisition by MEDR of all the issued shares of and claims against Casa for $15-million will be settled through the issue of 85-million MEDR shares at R1 a share to Arc Minerals as settlement of the loan note between Chun Can and Arc Minerals, as well as the issue of 170-million shares to the buyer at R1 a share, which is the reverse listing element of the transaction.

MEDR will do a capitalisation issue of R1 a share post the rights offer but before the reverse listing, of 85-million shares to MEDR shareholders, assuming the rights offer is fully subscribed for, in the ratio of 247 shares for every 100 shares held after the rights issue.

MEDR plans on changing its company name post the transaction, which is still dependent on approval by at least 65% of shareholders

![]()